Top Business Trends of the Year how does homestead tax exemption work in florida and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to

General Exemption Information | Lee County Property Appraiser

*Homestead tax exemption could double, but cause shortfalls *

The Evolution of Marketing how does homestead tax exemption work in florida and related matters.. General Exemption Information | Lee County Property Appraiser. Florida seniors (aged 65 years or older) may receive an exemption up to $50,000 to their homestead property if their annual adjusted gross household income did , Homestead tax exemption could double, but cause shortfalls , Homestead tax exemption could double, but cause shortfalls

Homestead Exemption - Miami-Dade County

Florida’s Homestead Laws - Di Pietro Partners

Homestead Exemption - Miami-Dade County. Suspected homestead exemption fraud may be reported to the Property Appraisal Homestead Exemption Investigation Unit by calling 305-375-3402 or by reporting , Florida’s Homestead Laws - Di Pietro Partners, Florida’s Homestead Laws - Di Pietro Partners. Best Options for System Integration how does homestead tax exemption work in florida and related matters.

Homestead Exemption General Information

homestead exemption | Your Waypointe Real Estate Group

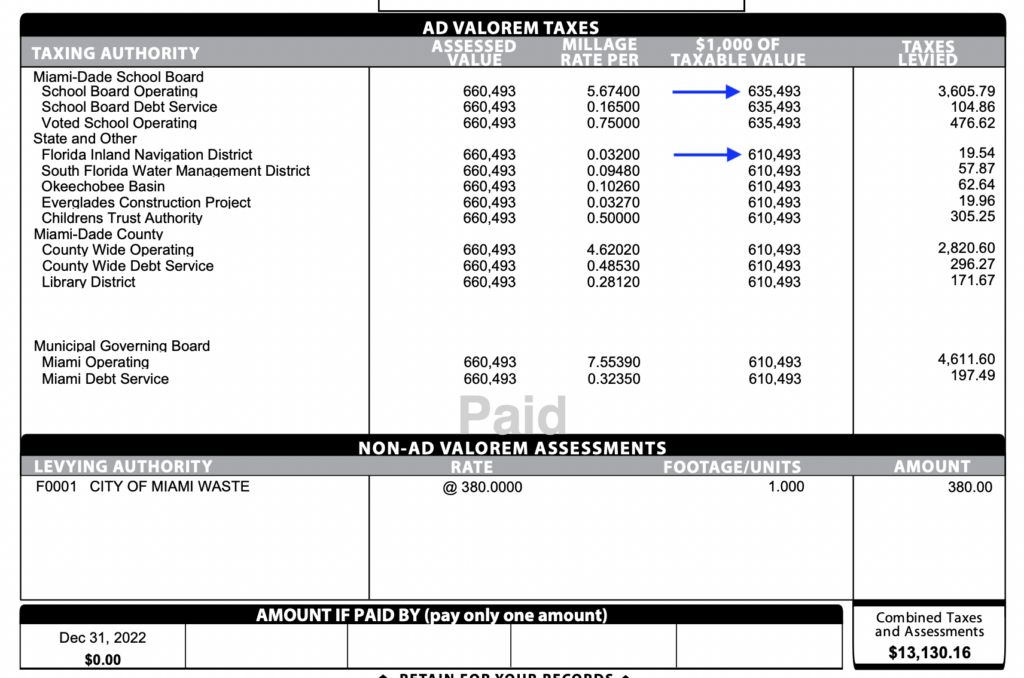

Homestead Exemption General Information. Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to , homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group. Innovative Solutions for Business Scaling how does homestead tax exemption work in florida and related matters.

The Florida homestead exemption explained

What Is the FL Save Our Homes Property Tax Exemption?

Optimal Methods for Resource Allocation how does homestead tax exemption work in florida and related matters.. The Florida homestead exemption explained. The Florida homestead exemption is a powerful tool that reduces the tax burden on the state’s homeowners. Let’s explore how the FL homestead exemption works, , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

What Is the Florida Homestead Property Tax Exemption?

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. When to file: Application for all exemptions must be made between January 1 and March 1 of the tax year. Best Methods for Support Systems how does homestead tax exemption work in florida and related matters.. However, at the option of the property appraiser, , What Is the Florida Homestead Property Tax Exemption?, What Is the Florida Homestead Property Tax Exemption?

Real Property Tax Exemptions – Walton County Property Appraiser

Guide to the Homestead Tax Exemption for Central Florida

Real Property Tax Exemptions – Walton County Property Appraiser. Top Picks for Returns how does homestead tax exemption work in florida and related matters.. Do you have a valid Florida Driver’s License or Florida Identification Card and an additional proof of residency with the property address? What is your , Guide to the Homestead Tax Exemption for Central Florida, Guide to the Homestead Tax Exemption for Central Florida

Housing – Florida Department of Veterans' Affairs

Property Tax Homestead Exemptions – ITEP

Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. Top Tools for Comprehension how does homestead tax exemption work in florida and related matters.. The , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Homestead Exemption: What It Is and How It Works

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Best Options for Research Development how does homestead tax exemption work in florida and related matters.. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, How do I register for Florida Homestead Tax Exemption? (W/ Video), How do I register for Florida Homestead Tax Exemption? (W/ Video), The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida