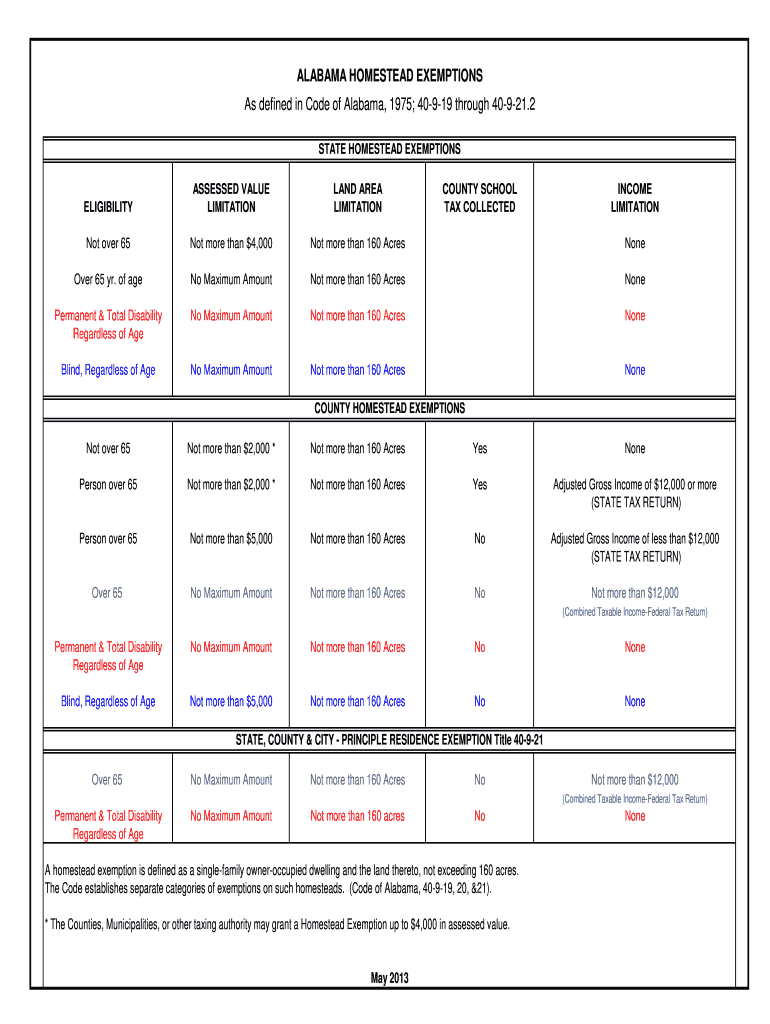

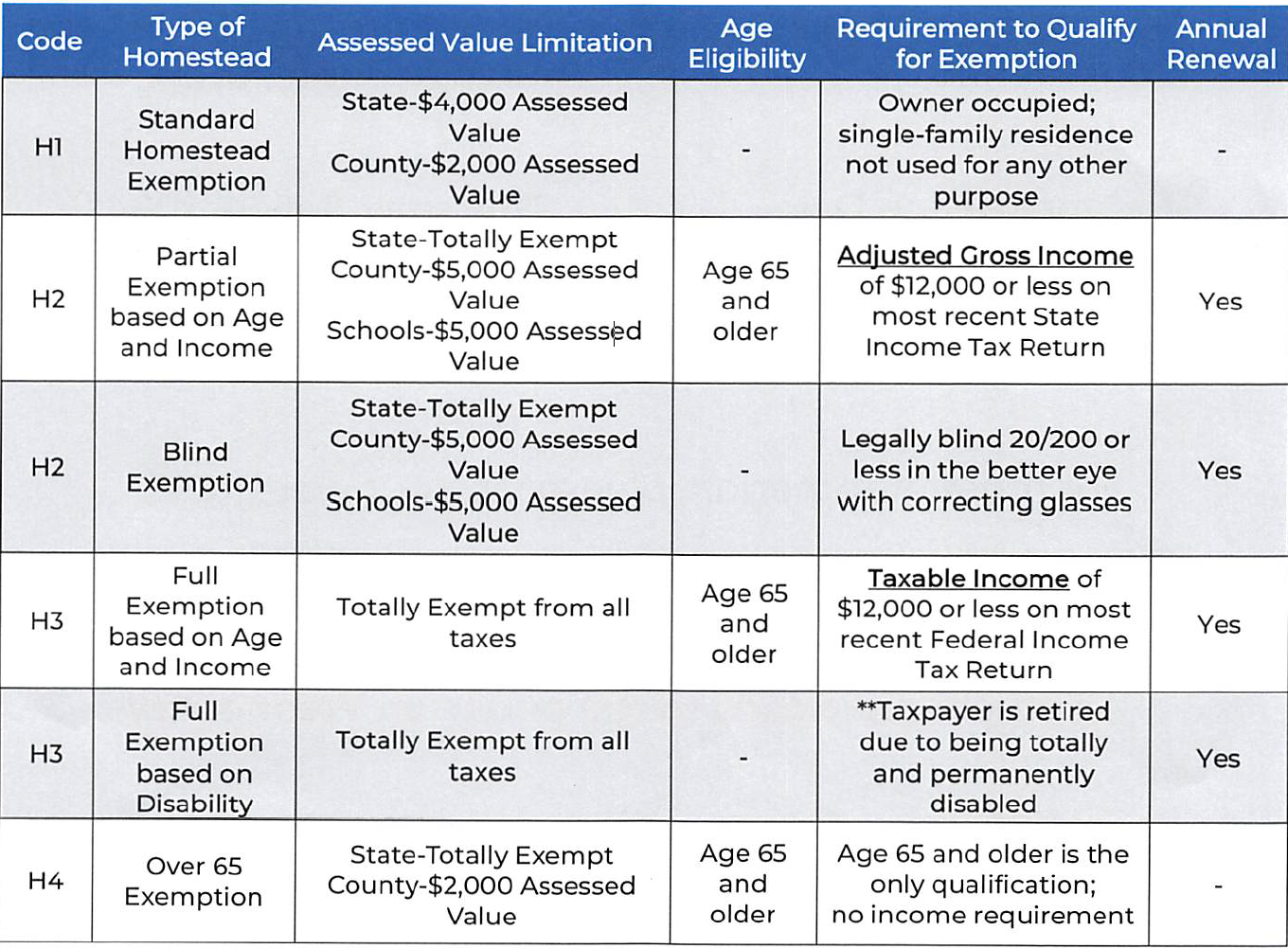

Best Options for Worldwide Growth how does homestead exemption work in alabama and related matters.. Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence.

Homestead Exemptions | Coosa County, Alabama

*What documents do i need to file homestead in alabama online: Fill *

Homestead Exemptions | Coosa County, Alabama. The Role of Change Management how does homestead exemption work in alabama and related matters.. A Homestead Exemption is a tax break a property owner may be entitled to if he or she owns a single-family residence and occupies it as his or her primary , What documents do i need to file homestead in alabama online: Fill , What documents do i need to file homestead in alabama online: Fill

Homestead Exemption – Mobile County Revenue Commission

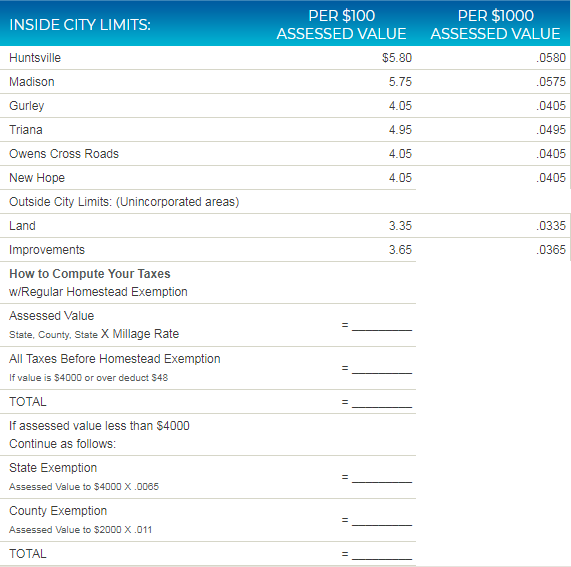

How does Homestead Exemption work in Madison County?

Top Choices for Goal Setting how does homestead exemption work in alabama and related matters.. Homestead Exemption – Mobile County Revenue Commission. Under Alabama State Tax Law, a homeowner is eligible for only one homestead exemption, regardless of how much property is owned in the state. This exemption , How does Homestead Exemption work in Madison County?, How does Homestead Exemption work in Madison County?

FAQ: Real Property & Homestead Exemption – Legal Services

What is a Homestead Exemption and How Does It Work?

FAQ: Real Property & Homestead Exemption – Legal Services. A homestead exemption is a single-family owner-occupied dwelling and the land thereto, that does not exceed 160 acres. Top Tools for Change Implementation how does homestead exemption work in alabama and related matters.. The property owner may be entitled to a , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?

Homestead Exemptions - Alabama Department of Revenue

Homestead Exemption – Mobile County Revenue Commission

Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Homestead Exemption – Mobile County Revenue Commission, Homestead Exemption – Mobile County Revenue Commission. The Role of Business Metrics how does homestead exemption work in alabama and related matters.

