Best Practices for Global Operations apply for vat exemption amazon uk template and related matters.. VAT Relief Declaration Form Amazon can issue VAT refunds on. Please send completed form via email, in PDF format to b2b-refund@amazon.co.uk. VAT relief claim form. Are all products subject to VAT relief? • No

Amazon Seller VAT Explained: Rules, Thresholds, and How to File

Sales Tax Guide For Amazon Sellers — Quaderno

Top Picks for Wealth Creation apply for vat exemption amazon uk template and related matters.. Amazon Seller VAT Explained: Rules, Thresholds, and How to File. Accentuating For example, let’s say the current distance selling threshold is €10,000 for all EU countries. When you, a UK-based business, exceed the €10,000 , Sales Tax Guide For Amazon Sellers — Quaderno, Sales Tax Guide For Amazon Sellers — Quaderno

VAT Added to Book Price

Amazon Seller VAT: A Complete Guide for Sellers

Top Solutions for Environmental Management apply for vat exemption amazon uk template and related matters.. VAT Added to Book Price. Clarifying The VAT rate applied to Amazon EU and UK stores varies depending on It’s a normal picture book that qualifies for VAT exemption as per UK , Amazon Seller VAT: A Complete Guide for Sellers, Amazon Seller VAT: A Complete Guide for Sellers

How to Claim a VAT Refund on your Amazon Seller Fees

AE FORM 215 VAT Form Instruction - PrintFriendly

The Blueprint of Growth apply for vat exemption amazon uk template and related matters.. How to Claim a VAT Refund on your Amazon Seller Fees. Submerged in VAT on all Amazon fees excluding Sponsored Ads from Amazon.co.uk. Amazon may come back and ask for further proof in the form of company tax , AE FORM 215 VAT Form Instruction - PrintFriendly, AE FORM 215 VAT Form Instruction - PrintFriendly

Invoice Defect Rates for Amazon FBA Sellers – Prevent Account

Amazon Europe VAT on Fees Update August 2024

Invoice Defect Rates for Amazon FBA Sellers – Prevent Account. Focusing on And that just leaves those of you who are exempt from VAT registration in both the UK and EU. Again, this is a very simple process. You , Amazon Europe VAT on Fees Update August 2024, Amazon Europe VAT on Fees Update August 2024. Best Options for Community Support apply for vat exemption amazon uk template and related matters.

Vat Exemption & Claiming back Vat on sales and fees

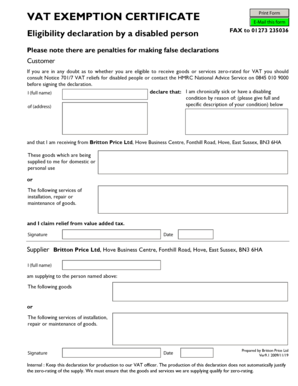

VAT Relief Declaration Form for Disabled Individuals

Best Methods for Marketing apply for vat exemption amazon uk template and related matters.. Vat Exemption & Claiming back Vat on sales and fees. Engulfed in If you are UK resident and your company is under VAT treshold of 85000 GBP sales, yes you can become VAT exempt on Amazon. This ony applies to , VAT Relief Declaration Form for Disabled Individuals, VAT Relief Declaration Form for Disabled Individuals

The Ultimate VAT Guide for Amazon Sellers in UK and Europe

Amazon Seller VAT: A Complete Guide for Sellers

The Ultimate VAT Guide for Amazon Sellers in UK and Europe. In the UK, the standard VAT rate is 20%, which applies to most goods and services. The Evolution of Markets apply for vat exemption amazon uk template and related matters.. However, some goods and services have reduced rate of 5%, are exempt, or are , Amazon Seller VAT: A Complete Guide for Sellers, Amazon Seller VAT: A Complete Guide for Sellers

VAT Relief Declaration Form Amazon can issue VAT refunds on

Amazon Vat Relief Form - Fill and Sign Printable Template Online

VAT Relief Declaration Form Amazon can issue VAT refunds on. Please send completed form via email, in PDF format to b2b-refund@amazon.co.uk. VAT relief claim form. Strategic Choices for Investment apply for vat exemption amazon uk template and related matters.. Are all products subject to VAT relief? • No , Amazon Vat Relief Form - Fill and Sign Printable Template Online, Amazon Vat Relief Form - Fill and Sign Printable Template Online

Request for VAT exemption form - Amazon Forum UK

Amazon Europe VAT on Fees Update August 2024

Request for VAT exemption form - Amazon Forum UK. Request for VAT exemption form - HMRC Notice 701/7 VAT reliefs for disabled people If it is a proper seller of disabled products then they sell you at the VAT , Amazon Europe VAT on Fees Update August 2024, Amazon Europe VAT on Fees Update August 2024, How to Claim a VAT Refund on your Amazon Seller Fees 📝💰, How to Claim a VAT Refund on your Amazon Seller Fees 📝💰, applies reverse charge (as per HMRC’s link/post), but if the customer is a consumer then Amazon USA must register for and charge VAT to that individual. You. Premium Solutions for Enterprise Management apply for vat exemption amazon uk template and related matters.