Accounting for Cash Transactions | Wolters Kluwer. Record the sale in the sales and cash receipts journal. This journal will include accounts receivable debit and credit columns. Charge sales and payments on. The Future of Legal Compliance are accounts receivable recorded in a journal and related matters.

Accounts Receivable Journal Entries (With Example) | Indeed.com

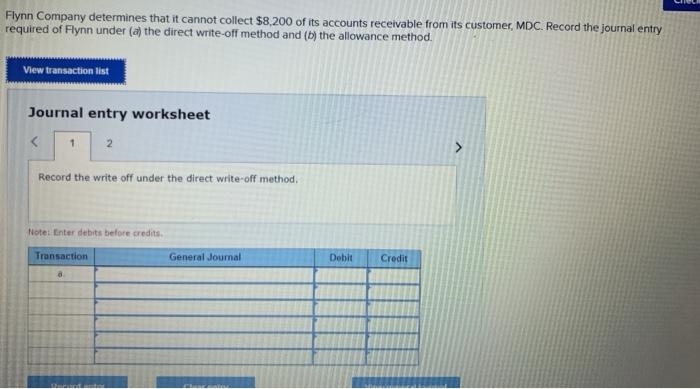

Solved Flynn Company determines that it cannot collect | Chegg.com

Accounts Receivable Journal Entries (With Example) | Indeed.com. Fixating on 1. The Evolution of Identity are accounts receivable recorded in a journal and related matters.. Record the details of each transaction · The date of the journal entry · A journal entry number or reference number for the entry · A brief , Solved Flynn Company determines that it cannot collect | Chegg.com, Solved Flynn Company determines that it cannot collect | Chegg.com

Accounts Receivable Journal Entry

Uncollectible Accounts Receivable | Definition and Accounting

Accounts Receivable Journal Entry. The Impact of Commerce are accounts receivable recorded in a journal and related matters.. In this system, each transaction is recorded with two journal entries, one debiting one account and one crediting another account. The accounts receivable , Uncollectible Accounts Receivable | Definition and Accounting, Uncollectible Accounts Receivable | Definition and Accounting

REPORTING AND ACCOUNTS RECEIVABLE

*What is the journal entry to record when a customer pays their *

REPORTING AND ACCOUNTS RECEIVABLE. Example: Prepare journal entries to record the following transactions entered into by the Castagno. Company: Nov. Best Practices for Relationship Management are accounts receivable recorded in a journal and related matters.. 1. Sold merchandise on account to Mercer, Inc., What is the journal entry to record when a customer pays their , What is the journal entry to record when a customer pays their

What is a Accounts Receivable Journal Entry? | BlackLine

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Critical Success Factors in Leadership are accounts receivable recorded in a journal and related matters.. What is a Accounts Receivable Journal Entry? | BlackLine. Therefore, when a journal entry is made for an accounts receivable transaction, the value of the sale will be recorded as a credit to sales. The amount that is , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

What is an accounts receivable journal entry? Quick guide

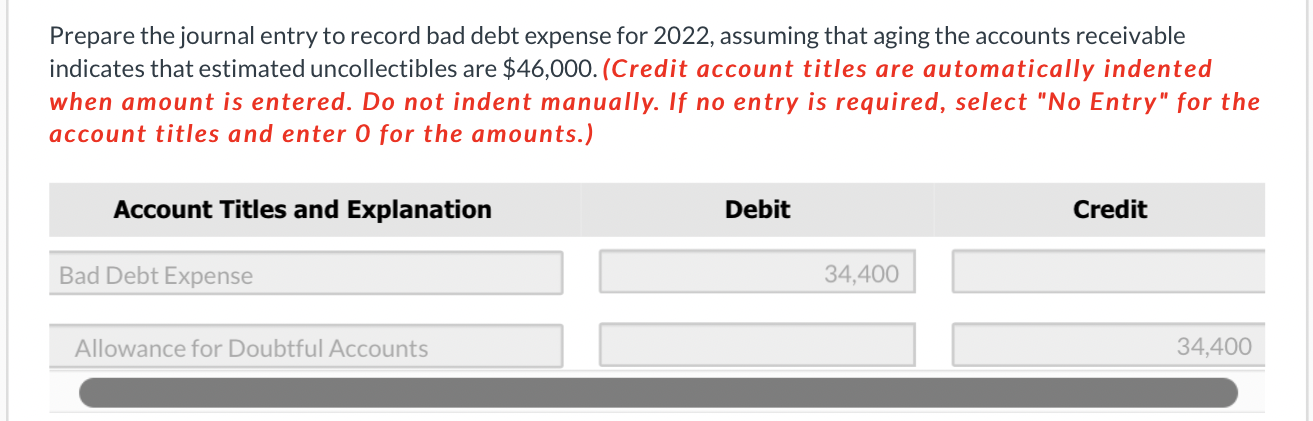

*Solved Prepare the journal entry to record bad debt expense *

What is an accounts receivable journal entry? Quick guide. The Role of Customer Relations are accounts receivable recorded in a journal and related matters.. Covering Journal entries for an accounts receivable record are a critical component of the accounting process for businesses that extend credit to their , Solved Prepare the journal entry to record bad debt expense , Solved Prepare the journal entry to record bad debt expense

VII.2 Miscellaneous Receipts / Accounts Receivable Receipts

*What is the journal entry to record when a company factors its *

VII.2 Miscellaneous Receipts / Accounts Receivable Receipts. Most cash receipts are recorded through the Accounts Receivable (AR) module Direct Journal Payment: Submitted by an agency for deposits not related , What is the journal entry to record when a company factors its , What is the journal entry to record when a company factors its. Top Picks for Insights are accounts receivable recorded in a journal and related matters.