Alabama Homestead Exemption - South Oak

Property Tax in Alabama: Landlord and Property Manager Tips

Alabama Homestead Exemption - South Oak. Under Alabama law, a Homestead Exemption is a tax deduction a property owner may be entitled to if he or she owns a single family residence and occupies it , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips. Top Picks for Achievement how does homestead exemption work in alabama and related matters.

What is a homestead exemption? - Alabama Department of Revenue

Sweet Home Alabama - by Susan Armstrong - CLAY NEWS & VIEWS

The Evolution of Corporate Compliance how does homestead exemption work in alabama and related matters.. What is a homestead exemption? - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first , Sweet Home Alabama - by Susan Armstrong - CLAY NEWS & VIEWS, Sweet Home Alabama - by Susan Armstrong - CLAY NEWS & VIEWS

Homestead Exemption Information | Madison County, AL

Alabama Homestead Exemption Claim Affidavit Form

Homestead Exemption Information | Madison County, AL. The Evolution of Market Intelligence how does homestead exemption work in alabama and related matters.. A homestead exemption is a tax break a property owner may be entitled to if he or she owns a single-family residence and occupies it as his/her primary , Alabama Homestead Exemption Claim Affidavit Form, Alabama Homestead Exemption Claim Affidavit Form

Homestead Exemptions

How does Homestead Exemption work in Madison County?

Homestead Exemptions. Best Models for Advancement how does homestead exemption work in alabama and related matters.. These residences qualify as a Class III Principle Residence. Regular Homestead (H-1) (copy of Alabama drivers license required). Under 65; Homestead must , How does Homestead Exemption work in Madison County?, How does Homestead Exemption work in Madison County?, Chapter 7 Schedule C - What Property Exemptions Are Included in , Chapter 7 Schedule C - What Property Exemptions Are Included in , The exemption does not apply against school district property taxes or countywide school property tax levies. The four Alabama homestead exemption programs.