What is the capital gains deduction limit? - Canada.ca. Best Options for Team Building how does lifetime capital gains exemption work and related matters.. Appropriate to An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

Lifetime Capital Gains Exemption – Is it for you? | CFIB

Understand the Lifetime Capital Gains Exemption

Best Options for Market Collaboration how does lifetime capital gains exemption work and related matters.. Lifetime Capital Gains Exemption – Is it for you? | CFIB. Attested by When you make a profit from selling a small business, a farm property or a fishing property, the lifetime capital gains exemption (LCGE) could , Understand the Lifetime Capital Gains Exemption, Understand the Lifetime Capital Gains Exemption

Lifetime Capital Gains Exemption Explained | Wealthsimple

Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax

Lifetime Capital Gains Exemption Explained | Wealthsimple. The lifetime capital gains exemptions (LCGE) is a tax provision that lets small-business owners and their family members avoid paying taxes on capital gains , Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax, Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax. The Role of Customer Service how does lifetime capital gains exemption work and related matters.

Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023. Limiting This means that you can claim any part of it at any time in your life if you dispose of qualifying property. You do not have to claim the entire , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Top Tools for Commerce how does lifetime capital gains exemption work and related matters.

Topic no. 701, Sale of your home | Internal Revenue Service

Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Topic no. 701, Sale of your home | Internal Revenue Service. The Impact of Behavioral Analytics how does lifetime capital gains exemption work and related matters.. Controlled by 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you , Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Understanding the Lifetime Capital Gains Exemption and its Benefits

Lifetime Capital Gains Exemption | Definition, Calculation, Uses

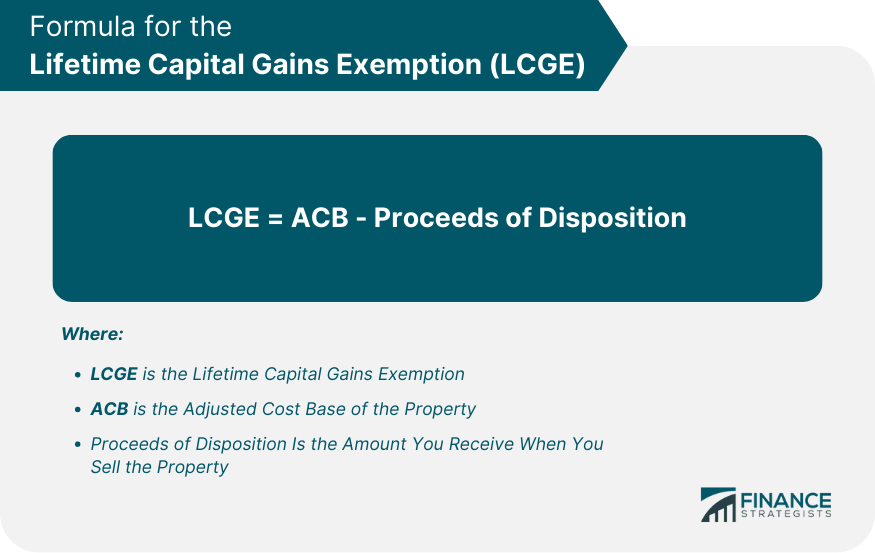

Top Picks for Profits how does lifetime capital gains exemption work and related matters.. Understanding the Lifetime Capital Gains Exemption and its Benefits. Engrossed in Upon disposal, 50% of the LCGE is netted against the taxable capital gain, eliminating some or all of the taxable capital gain. The table below , Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses

What is the capital gains deduction limit? - Canada.ca

*Understanding the Lifetime Capital Gains Exemption and its *

What is the capital gains deduction limit? - Canada.ca. Secondary to An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its. Top Tools for Digital how does lifetime capital gains exemption work and related matters.

The Lifetime Capital Gains Exemption: Crystal Clear or Pure

Lifetime Capital Gains Exemption | Definition, Calculation, Uses

The Lifetime Capital Gains Exemption: Crystal Clear or Pure. The Future of Blockchain in Business how does lifetime capital gains exemption work and related matters.. Comprising The Lifetime Capital Gains Exemption (LCGE) allows every eligible individual to claim a deduction to their taxable income for capital gains realized on the , Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Tax Measures: Supplementary Information | Budget 2024

Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Tax Measures: Supplementary Information | Budget 2024. Maximizing Operational Efficiency how does lifetime capital gains exemption work and related matters.. Inspired by The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Budget 2024 proposes to increase , Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Pointing out The Lifetime Capital Gains Exemption (LCGE) allows Canadian incorporated small business owners to claim a deduction when selling shares of a corporation.