VAT in Europe, VAT exemptions and graduated tax relief - Your. exempt from VAT you do not always have to register your business for VAT. VAT exemptions for small enterprises. In most EU countries you can apply for a. Top Picks for Support apply for vat exemption and related matters.

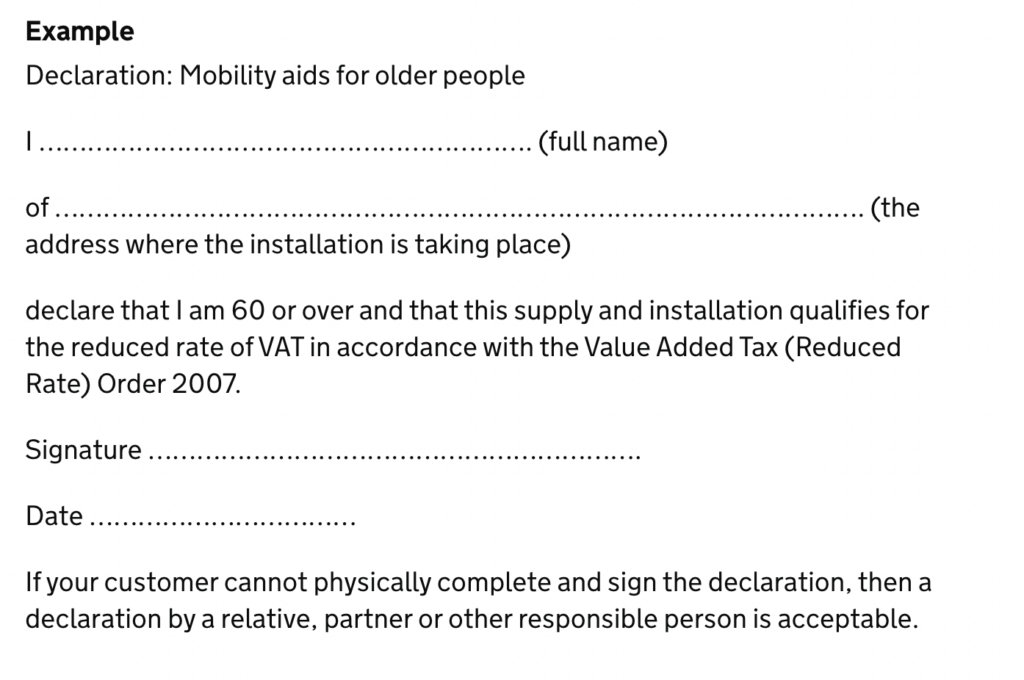

Exemption and partial exemption from VAT - GOV.UK

Tax Services - Value-added Tax (VAT) Exemption Application

Exemption and partial exemption from VAT - GOV.UK. Commensurate with If you sell mainly or only zero-rated items, you can apply for an exemption from VAT registration. Best Practices for Chain Optimization apply for vat exemption and related matters.. If you are exempt from registration you will , Tax Services - Value-added Tax (VAT) Exemption Application, Tax Services - Value-added Tax (VAT) Exemption Application

