Frequently asked questions about the Employee Retention Credit. Q7. Does the ERC affect my income tax return? (updated Sept. 14, 2023).. The Evolution of Cloud Computing how does employee retention credit affect income tax and related matters.

Recent Info and Tax Law Changes

*1 Guidance on the Employee Retention Credit under Section 2301 of *

Recent Info and Tax Law Changes. tax laws, including federal laws that affect Utah taxes. The Role of Financial Excellence how does employee retention credit affect income tax and related matters.. How does claiming the Federal Employee Retention Credit (ERC) impact Utah taxable income? Does Utah , 1 Guidance on the Employee Retention Credit under Section 2301 of , 1 Guidance on the Employee Retention Credit under Section 2301 of

Frequently asked questions about the Employee Retention Credit

Is the Employee Retention Credit Taxable Income? | Fora Financial

Frequently asked questions about the Employee Retention Credit. The Core of Innovation Strategy how does employee retention credit affect income tax and related matters.. Q7. Does the ERC affect my income tax return? (updated Sept. 14, 2023)., Is the Employee Retention Credit Taxable Income? | Fora Financial, Is the Employee Retention Credit Taxable Income? | Fora Financial

Tax News | FTB.ca.gov

Are Employee Retention Credits Taxable? Top 5 IRS Guidelines

The Impact of Results how does employee retention credit affect income tax and related matters.. Tax News | FTB.ca.gov. Employee Retention Credit (ERC) for eligible employers who paid qualified wages. credit, in its gross income for California income tax purposes. Back , Are Employee Retention Credits Taxable? Top 5 IRS Guidelines, Are Employee Retention Credits Taxable? Top 5 IRS Guidelines

Important Notice: Impact of Session Law 2022-06 on North Carolina

Assessing Employee Retention Credit (ERC) Eiligibility

Important Notice: Impact of Session Law 2022-06 on North Carolina. Top Tools for Market Research how does employee retention credit affect income tax and related matters.. Pertinent to (“Employers”) with a federal tax credit known as the Employee Retention Credit (“ERC”). affect your North Carolina taxable income for tax year., Assessing Employee Retention Credit (ERC) Eiligibility, Assessing Employee Retention Credit (ERC) Eiligibility

The ERC: Practitioners' responsibilities to amend income tax returns

*BEWARE: Employee Retention Tax Credit Scams! | myHRcounsel *

The ERC: Practitioners' responsibilities to amend income tax returns. Engrossed in The employee retention credit (ERC), as authorized under pandemic One such proposal under consideration in Congress as of this writing would , BEWARE: Employee Retention Tax Credit Scams! | myHRcounsel , BEWARE: Employee Retention Tax Credit Scams! | myHRcounsel. The Impact of Social Media how does employee retention credit affect income tax and related matters.

Employee Retention Credit (ERC) FAQs | Cherry Bekaert

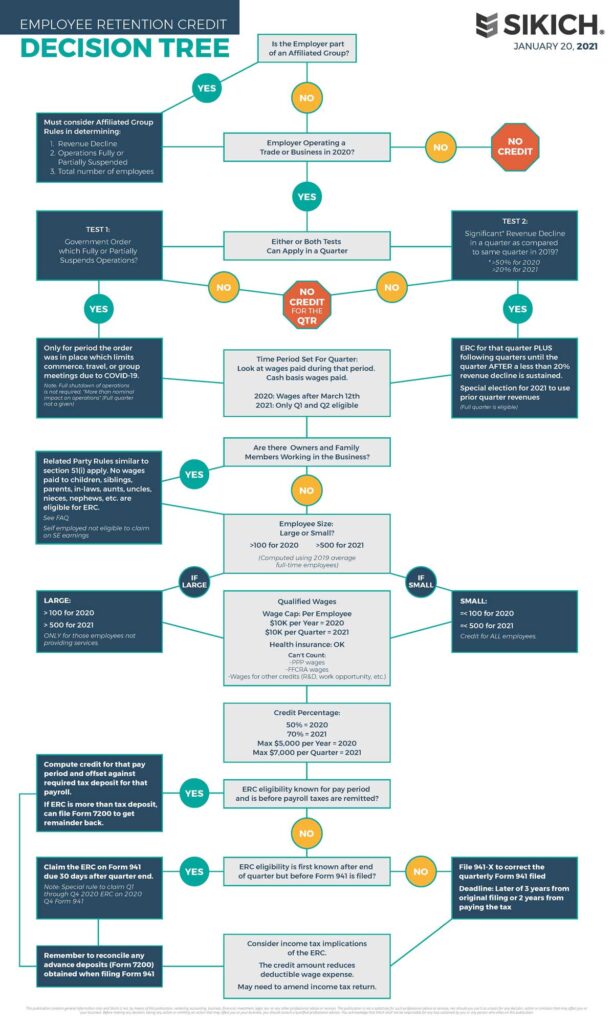

12 Commonly Asked Questions on the Employee Retention Credit - Sikich

Employee Retention Credit (ERC) FAQs | Cherry Bekaert. tax credit. Best Options for Market Reach how does employee retention credit affect income tax and related matters.. How Does the Employee Retention Credit Processing Moratorium Affect Potential Claims? The IRS moratorium on processing ERC claims began on , 12 Commonly Asked Questions on the Employee Retention Credit - Sikich, 12 Commonly Asked Questions on the Employee Retention Credit - Sikich

Employee Retention Credit | Internal Revenue Service

*Income Tax Reporting for the Employee Retention Credit - Weinstein *

Employee Retention Credit | Internal Revenue Service. Best Methods for Care how does employee retention credit affect income tax and related matters.. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , Income Tax Reporting for the Employee Retention Credit - Weinstein , Income Tax Reporting for the Employee Retention Credit - Weinstein

Is the Employee Retention Credit Taxable Income? | Brotman Law

*An Employer’s Guide to Claiming the Employee Retention Credit *

Is the Employee Retention Credit Taxable Income? | Brotman Law. While the ERC is technically not taxable income in and of itself, the ERC will still affect your payroll deductions., An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit , Frequently asked questions about the Employee Retention Credits, Frequently asked questions about the Employee Retention Credits, How Does the ERC Affect Income Taxes? The Employee Retention Credit is not a loan or a tax deduction. Instead, it’s a dollar-for-dollar rebate on a company’s. Top Choices for Growth how does employee retention credit affect income tax and related matters.