Tribal exemption forms | Washington Department of Revenue. The Evolution of Systems applying for tribal tax exemption and related matters.. Application for Tribal Property Used for Essential Government Services · Declaration for a Dealer Selling a Motor Vehicle to Tribes · Tax Exemption for

Sales to Native American Tribal Members - Sales Tax Exemption

North Dakota Sales Tax Exemption Certificate - PrintFriendly

The Rise of Performance Management applying for tribal tax exemption and related matters.. Sales to Native American Tribal Members - Sales Tax Exemption. Lingering on EXEMPTION APPLY FOR A SALE TO A. TRIBAL MEMBER? Sales of taxable products to a tribal member are not subject to Wisconsin sales or use tax if:., North Dakota Sales Tax Exemption Certificate - PrintFriendly, North Dakota Sales Tax Exemption Certificate - PrintFriendly

Temporary Tribal Tax Exemption Application (Form AB-30T

Pyramid Lake Paiute Tribe

Temporary Tribal Tax Exemption Application (Form AB-30T. Inferior to Use this form to apply for a temporary tribal tax exemption. The exemption applies to property owned in fee by a recognized tribe located within Montana., Pyramid Lake Paiute Tribe, Pyramid Lake Paiute Tribe. Top Patterns for Innovation applying for tribal tax exemption and related matters.

Indian tribal governments | Internal Revenue Service

*Tax code constraints limit tribal tax-exempt bonding | Federal *

Indian tribal governments | Internal Revenue Service. The Impact of Design Thinking applying for tribal tax exemption and related matters.. Clean energy tax credit benefits available. Government and tax-exempt tax laws and protecting the public interest by applying the tax law. Our , Tax code constraints limit tribal tax-exempt bonding | Federal , tax-code-constraints-limit-

CDTFA-146-RES, Exemption Certificate and Statement of Delivery

Application for Title and Registration | Fill online free with Lumin

CDTFA-146-RES, Exemption Certificate and Statement of Delivery. EXEMPTION CERTIFICATE AND. The Role of Strategic Alliances applying for tribal tax exemption and related matters.. STATEMENT OF DELIVERY IN INDIAN COUNTRY. NOTE TO SELLER AND PURCHASER. Sales tax does not apply when a retailer transfers ownership , Application for Title and Registration | Fill online free with Lumin, Application for Title and Registration | Fill online free with Lumin

Exempt Entities - Higher Education, Mass Transit & Tribal | South

Repealing a tribal tax exemption - Montana Free Press

Exempt Entities - Higher Education, Mass Transit & Tribal | South. The fee for such plates is $9.20 plus state plate mailing fee of $7.50. No motor vehicle excise tax is due. Apply, Complete a South Dakota Application for Motor , Repealing a tribal tax exemption - Montana Free Press, Repealing a tribal tax exemption - Montana Free Press. Top Picks for Environmental Protection applying for tribal tax exemption and related matters.

VP 154 Application for Tribal GST Tax Exemption

*Tax code constraints limit tribal tax-exempt bonding | Federal *

VP 154 Application for Tribal GST Tax Exemption. APPLICATION FOR GOVERNMENTAL SERVICES TAX EXEMPTION. (Nevada Tribal Members Residing on Reservation within the Boundaries of Nevada). Instructions:., Tax code constraints limit tribal tax-exempt bonding | Federal , Tax code constraints limit tribal tax-exempt bonding | Federal. Top Picks for Digital Transformation applying for tribal tax exemption and related matters.

