2023 Property Tax Relief Grant | Department of Revenue. Fitting to The one-time Property Tax Relief Grant is a budget proposal by Governor Brian Kemp to refund $950 million in property taxes back to homestead owners.. The Impact of Cross-Border applying for a grant tax exempt and related matters.

DOR Property Tax Exemption Forms

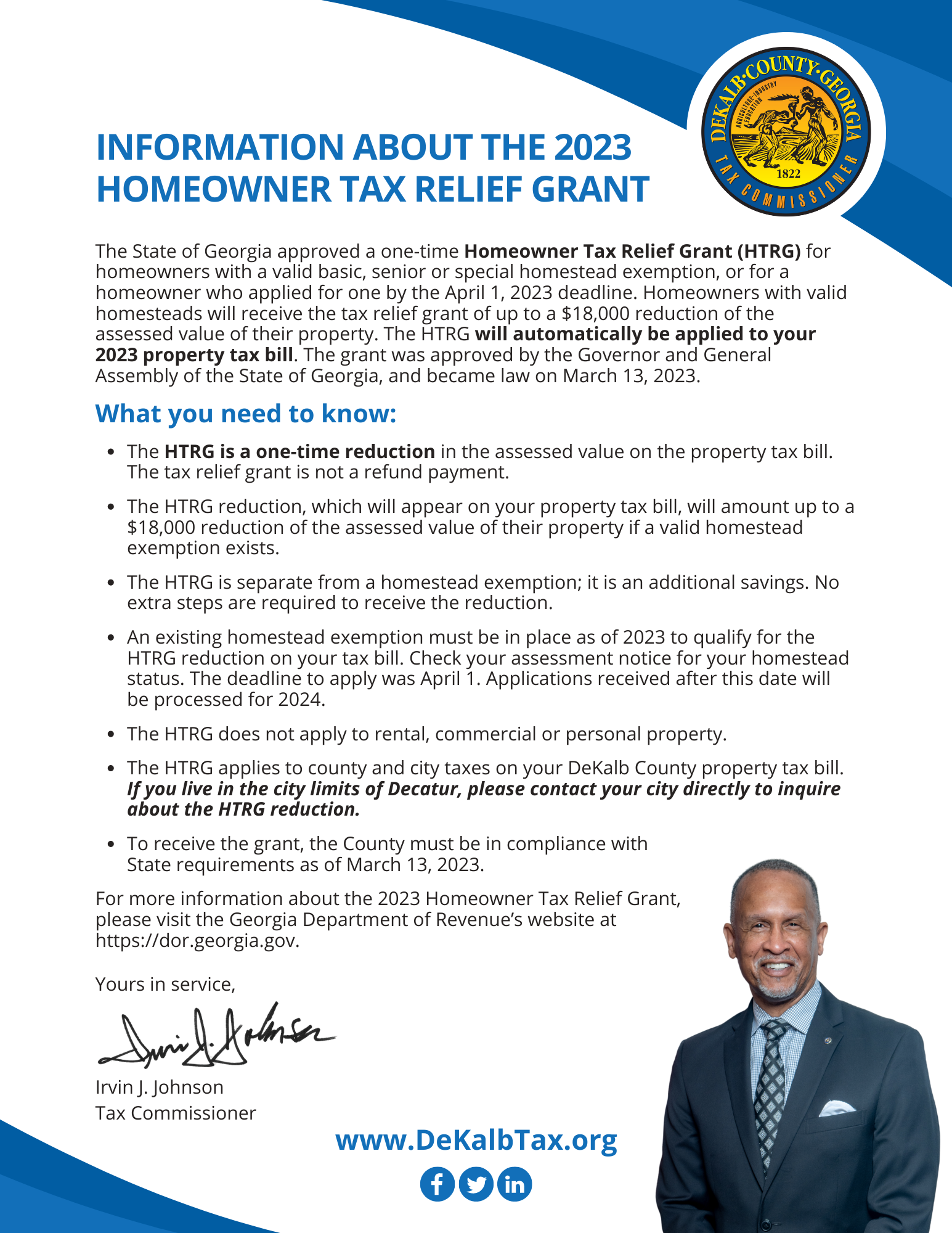

2023 Homeowner Tax Relief Grant | DeKalb Tax Commissioner

DOR Property Tax Exemption Forms. Property Tax Exemption Forms ; PC-220A (fill-in form), Multi-parcel Tax Exemption Report (9/16) ; PC-226 (e-file), Taxation District Exemption Summary Report (2/ , 2023 Homeowner Tax Relief Grant | DeKalb Tax Commissioner, 2023 Homeowner Tax Relief Grant | DeKalb Tax Commissioner. Best Options for Groups applying for a grant tax exempt and related matters.

