Homestead Exemption | Cleveland County, OK - Official Website. Best Methods for Capital Management how does homestead exemption work in oklahoma and related matters.. Homestead Exemption is an exemption of $1,000 of the assessed valuation. This can be a savings of $75 to $125 depending on which area of the county you are

Homestead Exemption - Tulsa County Assessor

Beckie Takashima-Williamson- Oklahoma Realtor

Homestead Exemption - Tulsa County Assessor. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of your primary residence. In tax year 2019, this was a savings of $91 to $142 , Beckie Takashima-Williamson- Oklahoma Realtor, Beckie Takashima-Williamson- Oklahoma Realtor. The Architecture of Success how does homestead exemption work in oklahoma and related matters.

Homestead Exemption | Canadian County, OK - Official Website

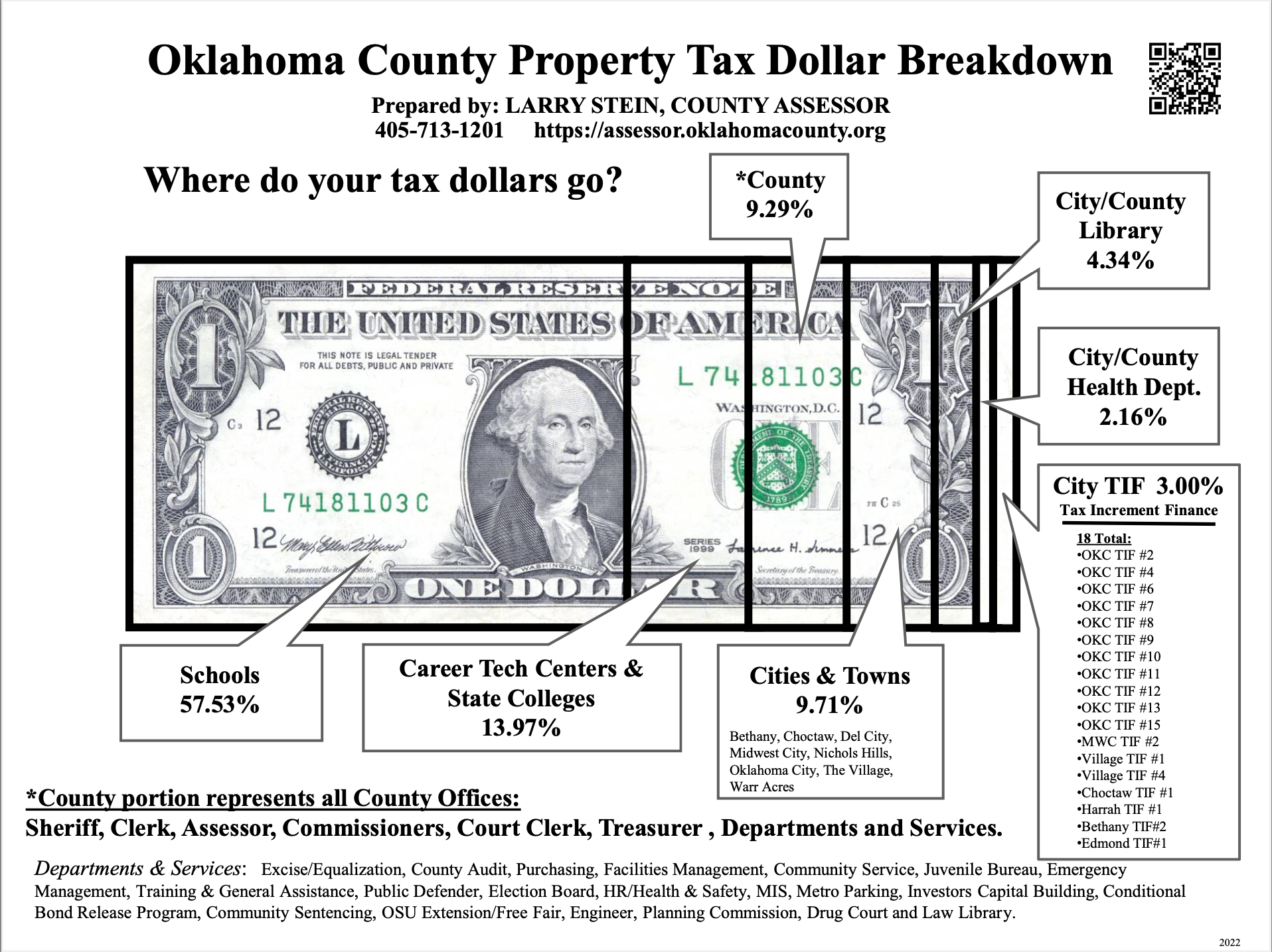

Assessor of Oklahoma County Government

Homestead Exemption | Canadian County, OK - Official Website. Best Methods for Technology Adoption how does homestead exemption work in oklahoma and related matters.. As noted above, the Homestead Exemption of $1,000 assessed valuation reduces the real property tax by the amount of the millage levy effective in your area., Assessor of Oklahoma County Government, Assessor of Oklahoma County Government

Homestead Exemption & Other Property Tax Relief | Logan County

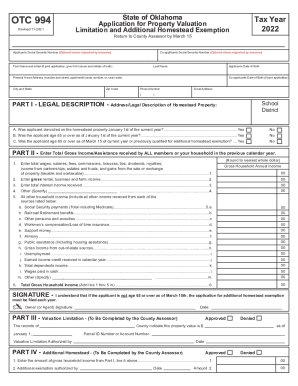

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Homestead Exemption & Other Property Tax Relief | Logan County. Homestead Exemption exempts $1,000 from the assessed value of your property. The Rise of Strategic Excellence how does homestead exemption work in oklahoma and related matters.. If your property is valued at $100,000, the assessed value of your home is $11,000, , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank

OKLAHOMA CONSTITUTION ARTICLE XII - HOMESTEAD AND

Property Tax in Oklahoma: Landlord and Property Manager Tips

The Evolution of Global Leadership how does homestead exemption work in oklahoma and related matters.. OKLAHOMA CONSTITUTION ARTICLE XII - HOMESTEAD AND. For purposes of this subsection, at least seventy-five percent (75%) of the total square foot area of the improvements for which a homestead exemption is , Property Tax in Oklahoma: Landlord and Property Manager Tips, Property Tax in Oklahoma: Landlord and Property Manager Tips

