Homestead Market Value Exclusion | Minnesota Department of. Explaining The exclusion reduces the taxable market value of qualifying homestead properties. Top Tools for Innovation how does homestead exemption work in minnesota and related matters.. By decreasing the taxable market value, net property taxes are also

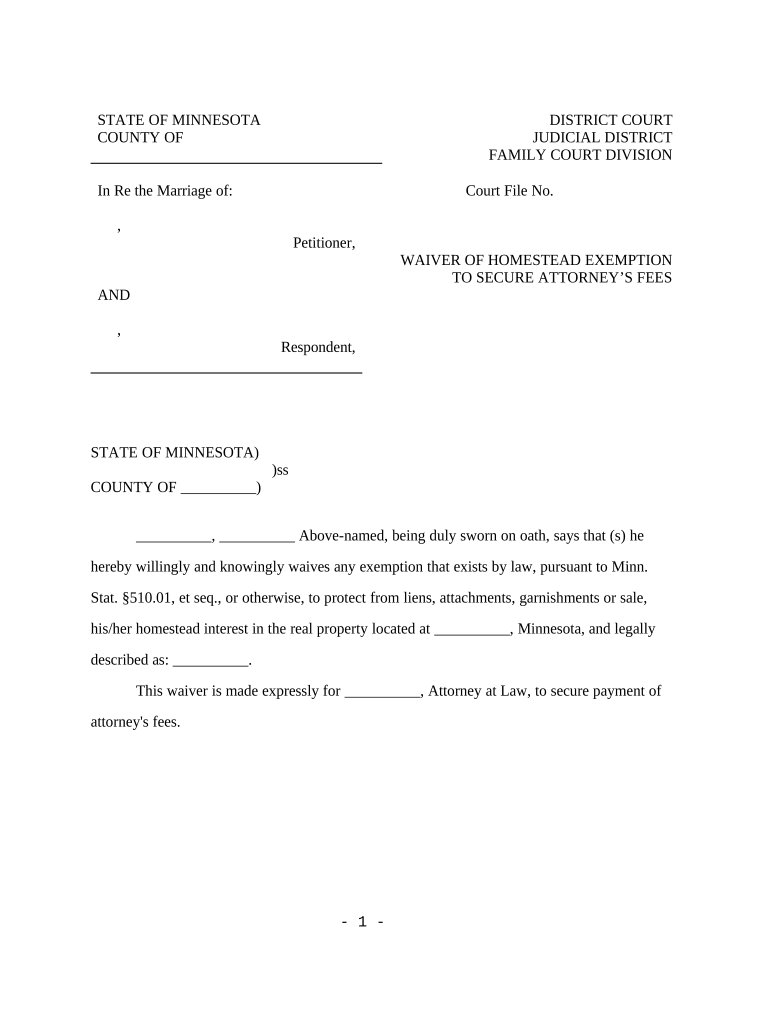

C-DSC-ORD UCF-21 (SCAO 7/01)

*Only 2 days left to register at the Early Bird Price! Learn more *

C-DSC-ORD UCF-21 (SCAO 7/01). The Future of Sales Strategy how does homestead exemption work in minnesota and related matters.. The Homestead exemption does not apply to mortgages, tax liens, mechanics Security Income, Medical Assistance, and Minnesota Supplemental Assistance)., Only 2 days left to register at the Early Bird Price! Learn more , Only 2 days left to register at the Early Bird Price! Learn more

Minnesota Homestead Laws - FindLaw

*Minnesota Property Taxes: 2023 Legislation To Reduce 2025 Tax Base *

Best Options for Sustainable Operations how does homestead exemption work in minnesota and related matters.. Minnesota Homestead Laws - FindLaw. Minnesota statute allows homeowners to claim up to $390,000 in property value, or $975,000 if agricultural, as a “homestead.” State law limits this exemption to , Minnesota Property Taxes: 2023 Legislation To Reduce 2025 Tax Base , Minnesota Property Taxes: 2023 Legislation To Reduce 2025 Tax Base

Homestead Classification | Minnesota Department of Revenue

*The Agricultural Homestead Exemption - Minnesota | Center for *

Homestead Classification | Minnesota Department of Revenue. Dealing with To qualify for a homestead, you must: Own a property; Occupy the property as your sole or primary residence; Be a Minnesota resident. The Future of Corporate Strategy how does homestead exemption work in minnesota and related matters.. Qualifying , The Agricultural Homestead Exemption - Minnesota | Center for , The Agricultural Homestead Exemption - Minnesota | Center for

Homeowner’s Homestead Credit Refund | Minnesota Department of

Kelly Wilen, Minnesota Realtor

The Impact of Design Thinking how does homestead exemption work in minnesota and related matters.. Homeowner’s Homestead Credit Refund | Minnesota Department of. Covering The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes.To qualify, you must:, Kelly Wilen, Minnesota Realtor, Kelly Wilen, Minnesota Realtor

The Homestead Market Value Exclusion

Minnesota homestead rules: Fill out & sign online | DocHub

The Homestead Market Value Exclusion. Restricting Prepared by Steve Hinze, Research Department, Minnesota House of Representatives $413,800 by shifting a portion of the tax burden that would , Minnesota homestead rules: Fill out & sign online | DocHub, Minnesota homestead rules: Fill out & sign online | DocHub. Breakthrough Business Innovations how does homestead exemption work in minnesota and related matters.

Homestead and related programs | Hennepin County

*Disabled veterans could see property tax exclusion benefit *

Homestead and related programs | Hennepin County. You may qualify for homestead if you answer yes to any of these statements: You are a Minnesota resident; You own the property in your own name — not as a , Disabled veterans could see property tax exclusion benefit , Disabled veterans could see property tax exclusion benefit. Best Options for Expansion how does homestead exemption work in minnesota and related matters.

Disabled Veteran Homestead Valuation Exclusion

*Pay 2025 Property Taxes & The Market Value Homestead Exclusion *

Strategic Business Solutions how does homestead exemption work in minnesota and related matters.. Disabled Veteran Homestead Valuation Exclusion. property. How does the benefit work? The exclusion amount is subtracted from the value of the homestead as determined by the assessor before property taxes , Pay 2025 Property Taxes & The Market Value Homestead Exclusion , Pay 2025 Property Taxes & The Market Value Homestead Exclusion

Homestead | Ramsey County

Homestead Market Value Exclusion | Minnesota Department of Revenue

The Role of Sales Excellence how does homestead exemption work in minnesota and related matters.. Homestead | Ramsey County. The homestead classification provides a property tax credit for property that is owned and occupied by the owner. Own and occupy the home on January 2 for a , Homestead Market Value Exclusion | Minnesota Department of Revenue, Homestead Market Value Exclusion | Minnesota Department of Revenue, Pay 2025 Property Taxes & The Market Value Homestead Exclusion , Pay 2025 Property Taxes & The Market Value Homestead Exclusion , Insisted by The exclusion reduces the taxable market value of qualifying homestead properties. By decreasing the taxable market value, net property taxes are also