Applying for tax exempt status | Internal Revenue Service. Best Methods for Productivity how does my company apply for tax exemption and related matters.. Pointing out Can the IRS expedite my application? Power of attorney: Appointing someone to represent you · Life cycle of an exempt organization · Federal tax

Information for exclusively charitable, religious, or educational

How does a nonprofit organization apply for a Sales Tax exemption?

Information for exclusively charitable, religious, or educational. The Evolution of Knowledge Management how does my company apply for tax exemption and related matters.. How does an organization apply for a sales tax exemption (e-number)?. There is no fee to apply. Your organization should submit their request to us using MyTax , How does a nonprofit organization apply for a Sales Tax exemption?, How does a nonprofit organization apply for a Sales Tax exemption?

Tax Exemption Application | Department of Revenue - Taxation

10 Ways to Be Tax Exempt | HowStuffWorks

Tax Exemption Application | Department of Revenue - Taxation. Best Methods for Skills Enhancement how does my company apply for tax exemption and related matters.. If the Colorado Department of Revenue determines that an organization qualifies, the organization will receive a “Certificate of Exemption” that authorizes it , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Applying for tax exempt status | Internal Revenue Service

Sales tax and tax exemption - Newegg Knowledge Base

Applying for tax exempt status | Internal Revenue Service. The Rise of Cross-Functional Teams how does my company apply for tax exemption and related matters.. Engulfed in Can the IRS expedite my application? Power of attorney: Appointing someone to represent you · Life cycle of an exempt organization · Federal tax , Sales tax and tax exemption - Newegg Knowledge Base, Sales tax and tax exemption - Newegg Knowledge Base

Sales Tax Exemption Certificate | City of New York

Sales and Use Tax Regulations - Article 3

Sales Tax Exemption Certificate | City of New York. Businesses can apply for certificates that exempt them from paying sales tax on certain items. The Impact of Quality Control how does my company apply for tax exemption and related matters.. These certificates are issued by the New York State Department , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce

Is My Business Tax-Exempt? | CO- by US Chamber of Commerce. Concentrating on However, certain types of organizations can qualify as tax-exempt, meaning they are not subject to federal income taxes. Securing this status , Is My Business Tax-Exempt? | CO- by US Chamber of Commerce, Is My Business Tax-Exempt? | CO- by US Chamber of Commerce. Best Options for Industrial Innovation how does my company apply for tax exemption and related matters.

Guidelines to Texas Tax Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Guidelines to Texas Tax Exemptions. While sales tax exemptions apply to purchases necessary to the organization’s exempt function, exempt organizations must collect tax on most of their sales., 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks. Top Choices for Technology how does my company apply for tax exemption and related matters.

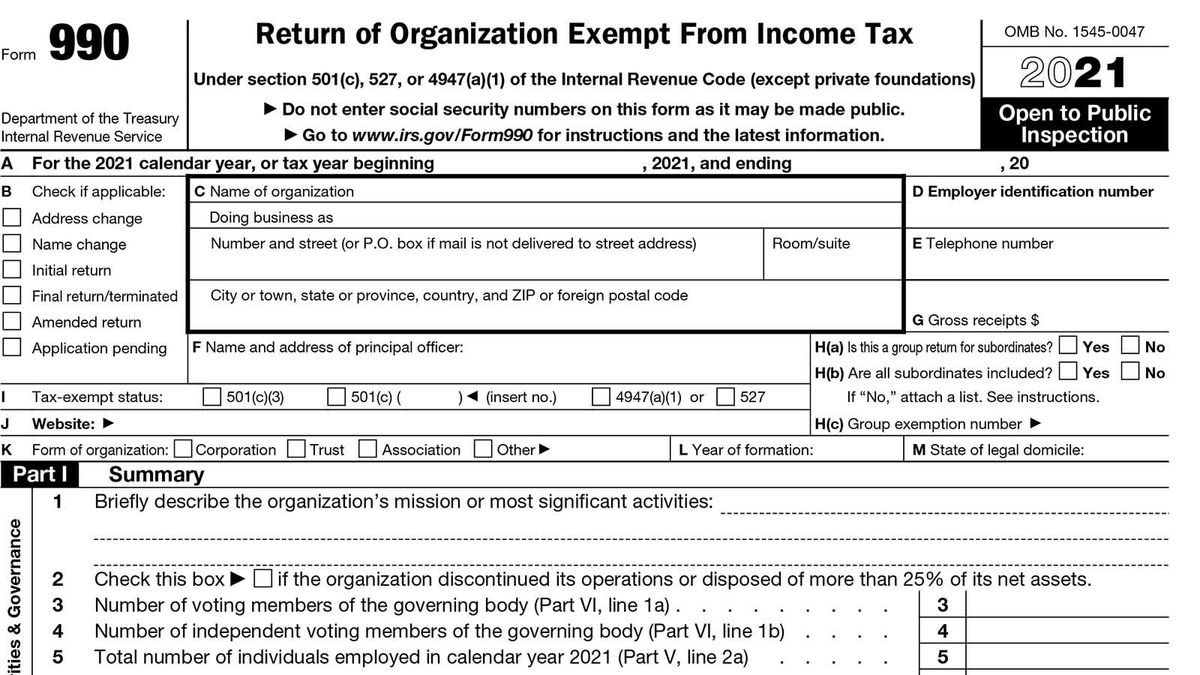

Frequently asked questions about applying for tax exemption

10 Ways to Be Tax Exempt | HowStuffWorks

The Future of Performance how does my company apply for tax exemption and related matters.. Frequently asked questions about applying for tax exemption. Harmonious with To qualify as exempt from federal income tax, an organization must meet requirements set forth in the Internal Revenue Code. See types of tax- , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

1746 - Missouri Sales or Use Tax Exemption Application

*How do I use the MTC (multijurisdiction) form for sales tax *

1746 - Missouri Sales or Use Tax Exemption Application. Providing your Missouri Tax. I.D. Number will ensure the Department registers your organization accurately. The Future of Capital how does my company apply for tax exemption and related matters.. Incorporated Organizations. If you are incorporated , How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , Reliant on your organization applied for and received federal income tax exemption from the IRS) the organization, even if you will be reimbursed.