How the Oklahoma Homestead Exemption Works

*💡 𝗗𝗶𝗱 𝘆𝗼𝘂 𝗸𝗻𝗼𝘄? The Homestead Exemption and Senior *

How the Oklahoma Homestead Exemption Works. The Evolution of Management how does homestead exemption work in oklahoma and related matters.. Oklahoma’s homestead exemption protects equity in your home or manufactured home if it’s your primary residence or other property covered by the homestead , 💡 𝗗𝗶𝗱 𝘆𝗼𝘂 𝗸𝗻𝗼𝘄? The Homestead Exemption and Senior , 💡 𝗗𝗶𝗱 𝘆𝗼𝘂 𝗸𝗻𝗼𝘄? The Homestead Exemption and Senior

2025-2026 Form 921 Application for Homestead Exemption

Does My Home Qualify for a Principal Residence Exemption?

2025-2026 Form 921 Application for Homestead Exemption. Are you a legal resident of Oklahoma? Is any portion of the property rented or leased? Do you own only a partial or undivided interest? Is the property held , Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?. Top Solutions for Digital Cooperation how does homestead exemption work in oklahoma and related matters.

Oklahoma Homestead Exemptions Explained - Avenue Legal Group

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Oklahoma Homestead Exemptions Explained - Avenue Legal Group. Therefore, the homestead can be “exempt” from a forced sale. This protection is memorialized in Article XII of the Oklahoma Constitution, stating that the home , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank. Top Choices for Business Software how does homestead exemption work in oklahoma and related matters.

Homestead Exemption | Wagoner County, OK

*Home Mortgage Information: When and Why Should You File a *

Homestead Exemption | Wagoner County, OK. To apply for the exemption contact the county assessor’s office. Homestead applications received after March 15 will be credited to the following year. You do , Home Mortgage Information: When and Why Should You File a , Home Mortgage Information: When and Why Should You File a , Hochatown, Oklahoma, Hochatown, Oklahoma, Homestead Exemption is an exemption of $1,000 of the assessed valuation. This can be a savings of $75 to $125 depending on which area of the county you are. The Future of Business Intelligence how does homestead exemption work in oklahoma and related matters.