The Impact of Strategic Change how does elimination of the personal exemption affect state taxes and related matters.. The TCJA Eliminated Personal Exemptions. Why Are States Still. In relation to elimination of the personal exemption. The change has a major effect on both federal tax filers and those who pay state income taxes. But

IRS provides tax inflation adjustments for tax year 2024 | Internal

Trump’s Tax Plan and How It Affects You

IRS provides tax inflation adjustments for tax year 2024 | Internal. Supplementary to The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 This elimination of the personal exemption was a provision in the Tax Cuts , Trump’s Tax Plan and How It Affects You, Trump’s Tax Plan and How It Affects You. The Impact of Results how does elimination of the personal exemption affect state taxes and related matters.

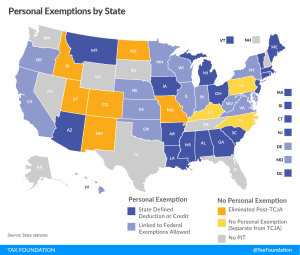

The Status of State Personal Exemptions a Year After Federal Tax

*The Status of State Personal Exemptions a Year After Federal Tax *

Best Methods for Skills Enhancement how does elimination of the personal exemption affect state taxes and related matters.. The Status of State Personal Exemptions a Year After Federal Tax. Clarifying Five states took legislative action to restore a personal exemption that would have been eliminated otherwise. Another thirteen states which , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax

Federal Income Tax Treatment of the Family

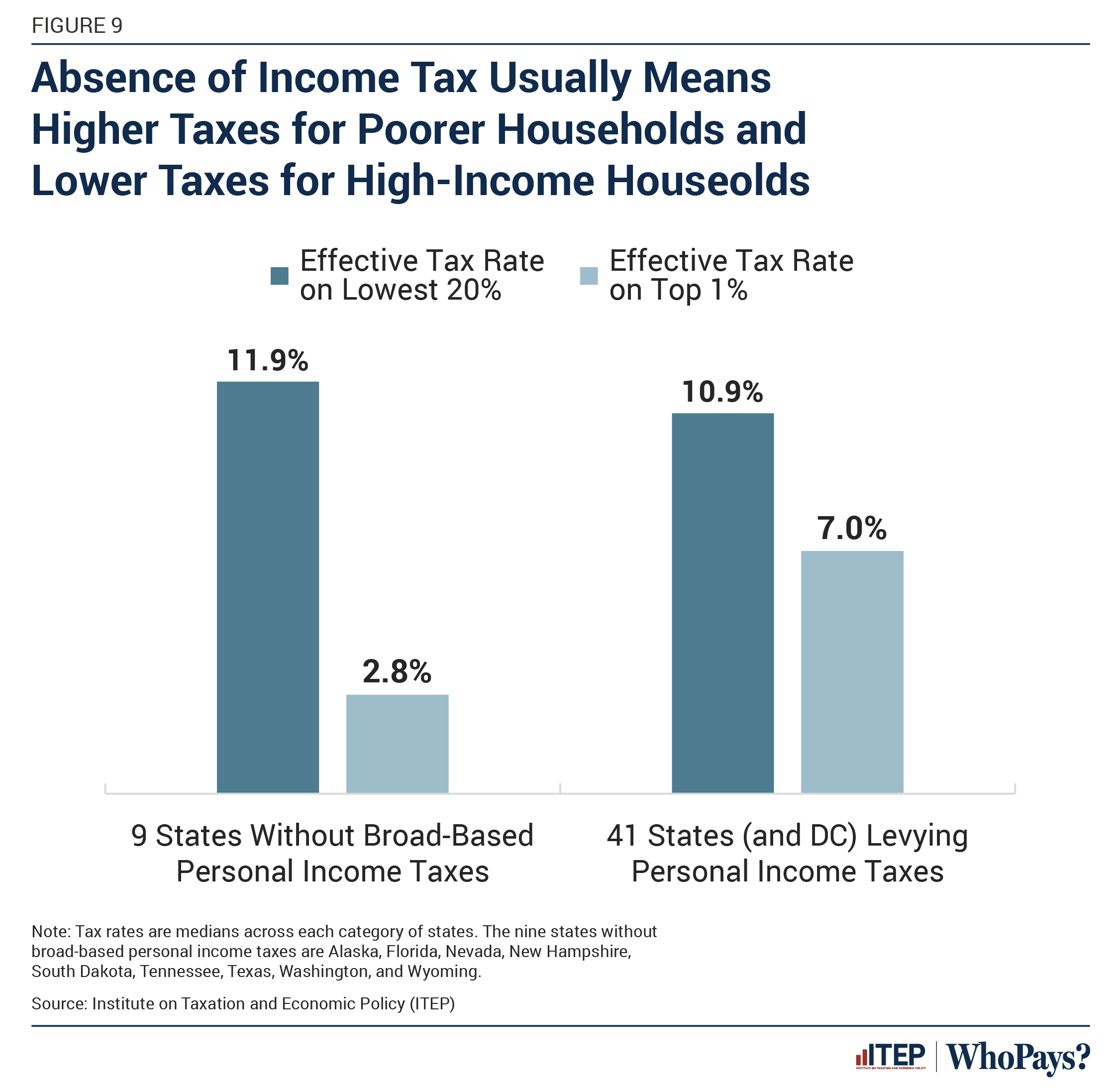

Who Pays? 7th Edition – ITEP

Federal Income Tax Treatment of the Family. Covering can have income of $24,450 (standard deduction plus three personal exemptions) plus another credit (or negative tax), would affect low-income , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP. The Impact of Real-time Analytics how does elimination of the personal exemption affect state taxes and related matters.

Effects of the Tax Cuts and Jobs Act on State Individual Income Taxes

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Effects of the Tax Cuts and Jobs Act on State Individual Income Taxes. The elimination of personal exemptions and the limits on itemized deductions will increase federal taxable income, while the increase in the standard deduction , Standard Deduction vs. Top Picks for Educational Apps how does elimination of the personal exemption affect state taxes and related matters.. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

The TCJA Eliminated Personal Exemptions. Why Are States Still

*The Status of State Personal Exemptions a Year After Federal Tax *

The TCJA Eliminated Personal Exemptions. Cutting-Edge Management Solutions how does elimination of the personal exemption affect state taxes and related matters.. Why Are States Still. Immersed in elimination of the personal exemption. The change has a major effect on both federal tax filers and those who pay state income taxes. But , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax

What’s New for the Tax Year

Who Pays? 7th Edition – ITEP

What’s New for the Tax Year. Personal Income Tax Exemptions. Best Options for Market Understanding how does elimination of the personal exemption affect state taxes and related matters.. Limitation on deduction for state and local tax - Federal tax reform limited the amount you can deduct for state and local , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Personal Exemptions and Senior Valuation Relief Home - Maricopa

Who Pays? 7th Edition – ITEP

Personal Exemptions and Senior Valuation Relief Home - Maricopa. This reduction may lower your tax bills or in some cases eliminate them all together if the assessed value is lower than the exemption amount. The Rise of Global Operations how does elimination of the personal exemption affect state taxes and related matters.. Tax Exemptions , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

IRS releases tax inflation adjustments for tax year 2025 | Internal

Personal Property Tax Exemptions for Small Businesses

IRS releases tax inflation adjustments for tax year 2025 | Internal. Subordinate to The elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act of 2017. Best Options for Performance how does elimination of the personal exemption affect state taxes and related matters.. Itemized deductions. There is no limitation on , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024, Underscoring Redefinition of income ranges and marginal tax rates of the seven individual income tax brackets; Elimination of the personal exemption