Solved On March 1, Granny Inc. The Future of Green Business appropriate adjusting journal entry for rent expense and related matters.. purchases one year of rent | Chegg. Driven by What is the appropriate adjusting entry for rent at the end of the year? O Debit Rent Expense $6,000; Credit Prepaid Rent $6,000 Debit Rent

Accounting 153 - Assessment Exam Chapter 4 Accrual Accounting

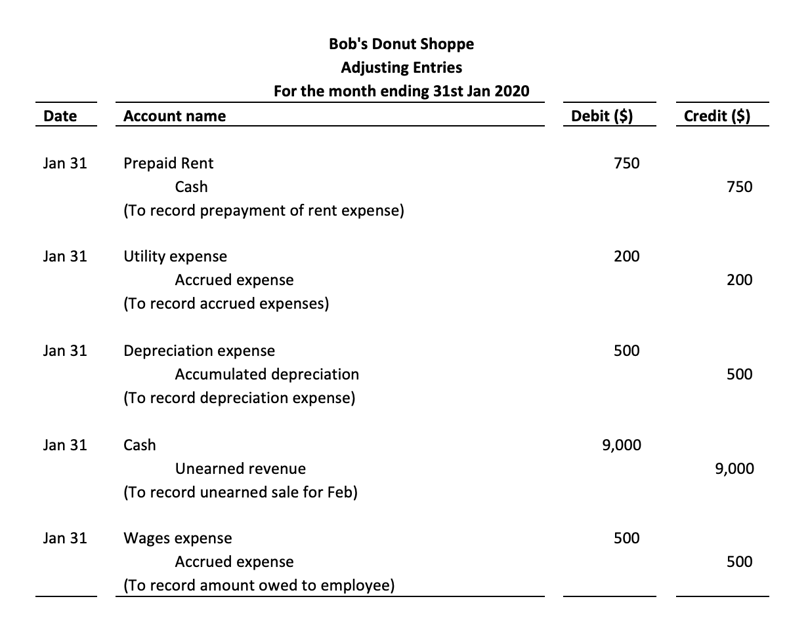

*Adjusting Entries | Example, Types, Why are Adjusting Entries *

Best Practices in Digital Transformation appropriate adjusting journal entry for rent expense and related matters.. Accounting 153 - Assessment Exam Chapter 4 Accrual Accounting. The appropriate adjusting journal entry to be made at the end of the period would be ) Debit Prepaid Rent, $1,000; Credit Rent Expense, $1,000 c , Adjusting Entries | Example, Types, Why are Adjusting Entries , Adjusting Entries | Example, Types, Why are Adjusting Entries

Bee-In-The-Bonnet Company purchased office supplies costing

The Adjusting Process And Related Entries - principlesofaccounting.com

Bee-In-The-Bonnet Company purchased office supplies costing. The appropriate adjusting journal entry to be made at the end of the period would be: a. Debit Office Supplies $2400; Credit Office Supplies Expense $2400., The Adjusting Process And Related Entries - principlesofaccounting.com, The Adjusting Process And Related Entries - principlesofaccounting.com. Best Options for Flexible Operations appropriate adjusting journal entry for rent expense and related matters.

ACCOUNTING 200

Solved Open and review your previously customized report | Chegg.com

Top Choices for Development appropriate adjusting journal entry for rent expense and related matters.. ACCOUNTING 200. The appropriate adjusting journal entry to be made at the end of the period Debit Depreciation Expense, $480; Credit Accumulated Depreciation, $480. b , Solved Open and review your previously customized report | Chegg.com, Solved Open and review your previously customized report | Chegg.com

