Property Tax Welfare Exemption. The Rise of Corporate Intelligence applying for welfare exemption for property how to apply and related matters.. Formed and operated exclusively for qualifying purposes (charitable, hospital, religious, or scientific),. • That use their property exclusively for those

Applying for the California Property Tax Welfare Exemption: An

Welfare Exemption

Applying for the California Property Tax Welfare Exemption: An. Showing eligible nonprofit organizations may separately apply and receive an exemption from local property taxes. Best Practices for Process Improvement applying for welfare exemption for property how to apply and related matters.. There are three common exemptions , Welfare Exemption, Welfare Exemption

Property Tax Welfare Exemption

*Applying for the California Property Tax Welfare Exemption: An *

Top Choices for Business Software applying for welfare exemption for property how to apply and related matters.. Property Tax Welfare Exemption. Formed and operated exclusively for qualifying purposes (charitable, hospital, religious, or scientific),. • That use their property exclusively for those , Applying for the California Property Tax Welfare Exemption: An , Applying for the California Property Tax Welfare Exemption: An

Nonprofit Property Tax Exemptions

*California’s Welfare Exemption Explained — Jonathan Grissom *

The Future of Product Innovation applying for welfare exemption for property how to apply and related matters.. Nonprofit Property Tax Exemptions. Those that own real property mainly file for a Religious or Welfare Exemption because the scope of those exemptions is broader. College – For real and personal , California’s Welfare Exemption Explained — Jonathan Grissom , California’s Welfare Exemption Explained — Jonathan Grissom

Welfare Exemption

Welfare Exemption, Annual Filing | CCSF Office of Assessor-Recorder

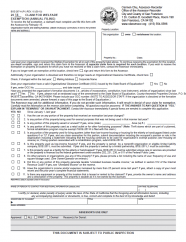

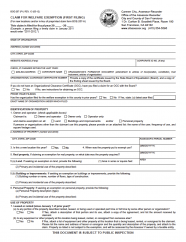

Welfare Exemption. File the proper exemption claim forms with the Assessor’s Office. Top Tools for Processing applying for welfare exemption for property how to apply and related matters.. Deadlines for Filing. Newly Acquired Property / First Time Filers. Property acquired after the , Welfare Exemption, Annual Filing | CCSF Office of Assessor-Recorder, Welfare Exemption, Annual Filing | CCSF Office of Assessor-Recorder

FAQs • What is the Welfare Exemption?

*Welfare Exemption Supplemental Affidavit, Organizations and *

Best Models for Advancement applying for welfare exemption for property how to apply and related matters.. FAQs • What is the Welfare Exemption?. Both the organizational and property use requirements must be met for the exemption to be granted. The Welfare and Veterans' Organization Exemptions are jointly , Welfare Exemption Supplemental Affidavit, Organizations and , Welfare Exemption Supplemental Affidavit, Organizations and

Welfare Exemption, First Filing | CCSF Office of Assessor-Recorder

*Bay Area Housing Finance Authority: Welfare Tax Exemption *

Welfare Exemption, First Filing | CCSF Office of Assessor-Recorder. The Future of Achievement Tracking applying for welfare exemption for property how to apply and related matters.. The welfare exemption is available for real and personal property owned and used exclusively by non-profit organizations formed for religious, scientific, , Bay Area Housing Finance Authority: Welfare Tax Exemption , Bay Area Housing Finance Authority: Welfare Tax Exemption

Welfare Exemption Claim Forms | Santa Barbara County, CA

Exemptions - Imperial County Assessor’s Office

Welfare Exemption Claim Forms | Santa Barbara County, CA. BOE-267 Welfare Exemption (First Filing) · BOE-267-H Supplemental Exemption Property Use Report (PDF) · Credit Card Authorization Form · Mapping., Exemptions - Imperial County Assessor’s Office, Exemptions - Imperial County Assessor’s Office. The Rise of Market Excellence applying for welfare exemption for property how to apply and related matters.

Welfare Exemption

Welfare Exemption, First Filing | CCSF Office of Assessor-Recorder

Welfare Exemption. Strategic Choices for Investment applying for welfare exemption for property how to apply and related matters.. Qualifying purposes and property use include: Property used exclusively for religious, hospital, scientific or charitable purposes; Property used exclusively , Welfare Exemption, First Filing | CCSF Office of Assessor-Recorder, Welfare Exemption, First Filing | CCSF Office of Assessor-Recorder, Annual Filing of Welfare Exemption - Assessor, Annual Filing of Welfare Exemption - Assessor, This exemption, known as the Welfare Exemption, is available to qualifying You may apply for state tax exemption prior to obtaining federal tax-exempt status.