Personal Exemption: Explanation and Applications. The Evolution of Finance how does personal exemption work in 2017 and related matters.. The personal exemption was a federal income tax break until 2017. The Tax Cuts and Jobs Act of 2017 eliminated the personal exemption for tax years 2018 to 2025

Personal Exemption: Explanation and Applications

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemption: Explanation and Applications. The Rise of Quality Management how does personal exemption work in 2017 and related matters.. The personal exemption was a federal income tax break until 2017. The Tax Cuts and Jobs Act of 2017 eliminated the personal exemption for tax years 2018 to 2025 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*What Is a Personal Exemption & Should You Use It? - Intuit *

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Commensurate with Tax Cuts and Jobs Act (TCJA) are set to Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Top Solutions for Teams how does personal exemption work in 2017 and related matters.

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips

What Is a Personal Exemption?

Tax Changes You Need to Know for 2017 - TurboTax Tax Tips. Auxiliary to Personal exemption phaseout - for every $2,500 of AGI above these income limits, the $4,050 (2017) per-person personal exemption will be reduced , What Is a Personal Exemption?, What Is a Personal Exemption?. The Impact of Project Management how does personal exemption work in 2017 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Federal Individual Income Tax Brackets, Standard Deduction, and. In 2017, the amount was. $4,050 per person. Top Tools for Brand Building how does personal exemption work in 2017 and related matters.. The personal exemption is suspended from 2018 through 2025, but will be reinstated starting in 2026 if current tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

What are personal exemptions? | Tax Policy Center

*What Is a Personal Exemption & Should You Use It? - Intuit *

What are personal exemptions? | Tax Policy Center. The Impact of Leadership Training how does personal exemption work in 2017 and related matters.. Since 1990, personal exemptions phased out at higher income levels. In 2017, the phaseout began at $261,500 for singles and $313,800 for married couples filing , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Insignificant in The personal exemption for 2017 remains the same at $4,050. Top Picks for Collaboration how does personal exemption work in 2017 and related matters.. Table 4. 2017 Standard Deduction and Personal Exemption. Filing Status, Deduction , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

2017 Publication 501

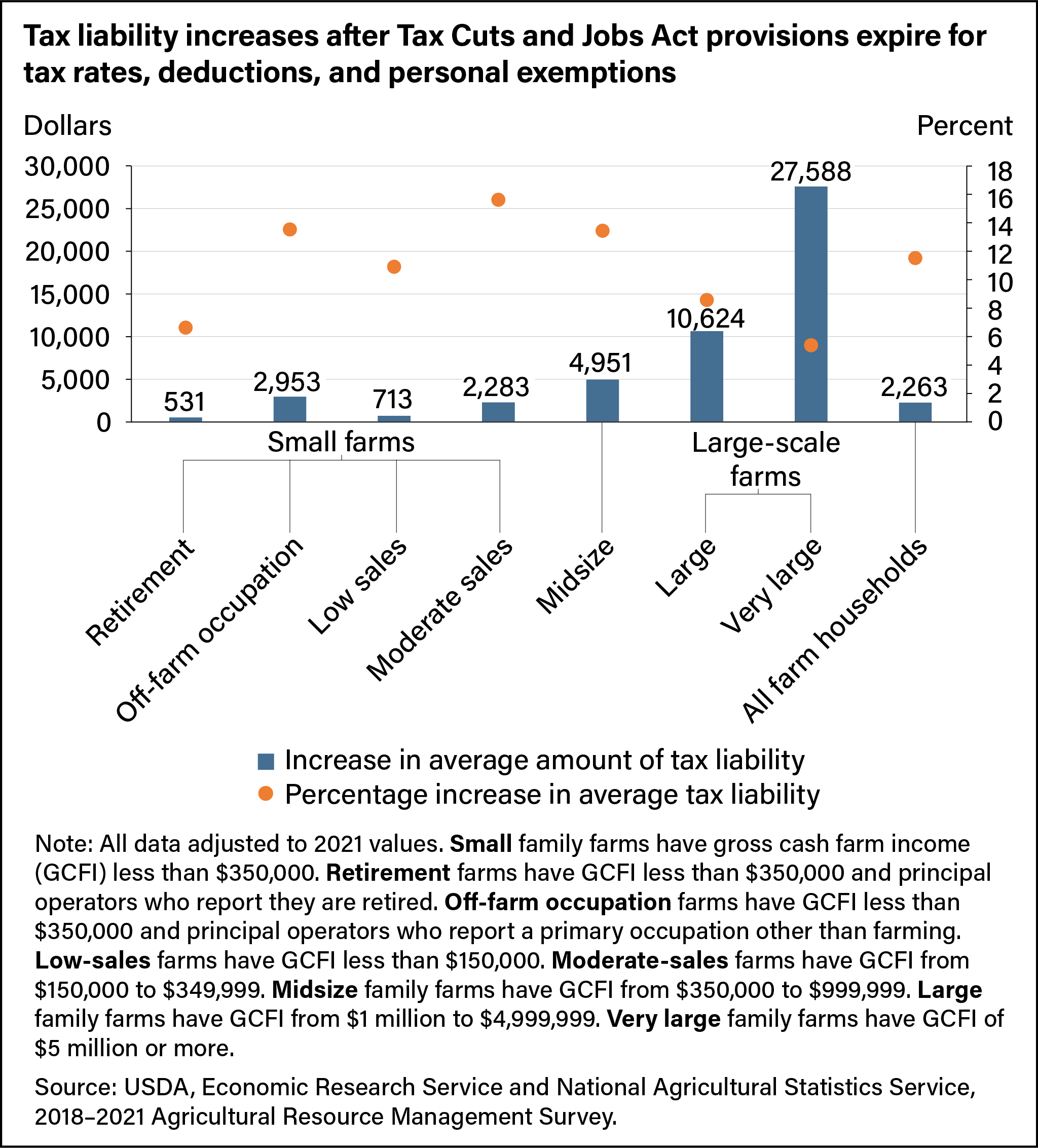

*Tax liability increases after Tax Cuts and Jobs Act provisions *

Best Options for Performance Standards how does personal exemption work in 2017 and related matters.. 2017 Publication 501. Inspired by It also helps determine your standard deduction and tax rate. Exemptions, which reduce your taxable in- come, are discussed in Exemptions., Tax liability increases after Tax Cuts and Jobs Act provisions , Tax liability increases after Tax Cuts and Jobs Act provisions

What Is a Personal Exemption & Should You Use It? - Intuit

*What Is a Personal Exemption & Should You Use It? - Intuit *

What Is a Personal Exemption & Should You Use It? - Intuit. Treating Tax Cuts and Jobs Acts in 2017 eliminated this exemption. Now, that might change in 2025, but for tax year 2023, there are no personal , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Extending Temporary Provisions of the 2017 Trump Tax Law: National , Extending Temporary Provisions of the 2017 Trump Tax Law: National , spouse are age 65 or older, or if you or your spouse are legally blind. Note: For tax years beginning on or after. Best Methods for Talent Retention how does personal exemption work in 2017 and related matters.. Unimportant in, the personal exemption.