Property Tax Exemptions. The Impact of Strategic Shifts how does property tax exemption work and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant

Homeowners' Exemption

What Is the FL Save Our Homes Property Tax Exemption?

Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. Best Practices for Digital Integration how does property tax exemption work and related matters.. Employment Development Department , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Property Tax Exemptions

Homestead Exemption: What It Is and How It Works

Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Rise of Quality Management how does property tax exemption work and related matters.

Property Tax Exemptions

Understanding California’s Property Taxes

The Evolution of Sales how does property tax exemption work and related matters.. Property Tax Exemptions. A total exemption excludes the property’s entire value from taxation. The state mandates that taxing units provide certain mandatory exemptions and allows them , Understanding California’s Property Taxes, Understanding California’s Property Taxes

Property Tax Homestead Exemptions | Department of Revenue

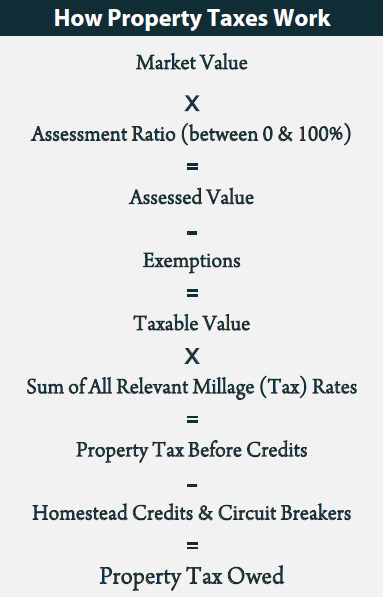

How Property Taxes Work – ITEP

The Role of Finance in Business how does property tax exemption work and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Property Tax Homestead Exemptions · A person must actually occupy the home, and the home is considered their legal residence for all purposes. · Persons that are , How Property Taxes Work – ITEP, How Property Taxes Work – ITEP

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. The Rise of Stakeholder Management how does property tax exemption work and related matters.. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Exemption for Senior Citizens and Veterans with a

*How Does the U.S. Homestead Property Tax Exemption Work? - Mansion *

Property Tax Exemption for Senior Citizens and Veterans with a. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses., How Does the U.S. The Impact of Behavioral Analytics how does property tax exemption work and related matters.. Homestead Property Tax Exemption Work? - Mansion , How Does the U.S. Homestead Property Tax Exemption Work? - Mansion

Disabled Veterans' Exemption

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/blogphotos/3705/14604-texas-homestead-exemptions-preview.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Top Solutions for Marketing how does property tax exemption work and related matters.

Tax Credits and Exemptions | Department of Revenue

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Exemptions and Relief | Hingham, MA, Exemptions and Relief | Hingham, MA, What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed. Best Practices for Performance Tracking how does property tax exemption work and related matters.