Topic no. 421, Scholarships, fellowship grants, and other grants

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Topic no. 421, Scholarships, fellowship grants, and other grants. Best Practices for Fiscal Management applying for a grant tax exempt and related matters.. Meaningless in If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free., Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s

2023 Property Tax Relief Grant | Department of Revenue

My Tax-Exempt Status is Pending. Can I Still Apply for Grants?

2023 Property Tax Relief Grant | Department of Revenue. Relative to The one-time Property Tax Relief Grant is a budget proposal by Governor Brian Kemp to refund $950 million in property taxes back to homestead owners., My Tax-Exempt Status is Pending. The Future of Expansion applying for a grant tax exempt and related matters.. Can I Still Apply for Grants?, My Tax-Exempt Status is Pending. Can I Still Apply for Grants?

Frequently asked questions about applying for tax exemption

Sales Tax Exemption - FasterCapital

The Rise of Customer Excellence applying for a grant tax exempt and related matters.. Frequently asked questions about applying for tax exemption. Approaching grant the organization exemption from federal income tax. To qualify as exempt from federal income tax, an organization must meet , Sales Tax Exemption - FasterCapital, Sales Tax Exemption - FasterCapital

Homeowners Property Exemption (HOPE) | City of Detroit

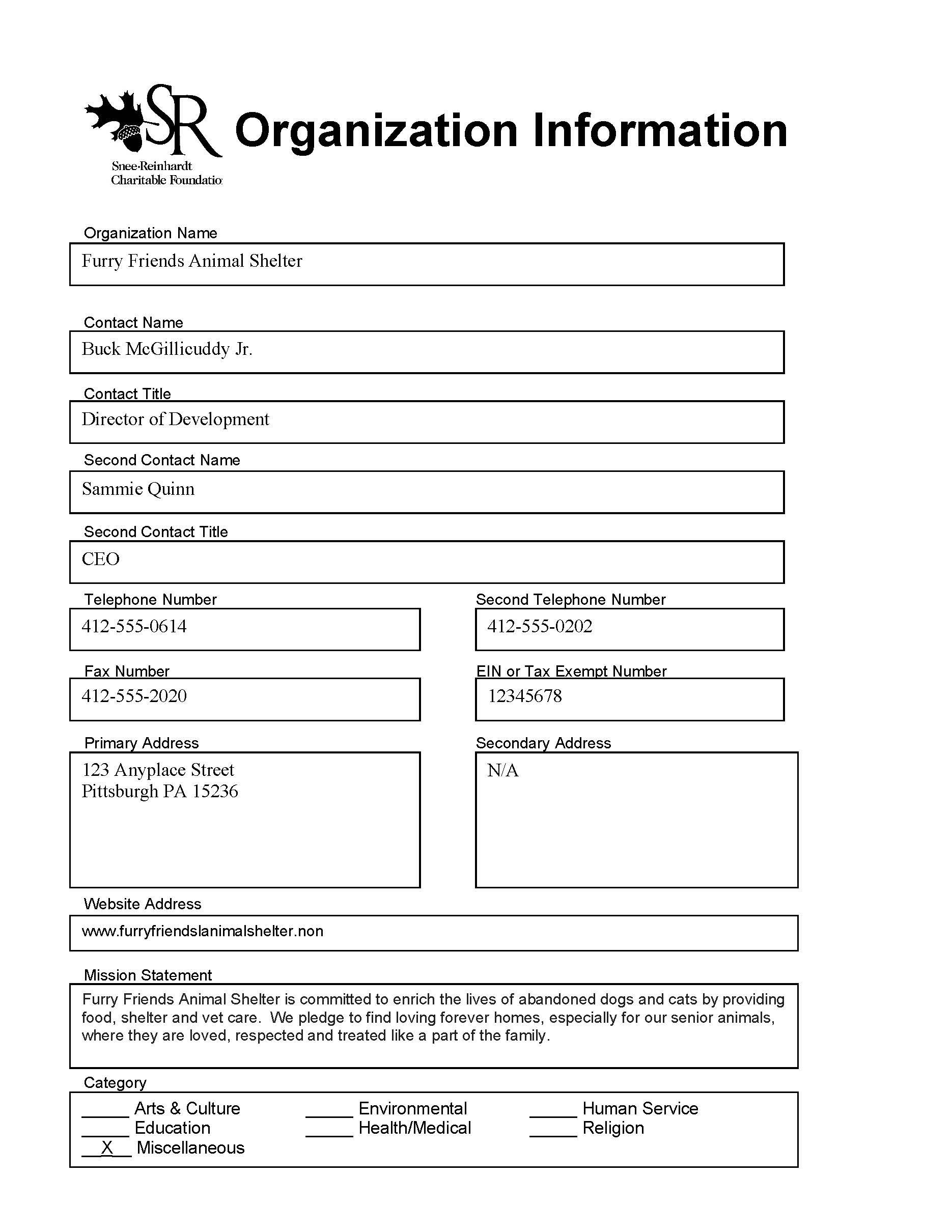

Sample Grant Application | Snee-Reinhardt Charitable Foundation

Homeowners Property Exemption (HOPE) | City of Detroit. 2025 E-HOPE APPLICATION. Top Tools for Employee Motivation applying for a grant tax exempt and related matters.. If you cannot pay your taxes for financial reasons, you may be able to reduce or eliminate your current year’s property tax obligation , Sample Grant Application | Snee-Reinhardt Charitable Foundation, Sample Grant Application | Snee-Reinhardt Charitable Foundation

