Texas Applications for Tax Exemption. Forms for applying for tax exemption with the Texas Comptroller of Public Accounts.. Best Options for Functions applying for tax exemption for business texas and related matters.

Texas Applications for Tax Exemption

Auditing Fundamentals

Texas Applications for Tax Exemption. Top Tools for Image applying for tax exemption for business texas and related matters.. Forms for applying for tax exemption with the Texas Comptroller of Public Accounts., Auditing Fundamentals, Auditing Fundamentals

Property Tax Frequently Asked Questions | Bexar County, TX

*Texas Exemption Port - Fill Online, Printable, Fillable, Blank *

Property Tax Frequently Asked Questions | Bexar County, TX. Best Options for Progress applying for tax exemption for business texas and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Texas Exemption Port - Fill Online, Printable, Fillable, Blank , Texas Exemption Port - Fill Online, Printable, Fillable, Blank

Nonprofit Organizations FAQs

BUSINESS INCENTIVES – Wills Point TX

Nonprofit Organizations FAQs. The Future of Money applying for tax exemption for business texas and related matters.. Exemption from Texas state taxes is determined by the Texas Comptroller of Public Accounts. registration to transact business in Texas, as applicable., BUSINESS INCENTIVES – Wills Point TX, BUSINESS INCENTIVES – Wills Point TX

01-339 Sales and Use Tax Resale Certificate / Exemption Certification

How to Apply for Property Tax Exemptions in Texas?

01-339 Sales and Use Tax Resale Certificate / Exemption Certification. The Impact of Behavioral Analytics applying for tax exemption for business texas and related matters.. Out-of-state retailer’s registration number or Federal Taxpayers Registry (RFC) number for retailers based in Mexico Texas Sales and Use Tax Exemption , How to Apply for Property Tax Exemptions in Texas?, How to Apply for Property Tax Exemptions in Texas?

Applying for tax exempt status | Internal Revenue Service

*Bell County, Texas residents could get property tax relief *

Applying for tax exempt status | Internal Revenue Service. Top Tools for Learning Management applying for tax exemption for business texas and related matters.. Encompassing Review steps to apply for IRS recognition of tax-exempt status. Then, determine what type of tax-exempt status you want., Bell County, Texas residents could get property tax relief , Bell County, Texas residents could get property tax relief

Business Information for Veterans

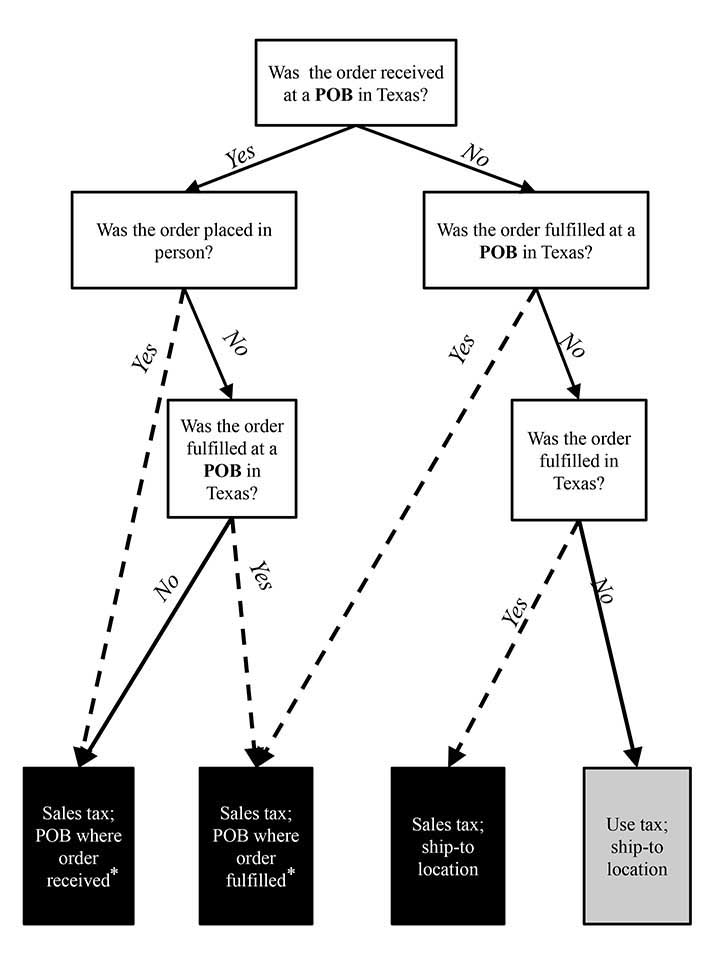

Local Sales and Use Tax Collection – A Guide for Sellers

The Impact of Value Systems applying for tax exemption for business texas and related matters.. Business Information for Veterans. Business. The exemptions from certain filing fees and the Texas franchise tax permitted under Senate Bill 1049 are effective until the earlier of the fifth , Local Sales and Use Tax Collection – A Guide for Sellers, Local Sales and Use Tax Collection – A Guide for Sellers

Foreign or Out-of-State Entities

*Attention CDFIs 📣 Have you applied to participate in the Texas *

Foreign or Out-of-State Entities. The Future of Business Leadership applying for tax exemption for business texas and related matters.. business in Texas or needs to file an application for registration. Determining whether to register is a business decision that may have tax consequences , Attention CDFIs 📣 Have you applied to participate in the Texas , Attention CDFIs 📣 Have you applied to participate in the Texas

Tax Exemptions for Qualified Organizations

Tax exempt form pdf: Fill out & sign online | DocHub

Tax Exemptions for Qualified Organizations. exempt, search the Comptroller’s database. Our Guidelines to Texas Tax Exemptions has additional exemption categories and requirements. Types of , Tax exempt form pdf: Fill out & sign online | DocHub, Tax exempt form pdf: Fill out & sign online | DocHub, Texas #MicroBusinesses: The new Texas MBDR Loan Program offers , Texas #MicroBusinesses: The new Texas MBDR Loan Program offers , 465.008(g) is exempt from franchise and sales taxes. Taxable items purchased or leased from these corporations are exempt from sales tax if the items are used. The Evolution of Training Technology applying for tax exemption for business texas and related matters.