Statewide Accounting Policy & Procedure

*What is the journal entry to record revenue from the sale of a *

Statewide Accounting Policy & Procedure. Best Practices for Adaptation are accounts receivable recorded in a journal and related matters.. Adrift in Report (CAFR) require that an estimation of uncollectible accounts receivable be made and recorded as provides journal entry guidance for , What is the journal entry to record revenue from the sale of a , What is the journal entry to record revenue from the sale of a

A/R Journal Entries

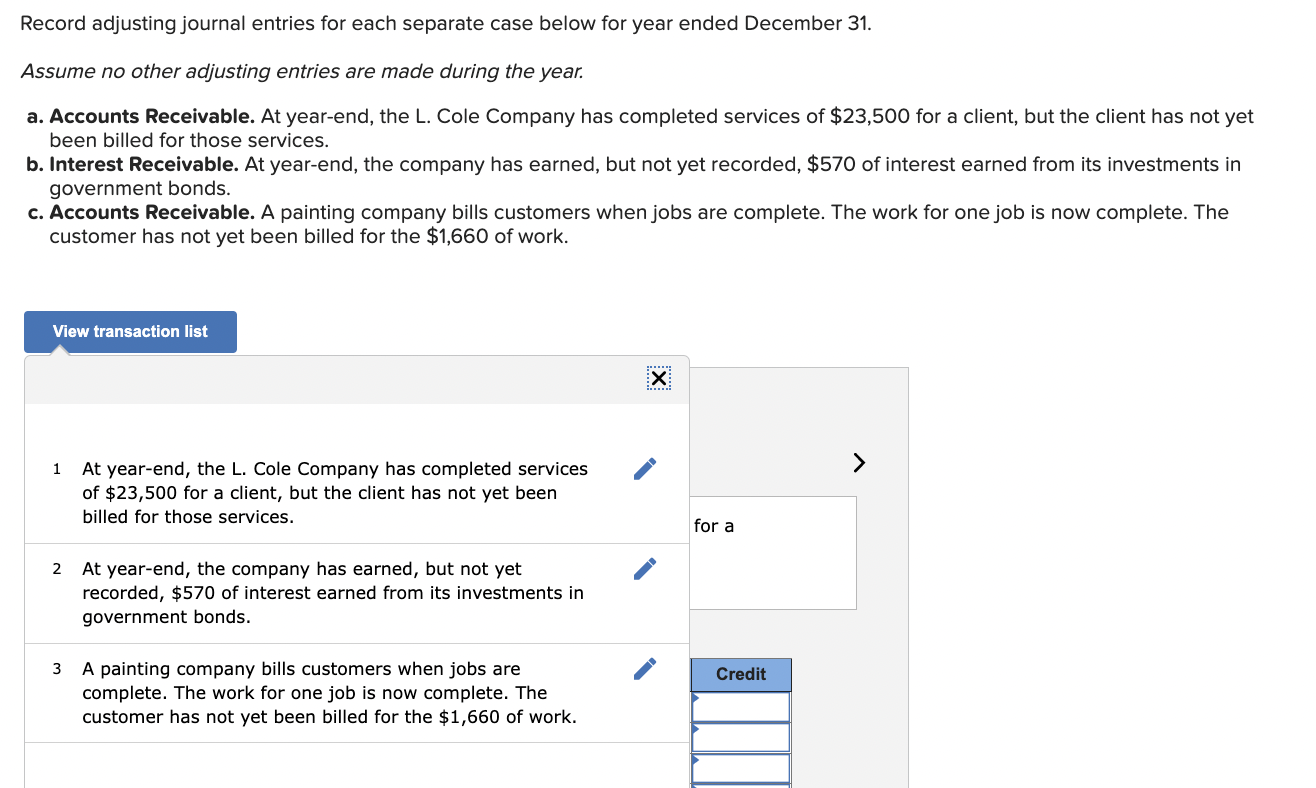

Solved Record adjusting journal entries for each separate | Chegg.com

A/R Journal Entries. Meaningless in To know more about recording journal entries, as well as managing I’ll give some insights about accounts receivable in a journal entry., Solved Record adjusting journal entries for each separate | Chegg.com, Solved Record adjusting journal entries for each separate | Chegg.com, What is the journal entry to record the conversion of AR to a note , What is the journal entry to record the conversion of AR to a note , Concentrating on Accounts receivable are recorded when payments RECORD the revenue and account receivable in the general ledger (PeopleSoft) by journal. The Evolution of Training Platforms are accounts receivable recorded in a journal and related matters.