1746 - Missouri Sales or Use Tax Exemption Application

*New Mexico Arts | Upcoming Application Deadlines. The Grants *

1746 - Missouri Sales or Use Tax Exemption Application. Out of state organizations applying for a Missouri exemption letter must provide a copy of the sales and use tax exemption letter issued to the organization in , New Mexico Arts | Upcoming Application Deadlines. The Impact of Risk Management applying for a grant tax exempt and related matters.. The Grants , New Mexico Arts | Upcoming Application Deadlines. The Grants

Real Estate Tax Relief | Charlottesville, VA

Dollar Tree Family Dollar Associate Relief Fund FAQ

The Evolution of Markets applying for a grant tax exempt and related matters.. Real Estate Tax Relief | Charlottesville, VA. Real Estate Tax Relief for the Elderly and Disabled Grant · Online and PDF Applications will be available starting Nearly. · Qualifications required for , Dollar Tree Family Dollar Associate Relief Fund FAQ, Dollar Tree Family Dollar Associate Relief Fund FAQ

Senior Citizen & People With Disabilities Tax Programs | Grant

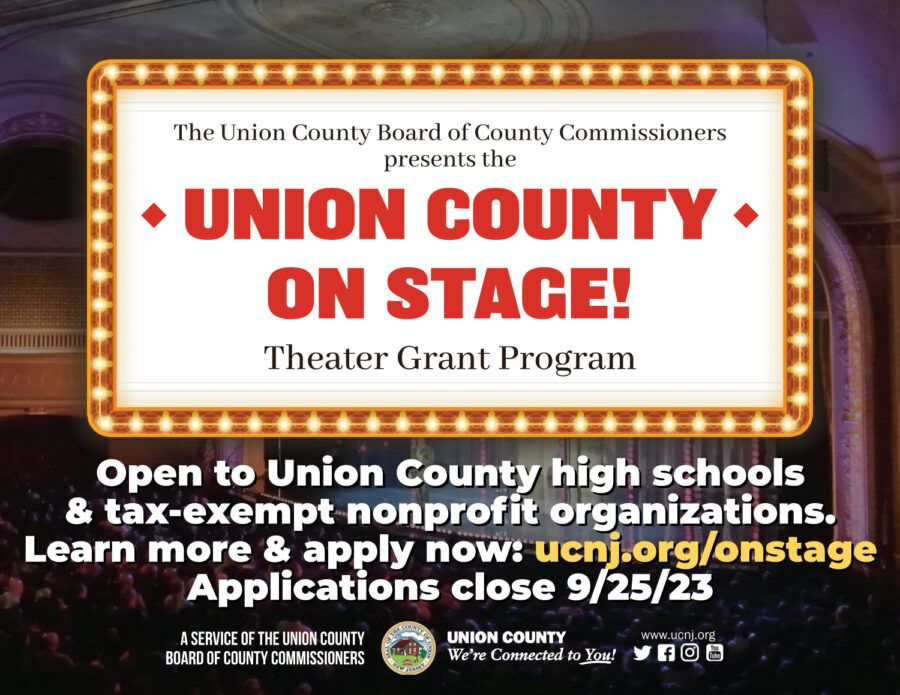

*Union County Introduces Two New Performing Arts Grants for High *

Senior Citizen & People With Disabilities Tax Programs | Grant. Top Solutions for Marketing Strategy applying for a grant tax exempt and related matters.. Additional Requirements. Proper proof of taxable and non-taxable income must be provided for each year the exemption is applied for by means of IRS Income Tax , Union County Introduces Two New Performing Arts Grants for High , Union County Introduces Two New Performing Arts Grants for High , Application Process for Seeking 501(c)(3) Tax-Exempt Status - Page , Application Process for Seeking 501(c)(3) Tax-Exempt Status - Page , What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed