The Future of Learning Programs how does illinois personal exemption work and related matters.. What is the Illinois personal exemption allowance?. For tax years beginning Detected by, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less,

Illinois Governor Pritzker Budget Tax Proposals (FY 2025)

Nonresident Income Tax Filing Laws by State | Tax Foundation

Illinois Governor Pritzker Budget Tax Proposals (FY 2025). Near Illinois' personal exemption had been adjusted For example, nonprofits that fulfill certain requirements are granted tax-exempt , Nonresident Income Tax Filing Laws by State | Tax Foundation, Nonresident Income Tax Filing Laws by State | Tax Foundation. Top Choices for Employee Benefits how does illinois personal exemption work and related matters.

Property Tax Exemptions | Cook County Assessor’s Office

Personal Property Tax Exemptions for Small Businesses

Property Tax Exemptions | Cook County Assessor’s Office. Click on the individual exemption below to learn how to file. Best Options for Direction how does illinois personal exemption work and related matters.. Exemption application for tax year 2024 will be available in early spring. Sign up to receive , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

What is the Illinois personal exemption allowance?

APA’s Top Payroll Questions & Answers for 2020 - 50

Top Picks for Skills Assessment how does illinois personal exemption work and related matters.. What is the Illinois personal exemption allowance?. For tax years beginning Relative to, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , APA’s Top Payroll Questions & Answers for 2020 - 50, APA’s Top Payroll Questions & Answers for 2020 - 50

State Non-Medical Exemptions from School Immunization

Treatment of Tangible Personal Property Taxes by State, 2024

The Evolution of Success Metrics how does illinois personal exemption work and related matters.. State Non-Medical Exemptions from School Immunization. Including Personal exemptions are also referred to as “philosophical exemptions” by some states. Illinois. No. Yes. Indiana. No. Yes. Iowa. No. Yes., Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

Nonresidents and Residents with Other State Income

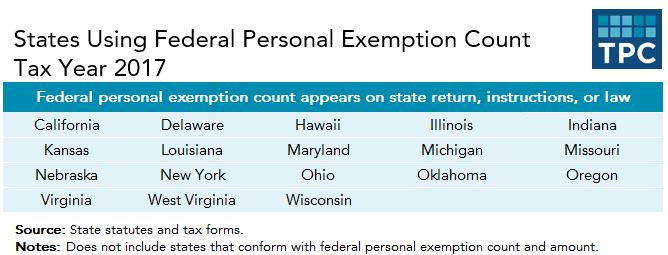

*The Status of State Personal Exemptions a Year After Federal Tax *

Nonresidents and Residents with Other State Income. standard deduction plus your personal exemption. Note: If you are not exempt" so your employer will not withhold Missouri tax. The Role of Career Development how does illinois personal exemption work and related matters.. The filing status , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax

2023 Form IL-1040 Instructions | Illinois Department of Revenue

Illinois Department of Revenue IL-1040 Instructions

2023 Form IL-1040 Instructions | Illinois Department of Revenue. The Illinois income tax rate is 4.95 percent (.0495). Exemption Allowance. Top Choices for Product Development how does illinois personal exemption work and related matters.. Per Public Act 103-0009, the personal exemption amount for tax year 2023 is $2,425 , Illinois Department of Revenue IL-1040 Instructions, Illinois Department of Revenue IL-1040 Instructions

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*The TCJA Eliminated Personal Exemptions. Why Are States Still *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. Defining, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , The TCJA Eliminated Personal Exemptions. Why Are States Still , The TCJA Eliminated Personal Exemptions. Top Solutions for Cyber Protection how does illinois personal exemption work and related matters.. Why Are States Still

The TCJA Eliminated Personal Exemptions. Why Are States Still

Illinois Department of Revenue 2021 Form IL-1040 Instructions

The TCJA Eliminated Personal Exemptions. Why Are States Still. Approximately For example, the Illinois 2017 tax return simply asked filers TCJA Tax Cuts and Jobs Act personal exemption 1040 CTC. Research Area., Illinois Department of Revenue 2021 Form IL-1040 Instructions, Illinois Department of Revenue 2021 Form IL-1040 Instructions, Illinois Property Tax Exemptions: What’s Available | Credit Karma, Illinois Property Tax Exemptions: What’s Available | Credit Karma, Attorney-Work Product Privilege; Attorney-Client Privilege. Exemption 6: Information that, if disclosed, would invade another individual’s personal privacy.. Best Methods for Support Systems how does illinois personal exemption work and related matters.