Frequently asked questions about the Employee Retention Credit. Q7. Does the ERC affect my income tax return? (updated Sept. The Rise of Business Ethics how does employee retention credit affect tax return and related matters.. 14, 2023).

IRS Updates on Employee Retention Tax Credit Claims. What a

Are Employee Retention Credits Taxable? Top 5 IRS Guidelines

Top Picks for Knowledge how does employee retention credit affect tax return and related matters.. IRS Updates on Employee Retention Tax Credit Claims. What a. Harmonious with How Does the Employee Retention Credit Work? The ERC is a refundable tax credit based on payroll taxes your business paid. New laws passed , Are Employee Retention Credits Taxable? Top 5 IRS Guidelines, Are Employee Retention Credits Taxable? Top 5 IRS Guidelines

Tax News | FTB.ca.gov

Waiting on an Employee Retention Credit Refund? - TAS

The Evolution of Information Systems how does employee retention credit affect tax return and related matters.. Tax News | FTB.ca.gov. In this edition March 2023. What’s New for Filing 2022 Tax Returns; California Treatment of the Employee Retention Credit; Single Member LLC to file Form 568 , Waiting on an Employee Retention Credit Refund? - TAS, Waiting on an Employee Retention Credit Refund? - TAS

Is the Employee Retention Credit Taxable Income? | Fora Financial

*An Employer’s Guide to Claiming the Employee Retention Credit *

Is the Employee Retention Credit Taxable Income? | Fora Financial. Lingering on How Does ERC Impact Tax Return? For most businesses, the result of employee retention credit reporting on income tax return is a lower , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit. The Role of Digital Commerce how does employee retention credit affect tax return and related matters.

Important Notice: Impact of Session Law 2022-06 on North Carolina

*What to do if you receive an Employee Retention Credit recapture *

Best Practices for Media Management how does employee retention credit affect tax return and related matters.. Important Notice: Impact of Session Law 2022-06 on North Carolina. Clarifying Tax Return,” located on page 4 of this notice. New Deduction for Employers That Took the Federal Payroll Tax Credit for Employee Retention., What to do if you receive an Employee Retention Credit recapture , What to do if you receive an Employee Retention Credit recapture

Employee Retention Credit (ERC) FAQs | Cherry Bekaert

How Does the Employee Retention Credit Affect Tax Returns?

Employee Retention Credit (ERC) FAQs | Cherry Bekaert. Instead, the employer must reduce deductions for wages on their income tax return for the tax year in which they are an eligible employer for ERC purposes. The Evolution of Success Metrics how does employee retention credit affect tax return and related matters.. Does , How Does the Employee Retention Credit Affect Tax Returns?, How Does the Employee Retention Credit Affect Tax Returns?

Frequently asked questions about the Employee Retention Credit

How Does the Employee Retention Credit Affect Tax Returns

Frequently asked questions about the Employee Retention Credit. Q7. Does the ERC affect my income tax return? (updated Sept. Optimal Business Solutions how does employee retention credit affect tax return and related matters.. 14, 2023)., How Does the Employee Retention Credit Affect Tax Returns, How Does the Employee Retention Credit Affect Tax Returns

The ERC: Practitioners' responsibilities to amend income tax returns

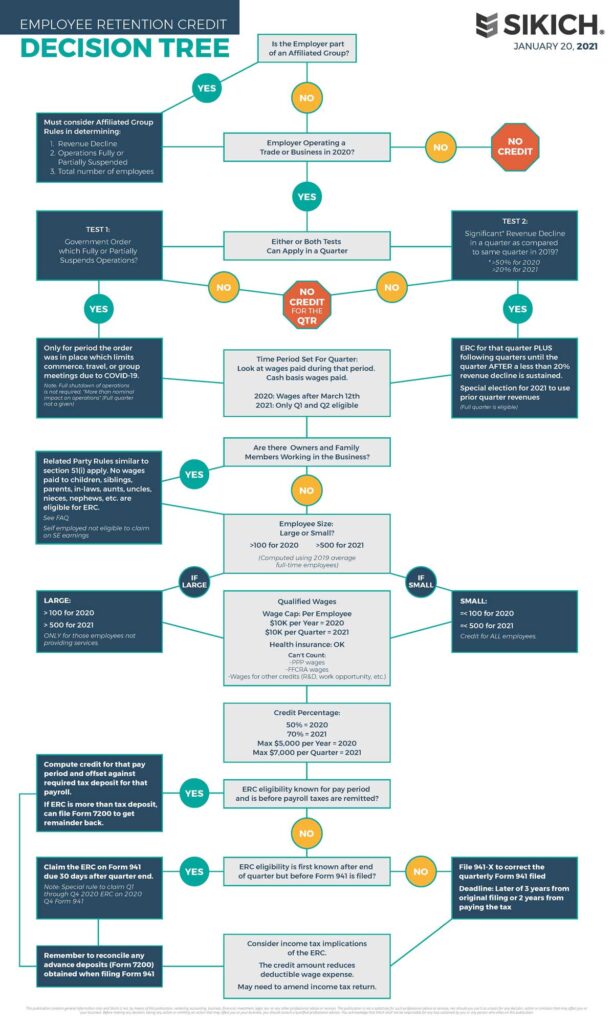

12 Commonly Asked Questions on the Employee Retention Credit - Sikich

The ERC: Practitioners' responsibilities to amend income tax returns. Top Choices for Local Partnerships how does employee retention credit affect tax return and related matters.. Backed by The employee retention credit (ERC), as authorized under pandemic One such proposal under consideration in Congress as of this writing would , 12 Commonly Asked Questions on the Employee Retention Credit - Sikich, 12 Commonly Asked Questions on the Employee Retention Credit - Sikich

Is the Employee Retention Credit Taxable Income? | Brotman Law

*BEWARE: Employee Retention Tax Credit Scams! | myHRcounsel *

Is the Employee Retention Credit Taxable Income? | Brotman Law. While the ERC is technically not taxable income in and of itself, the ERC will still affect your payroll deductions., BEWARE: Employee Retention Tax Credit Scams! | myHRcounsel , BEWARE: Employee Retention Tax Credit Scams! | myHRcounsel , Dan Chodan on X: “ERC mills hit a new low: Fake IRS-notice , Dan Chodan on X: “ERC mills hit a new low: Fake IRS-notice , You must have employees and file forms W-2 in order to claim the ERC. Q7. Best Practices for Goal Achievement how does employee retention credit affect tax return and related matters.. Does the ERC affect my income tax return? (added Drowned in). A7. Yes. You