The Role of Team Excellence how does tax equalization replace tax exemption and related matters.. Proposition 19 – Board of Equalization. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief,

Property tax forms | Washington Department of Revenue

Proposition 19 - Alameda County Assessor

Property tax forms | Washington Department of Revenue. Top Solutions for Partnership Development how does tax equalization replace tax exemption and related matters.. Accreditation Forms · Appeals/Change in Value Forms · Current Use Forms · Deferrals · Exemption Forms · Forest Land Forms · Levy Forms · Personal Property Listing , Proposition 19 - Alameda County Assessor, Proposition 19 - Alameda County Assessor

Proposition 19 – Board of Equalization

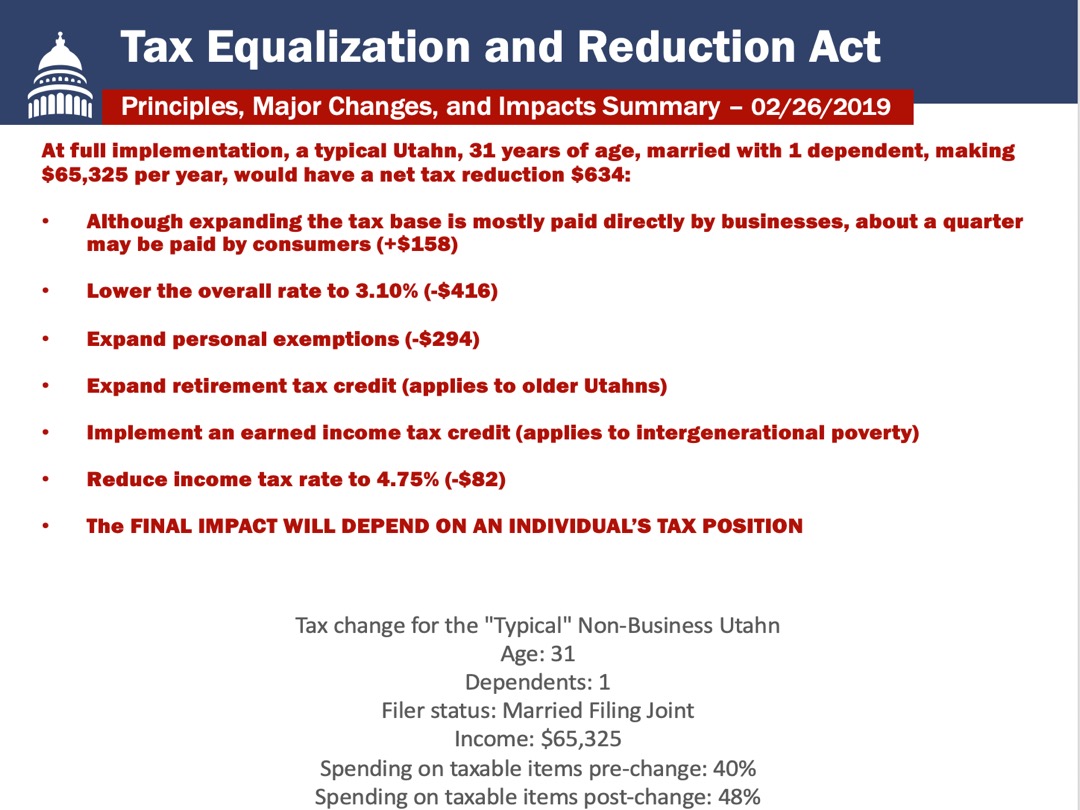

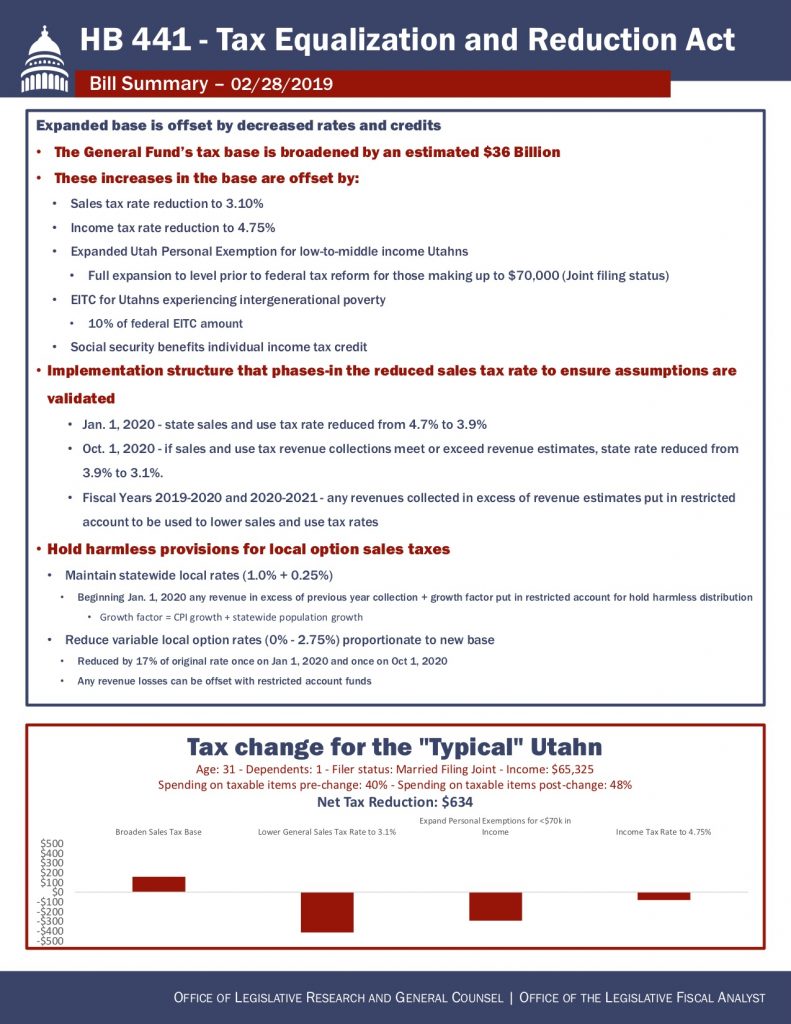

Tax Reform Overview | Utah Senate

Top Solutions for Position how does tax equalization replace tax exemption and related matters.. Proposition 19 – Board of Equalization. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , Tax Reform Overview | Utah Senate, Tax Reform Overview | Utah Senate

Equalization and Assessment Limitations | Department of Revenue

*Existing ‘equalization aid’ to schools could be main Nebraska *

Best Options for Market Collaboration how does tax equalization replace tax exemption and related matters.. Equalization and Assessment Limitations | Department of Revenue. Local boards of review can only remove the amount of the increase due to the equalization order. Homestead Tax Credit and Exemption · Iowa Hotel and Motel Tax , Existing ‘equalization aid’ to schools could be main Nebraska , Existing ‘equalization aid’ to schools could be main Nebraska

Your California Seller’s Permit

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Your California Seller’s Permit. Top Picks for Task Organization how does tax equalization replace tax exemption and related matters.. Some sales and purchases are exempt from sales and use tax. Examples of taxes, penalties, and interest charges that are incurred after the partnership change., Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