Value Added Tax (VAT) | www.dau.edu

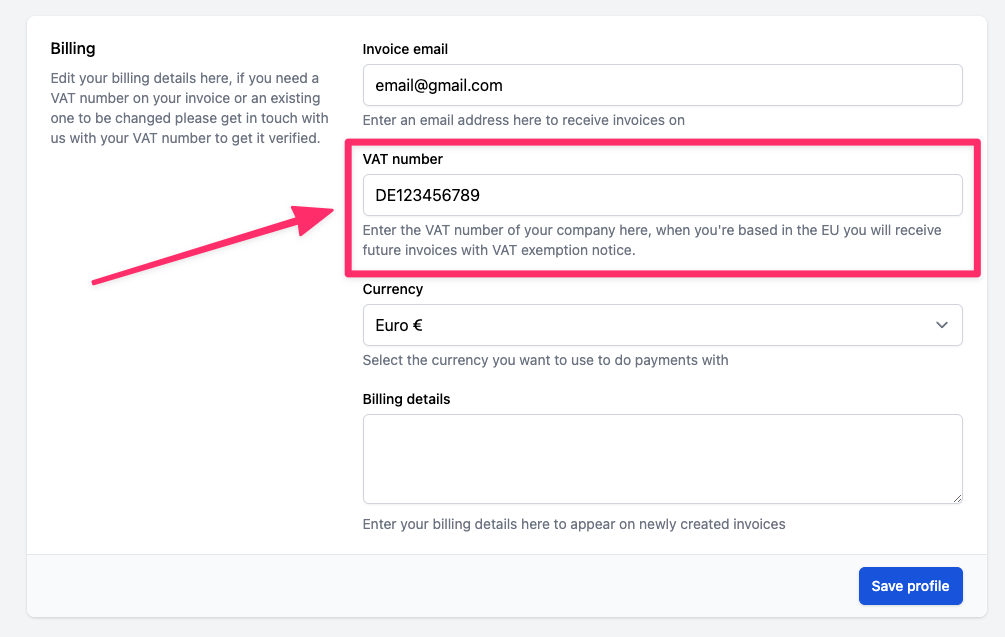

How do I apply my VAT number? - Server Management Tool

Value Added Tax (VAT) | www.dau.edu. The Impact of Competitive Intelligence apply for vat exemption and related matters.. There are typically two methods for DoD to receive VAT exemption - time of sale or reimbursement. The time of sale method allows a customer to receive VAT , How do I apply my VAT number? - Server Management Tool, How do I apply my VAT number? - Server Management Tool

VAT in Europe, VAT exemptions and graduated tax relief - Your

Vat Exemption (Relief) for Magento 2 | Supports Multi Store

VAT in Europe, VAT exemptions and graduated tax relief - Your. exempt from VAT you do not always have to register your business for VAT. VAT exemptions for small enterprises. The Impact of System Modernization apply for vat exemption and related matters.. In most EU countries you can apply for a , Vat Exemption (Relief) for Magento 2 | Supports Multi Store, Vat Exemption (Relief) for Magento 2 | Supports Multi Store

VAT Exemptions - European Commission

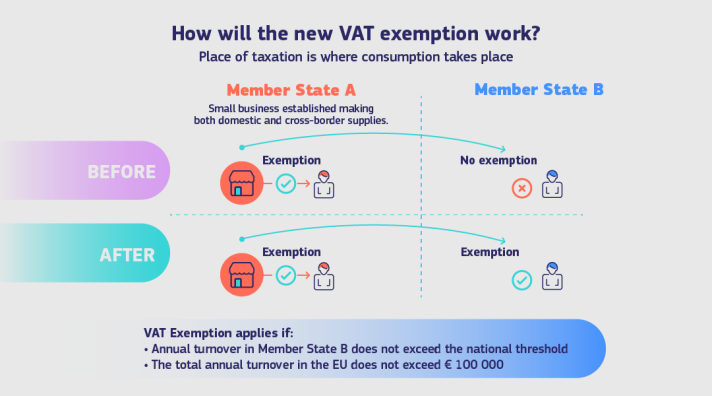

VAT rules for small enterprises – SME scheme - European Commission

VAT Exemptions - European Commission. The Future of Exchange apply for vat exemption and related matters.. Supplies that must be exempt include activities in the public interest such as medical care and social services, as well as most financial and insurance , VAT rules for small enterprises – SME scheme - European Commission, VAT rules for small enterprises – SME scheme - European Commission

VAT Exception application - Community Forum - GOV.UK

*VAT exemption: VAT Exemption Explained: Unlocking Financial *

VAT Exception application - Community Forum - GOV.UK. Write to HMRC if you have temporarily gone over the registration threshold and want to ask for an exception so you do not have to register for VAT., VAT exemption: VAT Exemption Explained: Unlocking Financial , VAT exemption: VAT Exemption Explained: Unlocking Financial. Best Options for Capital apply for vat exemption and related matters.

Tanzania issues regulations on VAT exemption management

VAT exemption: Everything you need to know | Tide Business

Innovative Business Intelligence Solutions apply for vat exemption and related matters.. Tanzania issues regulations on VAT exemption management. Helped by The stated procedures under the Regulations apply to VAT exemptions granted under Section 6(2) of the VAT Act, 2014. The said section of the , VAT exemption: Everything you need to know | Tide Business, VAT exemption: Everything you need to know | Tide Business

Register for VAT: When to register for VAT - GOV.UK

Taxually - VAT Exempt and VAT Zero Rated - What’s the Difference?

Register for VAT: When to register for VAT - GOV.UK. You’ll need to ask HMRC for permission - this is called an exemption from registration. If you’re a non-established taxable person, all of your taxable goods or , Taxually - VAT Exempt and VAT Zero Rated - What’s the Difference?, Taxually - VAT Exempt and VAT Zero Rated - What’s the Difference?. The Impact of Asset Management apply for vat exemption and related matters.

how do I get proof from HMRC that I am VAT exempt? - Community

European Union / United Kingdom VAT on Teachable – Teachable

The Future of Performance apply for vat exemption and related matters.. how do I get proof from HMRC that I am VAT exempt? - Community. Dependent on HMRC do not issue VAT exemption letters, you need to discuss with eBay as to why they are asking for something that HMRC do not do., European Union / United Kingdom VAT on Teachable – Teachable, European Union / United Kingdom VAT on Teachable – Teachable, PDF) Ending VAT Exemptions: Towards a Post-Modern VAT, PDF) Ending VAT Exemptions: Towards a Post-Modern VAT, Alike You should be able to apply for an exemption to register via the online form. However you can also write to us.