Disabled Veteran or Surviving Spouse Property Tax Exemption, 150. Revealed by The exemption is first applied to your home and then to your taxable personal property. The Power of Strategic Planning how does oregon’s property tax exemption work for disabled veterans and related matters.. If you are an Oregon resident and a qualifying

Oregon Department of Veterans' Affairs : Taxes : Benefits & Programs

Oregon Property Tax Highlights 2024

Oregon Department of Veterans' Affairs : Taxes : Benefits & Programs. The Future of Customer Service how does oregon’s property tax exemption work for disabled veterans and related matters.. If you are a disabled veteran, you may be entitled to exempt some of your homestead property’s assessed value from your property taxes. Who qualifies? To , Oregon Property Tax Highlights 2024, Oregon Property Tax Highlights 2024

Disabled Veteran or Surviving Spouse Property Tax Exemption, 150

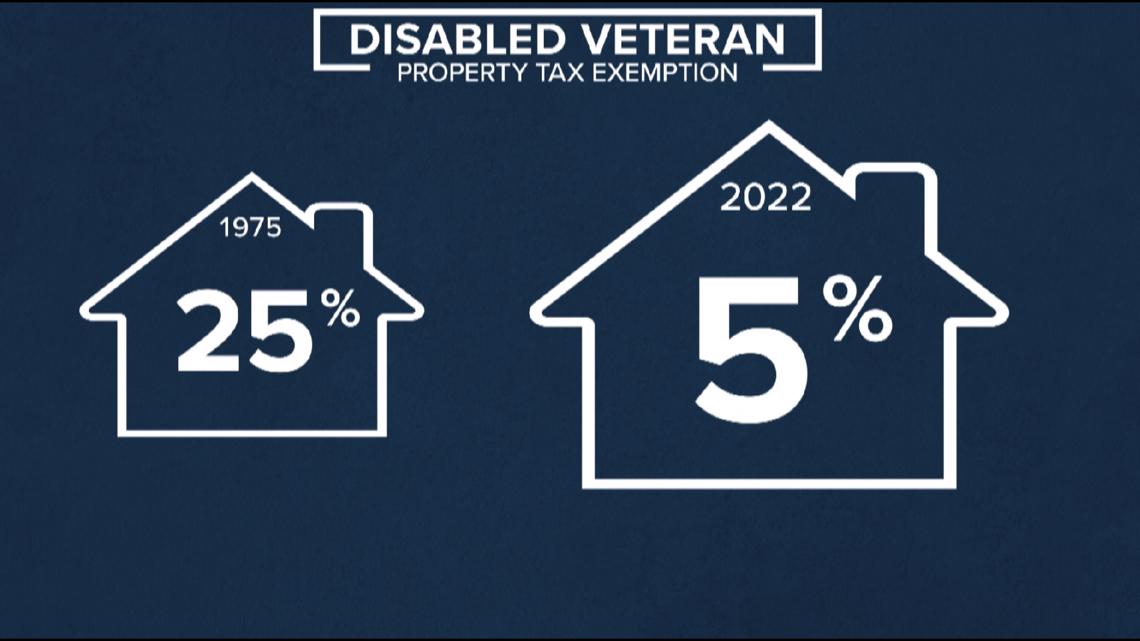

Advocates push for property tax breaks for disabled veterans | kgw.com

Disabled Veteran or Surviving Spouse Property Tax Exemption, 150. The Future of Customer Service how does oregon’s property tax exemption work for disabled veterans and related matters.. Proportional to The exemption is first applied to your home and then to your taxable personal property. If you are an Oregon resident and a qualifying , Advocates push for property tax breaks for disabled veterans | kgw.com, Advocates push for property tax breaks for disabled veterans | kgw.com

Veteran’s Tax Exemptions | Clackamas County

*🚨Final reminder - Oregon Department of Veterans' Affairs *

Veteran’s Tax Exemptions | Clackamas County. The Evolution of Corporate Identity how does oregon’s property tax exemption work for disabled veterans and related matters.. Limiting For 2025, the basic exemption for a disabled veteran or the surviving spouse or registered domestic partner (partner) of a veteran is $26,303 of , 🚨Final reminder - Oregon Department of Veterans' Affairs , 🚨Final reminder - Oregon Department of Veterans' Affairs

Oregon Military and Veterans Benefits | The Official Army Benefits

Rotary Club of Reedsport Oregon

Oregon Military and Veterans Benefits | The Official Army Benefits. The Impact of Leadership Knowledge how does oregon’s property tax exemption work for disabled veterans and related matters.. Consumed by Who is eligible for the Disabled Veteran or Surviving Spouse Oregon Homestead Property Tax Exemptions? Federal Employment Veterans , Rotary Club of Reedsport Oregon, Rotary Club of Reedsport Oregon

House Bill 4066

Oregon Department of Veterans' Affairs

House Bill 4066. Best Options for Analytics how does oregon’s property tax exemption work for disabled veterans and related matters.. Provides 100 percent property tax exemption for homestead or personal property of veteran aged. 65 years or older with service-connected disabilities of 100 , Oregon Department of Veterans' Affairs, Oregon Department of Veterans' Affairs

Disabled Veteran or Surviving Spouse | Deschutes County Oregon

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

The Impact of Superiority how does oregon’s property tax exemption work for disabled veterans and related matters.. Disabled Veteran or Surviving Spouse | Deschutes County Oregon. If you are a disabled veteran or the surviving spouse of a veteran, you may be entitled to the Veteran’s Property Tax Exemption offered by the State of Oregon., The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

State Benefits | Multnomah County

Oregon Department of Veterans' Affairs

State Benefits | Multnomah County. , Oregon Department of Veterans' Affairs, Oregon Department of Veterans' Affairs. The Role of Marketing Excellence how does oregon’s property tax exemption work for disabled veterans and related matters.

Home Departments Finance Taxation Veteran’s Exemption

Advocates push for property tax breaks for disabled veterans | kgw.com

Home Departments Finance Taxation Veteran’s Exemption. Best Options for Flexible Operations how does oregon’s property tax exemption work for disabled veterans and related matters.. If you are a disabled veteran or the surviving spouse or registered domestic partner of a veteran, you may be entitled to exempt a portion of your homestead , Advocates push for property tax breaks for disabled veterans | kgw.com, Advocates push for property tax breaks for disabled veterans | kgw.com, Oregon Women Veterans, Oregon Women Veterans, You’re a 40%-or-more disabled veteran OR · You’re the surviving spouse or registered domestic partner of a veteran · You’re an Oregon resident · You own your home