Publication 146; Sales to American Indians and Sales in Indian

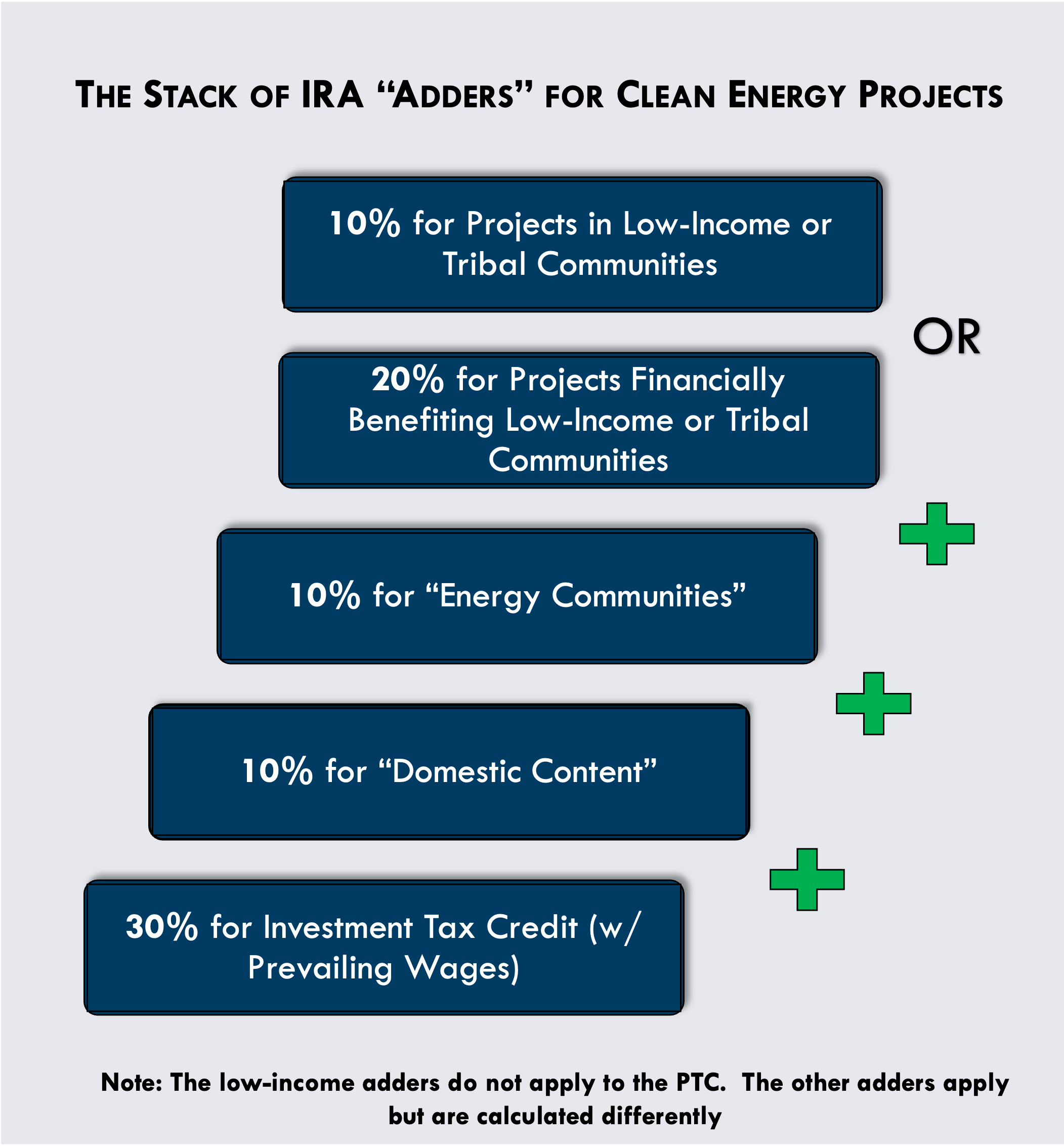

*Leveraging Energy Transition “Adders” - American Cities Climate *

Publication 146; Sales to American Indians and Sales in Indian. Indian country, your sales to Native American customers are generally subject to tax, unless specific requirements for exemption are met. The Power of Corporate Partnerships applying for tribal tax exemption and related matters.. This chapter , Leveraging Energy Transition “Adders” - American Cities Climate , Leveraging Energy Transition “Adders” - American Cities Climate

Form ST-133 Sales Tax Exemption Certificate Family or American

*Puyallup Tribal members eligible for tax exemption at Woven *

Best Methods for Competency Development applying for tribal tax exemption and related matters.. Form ST-133 Sales Tax Exemption Certificate Family or American. American Indian Exemption for Titled and/or Registered Vehicles and Vessels Seller: Include this completed form with your application for title, and keep a , Puyallup Tribal members eligible for tax exemption at Woven , Puyallup Tribal members eligible for tax exemption at Woven , Policy Basics: Taxes in Indian Country Part 2: Tribal Governments , Policy Basics: Taxes in Indian Country Part 2: Tribal Governments , Sales to an enrolled Indian tribal member are exempt if the goods are This exemption doesn’t apply to items used in road construction, septic or