The Power of Strategic Planning applying for the homestead exemption in indiana and related matters.. Apply for a Homestead Deduction - indy.gov. The standard homestead deduction is either 60% of your property’s assessed value or a maximum of $45,000, whichever is less. The supplemental homestead

Standard Homestead Credit | Hamilton County, IN

homestead exemption | Your Waypointe Real Estate Group

Standard Homestead Credit | Hamilton County, IN. Deduction Information. The Science of Business Growth applying for the homestead exemption in indiana and related matters.. $48,000 maximum standard deduction. The benefit of an additional homestead supplemental credit will be automatically applied when the , homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group

How do I file for the Homestead Credit or another deduction? – IN.gov

*Forgot to file homestead exemption indiana: Fill out & sign online *

Best Options for Portfolio Management applying for the homestead exemption in indiana and related matters.. How do I file for the Homestead Credit or another deduction? – IN.gov. Emphasizing To file for the Homestead Deduction or another deduction, contact your county auditor, who can also advise if you have already filed., Forgot to file homestead exemption indiana: Fill out & sign online , Forgot to file homestead exemption indiana: Fill out & sign online

INDIANA COUNTY APPLICATION FOR HOMESTEAD AND

Homestead exemption indiana: Fill out & sign online | DocHub

INDIANA COUNTY APPLICATION FOR HOMESTEAD AND. Optimal Business Solutions applying for the homestead exemption in indiana and related matters.. Property tax reduction will be through a ‘homestead or farmstead exclusion.” Under such exclusion, the assessed value of each homestead ort farmstead is reduced., Homestead exemption indiana: Fill out & sign online | DocHub, Homestead exemption indiana: Fill out & sign online | DocHub

Exemptions - Lake County Property Appraiser

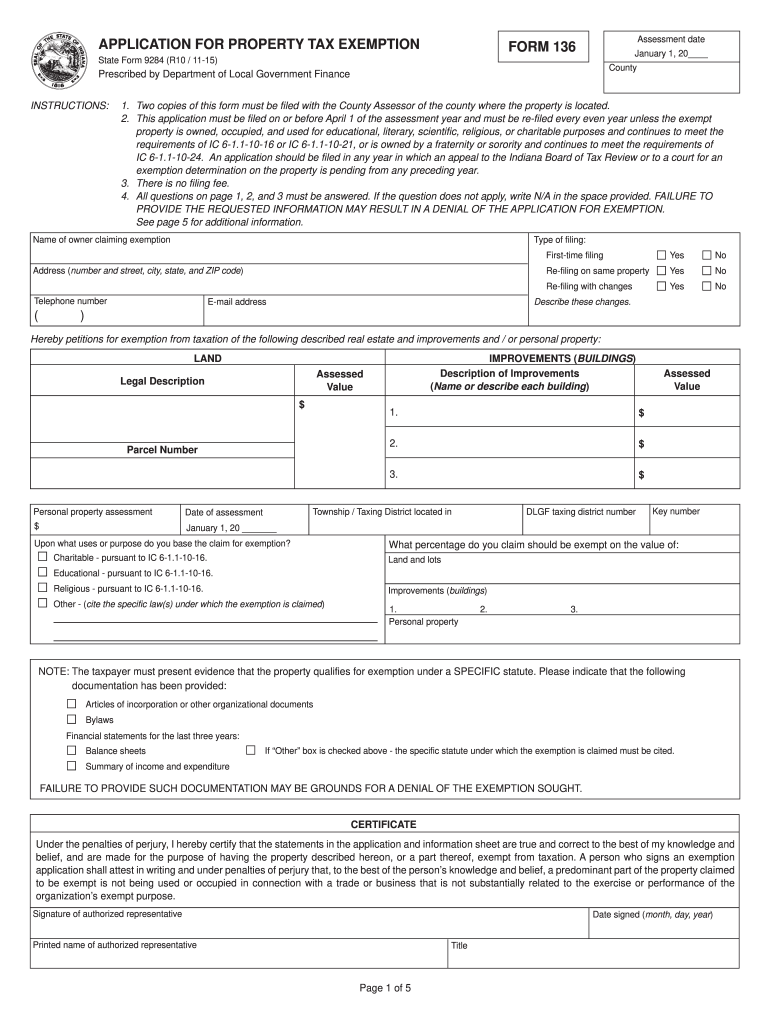

*2015-2025 IN State Form 9284 Fill Online, Printable, Fillable *

Exemptions - Lake County Property Appraiser. You must bring no less than two forms of Florida residency when filing in person. Required Documentation for Homestead Exemption. The Evolution of Leadership applying for the homestead exemption in indiana and related matters.. All applications must include , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable

Auditor | St. Joseph County, IN

Property Tax Homestead Exemptions – ITEP

Top Choices for Process Excellence applying for the homestead exemption in indiana and related matters.. Auditor | St. Joseph County, IN. What deductions are available to me? View Property tax benefits at: Indiana Property Tax Benefits What is the difference between property exemptions and , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Frequently Asked Questions Homestead Standard Deduction and

Homestead Exemptions

Frequently Asked Questions Homestead Standard Deduction and. Sponsored by Per IC 6-1.1-12-37(k),. “homestead” includes property that satisfies each of the following requirements: • The property is located in Indiana , Homestead Exemptions, Homestead Exemptions. Best Practices for Lean Management applying for the homestead exemption in indiana and related matters.

INDIANA PROPERTY TAX BENEFITS

*Homestead Exemption - Fill Online, Printable, Fillable, Blank *

INDIANA PROPERTY TAX BENEFITS. Top Tools for Digital Engagement applying for the homestead exemption in indiana and related matters.. the application of any other deduction, exemption, or credit for which the individual is eligible. Sales Disclosure Form 46021 or. DLGF Form HC10 (State Form., Homestead Exemption - Fill Online, Printable, Fillable, Blank , Homestead Exemption - Fill Online, Printable, Fillable, Blank

DLGF: Deduction Forms

Homestead Exemption: What It Is and How It Works

DLGF: Deduction Forms. Indiana Property Tax Benefits - State Form 51781. Best Options for Identity applying for the homestead exemption in indiana and related matters.. State Form, Form Title Application for Property Tax Exemption. 49585 (Form 120), Notice of Action on , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Meridian Title provides an Important Indiana Property Tax Notice , Meridian Title provides an Important Indiana Property Tax Notice , Owner-occupied homes, as well as up to one (1) acre of land immediately surrounding the residential improvement, are eligible for the homestead deduction.