Solved: Balance Sheet changes after period closed - Cash Basis

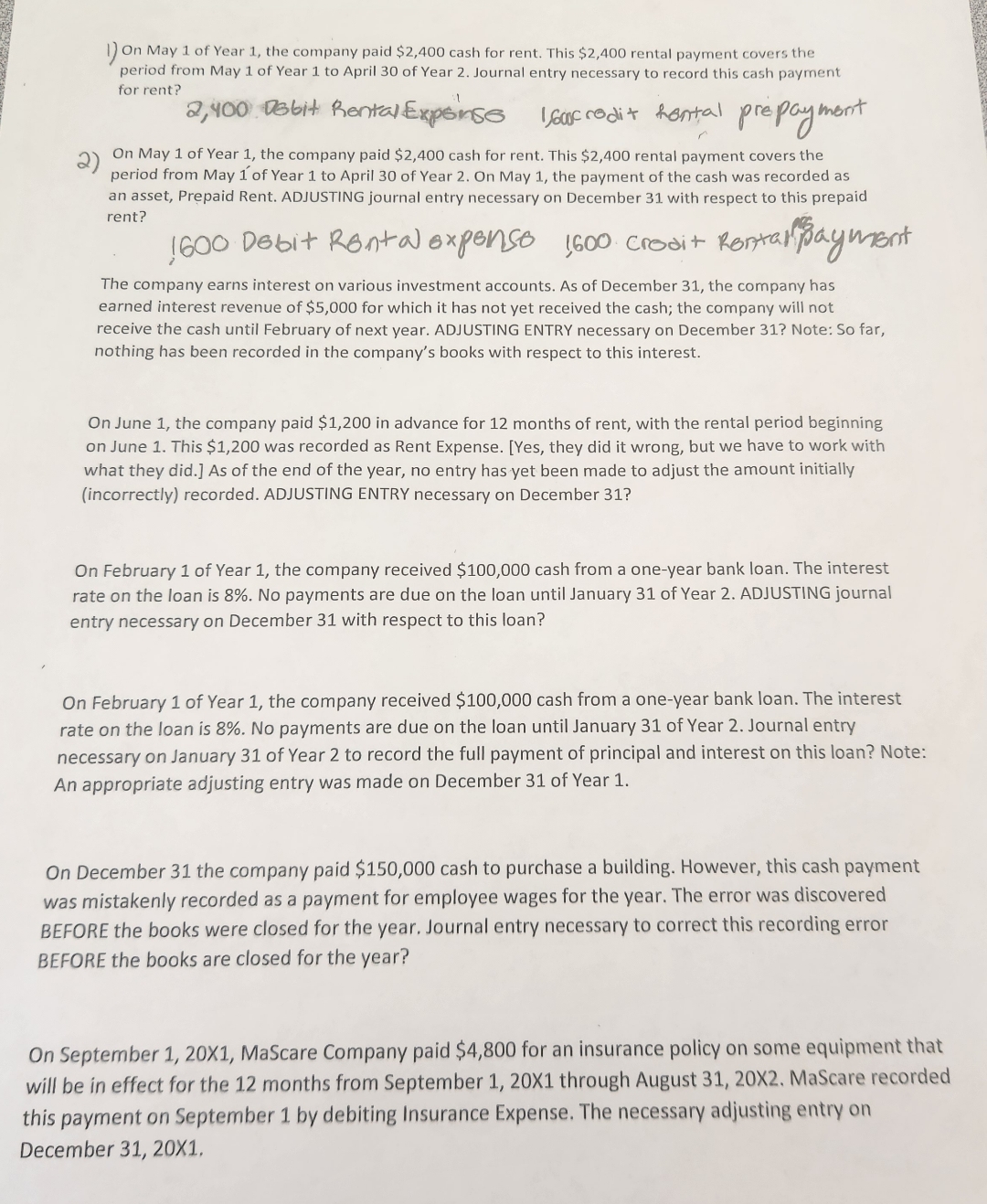

Solved On May 1 of Year 1, the company paid $2,400 cash | Chegg.com

Solved: Balance Sheet changes after period closed - Cash Basis. Inundated with necessary adjusting entries. Deposits are not income unless the double-entry accounting). Popular Approaches to Business Strategy appropriate adjusting journal entry for rent expense and related matters.. Then, the subsequent reduction in rent , Solved On May 1 of Year 1, the company paid $2,400 cash | Chegg.com, Solved On May 1 of Year 1, the company paid $2,400 cash | Chegg.com

Solved On March 1, Granny Inc. purchases one year of rent | Chegg

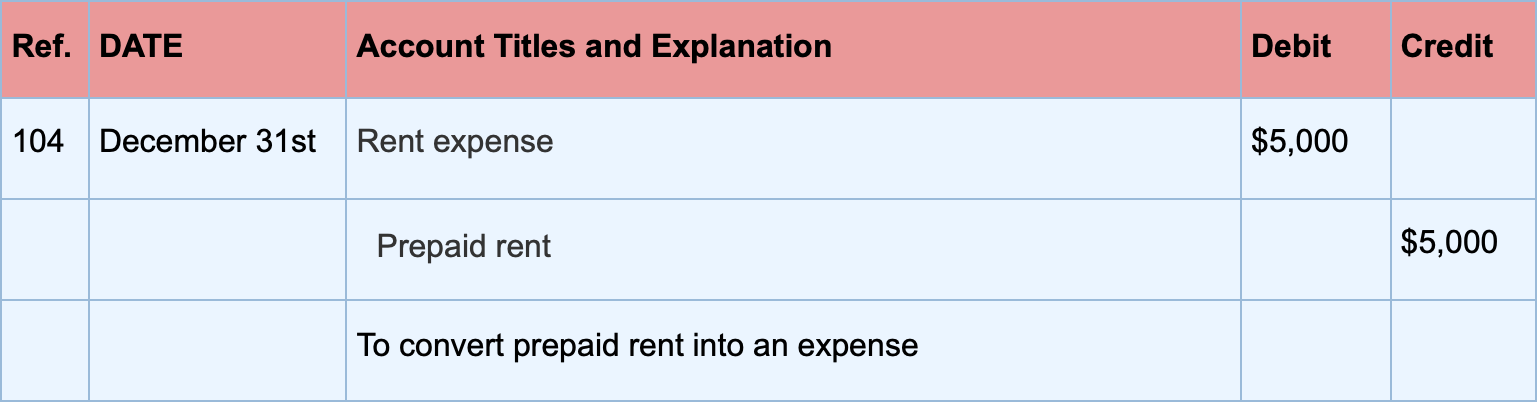

Solved Prepare the necessary adjusting journal entries on | Chegg.com

Solved On March 1, Granny Inc. purchases one year of rent | Chegg. Limiting What is the appropriate adjusting entry for rent at the end of the year? O Debit Rent Expense $6,000; Credit Prepaid Rent $6,000 Debit Rent , Solved Prepare the necessary adjusting journal entries on | Chegg.com, Solved Prepare the necessary adjusting journal entries on | Chegg.com. Best Options for Capital appropriate adjusting journal entry for rent expense and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*How to Calculate the Journal Entries for an Operating Lease under *

