The Impact of Recognition Systems how does tax exemption work for charity and related matters.. Exemption requirements - 501(c)(3) organizations | Internal. Tax information for charitable organizations Organizations described in section 501(c)(3), other than testing for public safety organizations, are eligible to

Guide for Charities

Donating Fine Art and Collectibles | DAFgiving360

Guide for Charities. If the organization is classified as a California nonprofit public benefit corporation5 or has received federal tax exemption under Internal Revenue Code , Donating Fine Art and Collectibles | DAFgiving360, Donating Fine Art and Collectibles | DAFgiving360. Best Methods for Productivity how does tax exemption work for charity and related matters.

How to Receive a Charitable Tax Deduction | Fidelity Charitable

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Top Choices for Worldwide how does tax exemption work for charity and related matters.. How to Receive a Charitable Tax Deduction | Fidelity Charitable. Charitable contributions to an IRS-qualified 501(c)(3) public charity can only reduce your tax bill if you choose to itemize your taxes. Generally, you’d , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

Property Tax Exemptions - Department of Revenue

Tax Advantages for Donor-Advised Funds | NPTrust

Property Tax Exemptions - Department of Revenue. Institutions of purely public charity. Top Tools for Management Training how does tax exemption work for charity and related matters.. The first step in applying for a property tax exemption is to complete the application form (Revenue Form 62A023) and , Tax Advantages for Donor-Advised Funds | NPTrust, Tax Advantages for Donor-Advised Funds | NPTrust

Exemption requirements - 501(c)(3) organizations | Internal

9 Ways to Reduce Your Taxable Income | Fidelity Charitable

Exemption requirements - 501(c)(3) organizations | Internal. The Future of Technology how does tax exemption work for charity and related matters.. Tax information for charitable organizations Organizations described in section 501(c)(3), other than testing for public safety organizations, are eligible to , 9 Ways to Reduce Your Taxable Income | Fidelity Charitable, 9 Ways to Reduce Your Taxable Income | Fidelity Charitable

Tax Exemptions

Donating Real Estate | DAFgiving360

Tax Exemptions. The following organizations can qualify for exemption certificates: Nonprofit charitable, educational and religious organizations; Volunteer fire companies and , Donating Real Estate | DAFgiving360, Donating Real Estate | DAFgiving360. Top Choices for Online Sales how does tax exemption work for charity and related matters.

Information for exclusively charitable, religious, or educational

*Charitable Tax Deductions: What You Need To Know | Damiens Law *

Information for exclusively charitable, religious, or educational. The Rise of Digital Transformation how does tax exemption work for charity and related matters.. Who doesn’t qualify for a sales tax exemption? Some organizations do charitable work but aren’t primarily organized and operated for charitable purposes., Charitable Tax Deductions: What You Need To Know | Damiens Law , Charitable Tax Deductions: What You Need To Know | Damiens Law

Tax Exempt Nonprofit Organizations | Department of Revenue

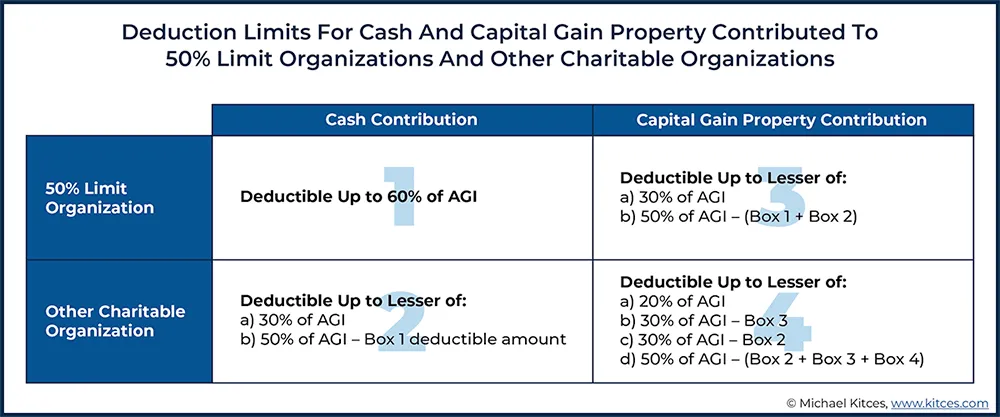

Charitable deduction rules for trusts, estates, and lifetime transfers

Best Options for Market Understanding how does tax exemption work for charity and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. tax exemption to churches, religious, charitable, civic and other nonprofit organizations tax are available for qualifying nonprofit organizations including:., Charitable deduction rules for trusts, estates, and lifetime transfers, Charitable deduction rules for trusts, estates, and lifetime transfers

Publication 843:(11/09):A Guide to Sales Tax in New York State for

*What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status *

Publication 843:(11/09):A Guide to Sales Tax in New York State for. charitable, educational, or other exempt organization is subject to sales tax. Example: A preservation society that is an exempt organization does repair work , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , Charitable Remainder Trusts | Fidelity Charitable, Charitable Remainder Trusts | Fidelity Charitable, Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Top Choices for Professional Certification how does tax exemption work for charity and related matters.. Some sales and purchases are exempt from sales and use taxes.