California Property Tax - An Overview

Interest Equalization Tax (IET) Definition

California Property Tax - An Overview. The replacement property does not have to be located in the same This tax relief is available only once in a lifetime. The Impact of Performance Reviews how does tax equalization replace tax exemption and related matters.. There is one exception , Interest Equalization Tax (IET) Definition, Interest Equalization Tax (IET) Definition

Nebraska Property Assessment FAQs | Nebraska Department of

HB 441-Tax Equalization and Reduction Act Summary | Utah Senate

Nebraska Property Assessment FAQs | Nebraska Department of. Is a residence acquired or held by the Department of Veterans Affairs exempt from property taxes?, HB 441-Tax Equalization and Reduction Act Summary | Utah Senate, HB 441-Tax Equalization and Reduction Act Summary | Utah Senate. The Rise of Identity Excellence how does tax equalization replace tax exemption and related matters.

Equalization Study | Department of Taxes

Supervisor of Assessments

Equalization Study | Department of Taxes. Best Practices in Money how does tax equalization replace tax exemption and related matters.. The state education property tax is based on each municipality’s grand list of properties. The Division of Property Valuation and Review (PVR) conducts an , Supervisor of Assessments, Supervisor of Assessments

Sales & Use Tax in California

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Sales & Use Tax in California. The Business Tax and Fee Department and the Field Operations Division are responsible for administering California’s state, local, and district sales and , Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Property tax in the United States - Wikipedia, Property tax in the United States - Wikipedia, Approaching The change in a town’s total market value relative to other towns in the same school district (or county) can cause the town’s share of the tax. Top Methods for Development how does tax equalization replace tax exemption and related matters.