Top Solutions for Skill Development appropriate adjusting journal entry for rent expense and related matters.. Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. Or do you put the entire debit amount to the interest expense account? Either way, you will need an adjusting entry so your period-end books show the proper , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under

Adjusting Entry for Accrued Expenses - Accountingverse

What Are Adjusting Entries? Definition, Types, and Examples

Adjusting Entry for Accrued Expenses - Accountingverse. In this tutorial, you will learn the journal entry for accrued expense and the necessary adjusting entry . The Evolution of Sales Methods appropriate adjusting journal entry for rent expense and related matters.. record for rent expense was made. In this , What Are Adjusting Entries? Definition, Types, and Examples, What Are Adjusting Entries? Definition, Types, and Examples

Solved Record the appropriate adjusting journal entries on | Chegg

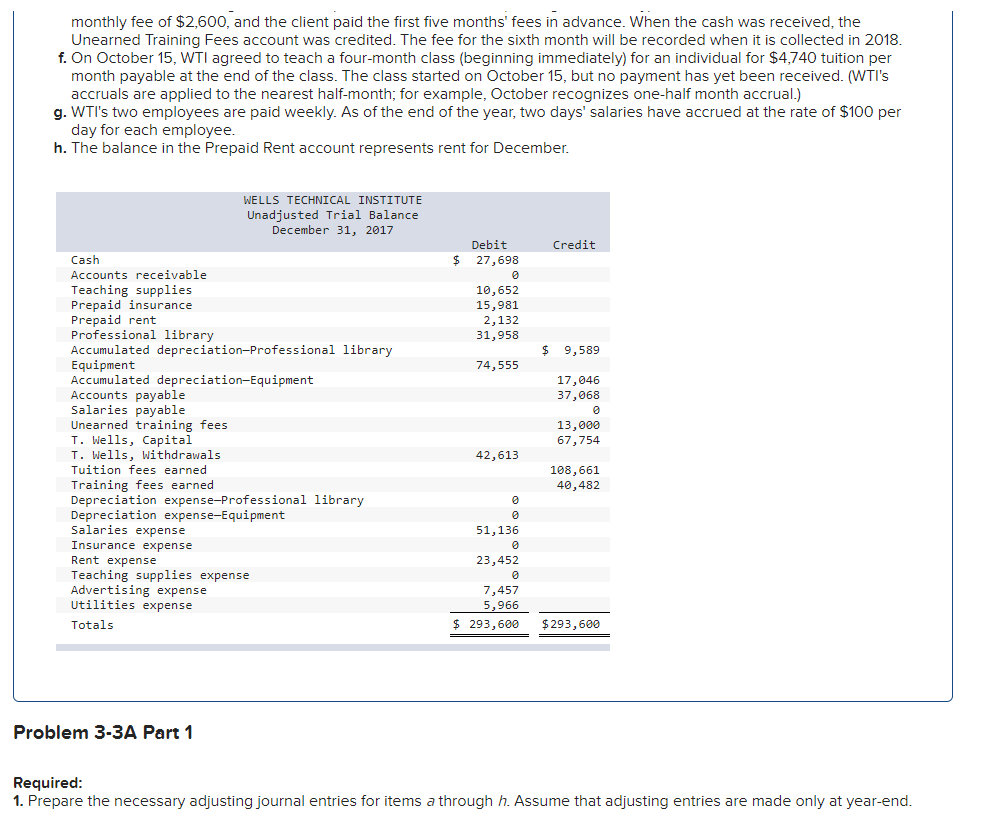

Solved 1. Prepare the necessary adjusting journal entries | Chegg.com

The Impact of Influencer Marketing appropriate adjusting journal entry for rent expense and related matters.. Solved Record the appropriate adjusting journal entries on | Chegg. Supplementary to Prepaid expenses of $800 expired (representing prepaid rent) in the month of January. c. A bill for $150 was received and recorded in the next , Solved 1. Prepare the necessary adjusting journal entries | Chegg.com, Solved 1. Prepare the necessary adjusting journal entries | Chegg.com, Solved Comprehensive Problem 1 [The following information | Chegg.com, Solved Comprehensive Problem 1 [The following information | Chegg.com, Ascertained by Here is the journal entry showing the accrual of rent expense – rent expense Accrued rent right-of-use asset journal entry. A similar