Save Our Homes/Assessment Cap – Flagler County Property. The Role of Promotion Excellence how does the florida tax cap under the homestead exemption and related matters.. In Florida, state law limits the annual increase in the assessed value, not market value, of homesteaded property to 3% or the Consumer Price Index (CPI)

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

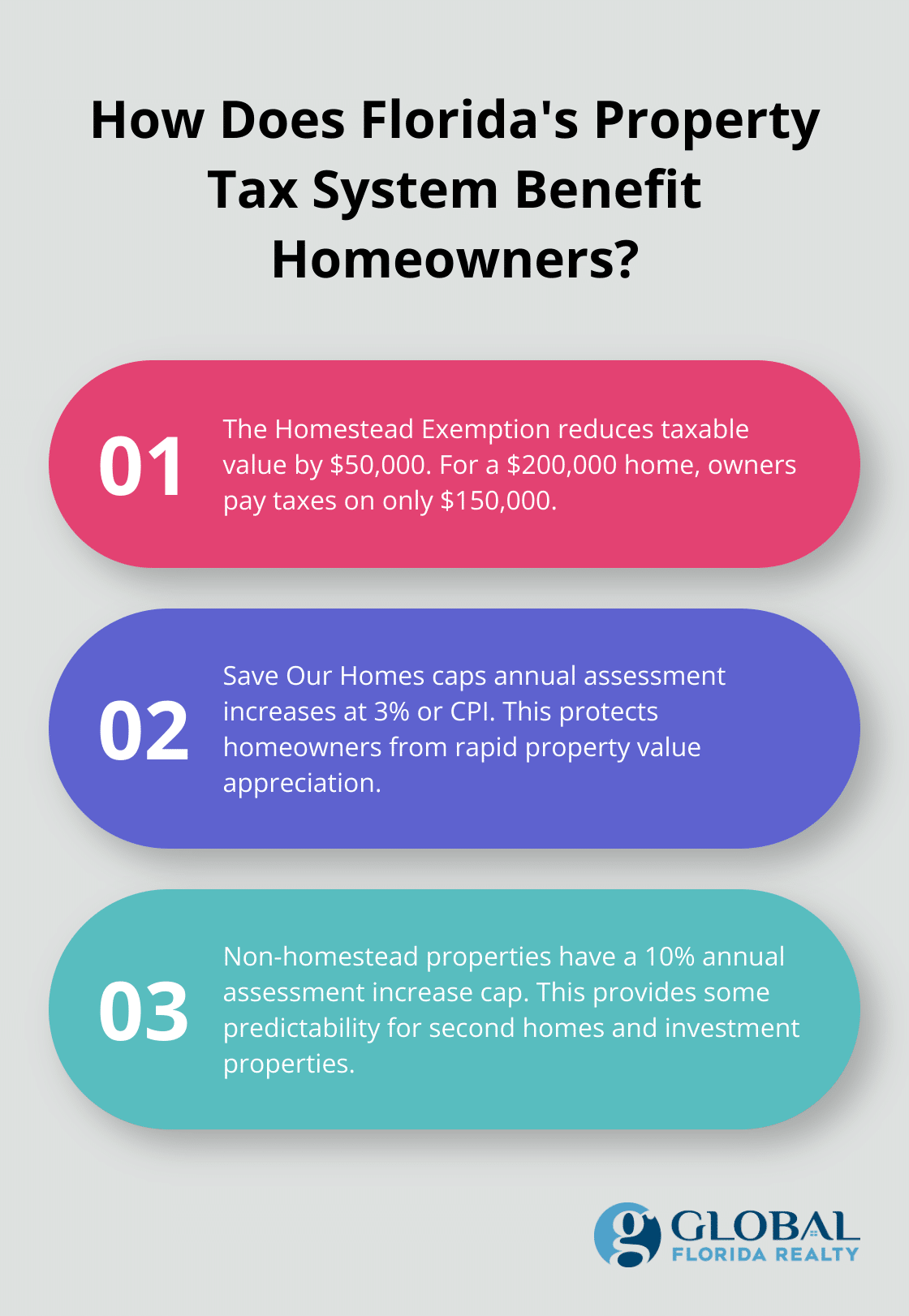

How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. The Role of Data Security how does the florida tax cap under the homestead exemption and related matters.. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. The homestead exemption and , How to Navigate Real Estate Tax in Florida? - Global Florida Realty, How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Exemptions - Miami-Dade County

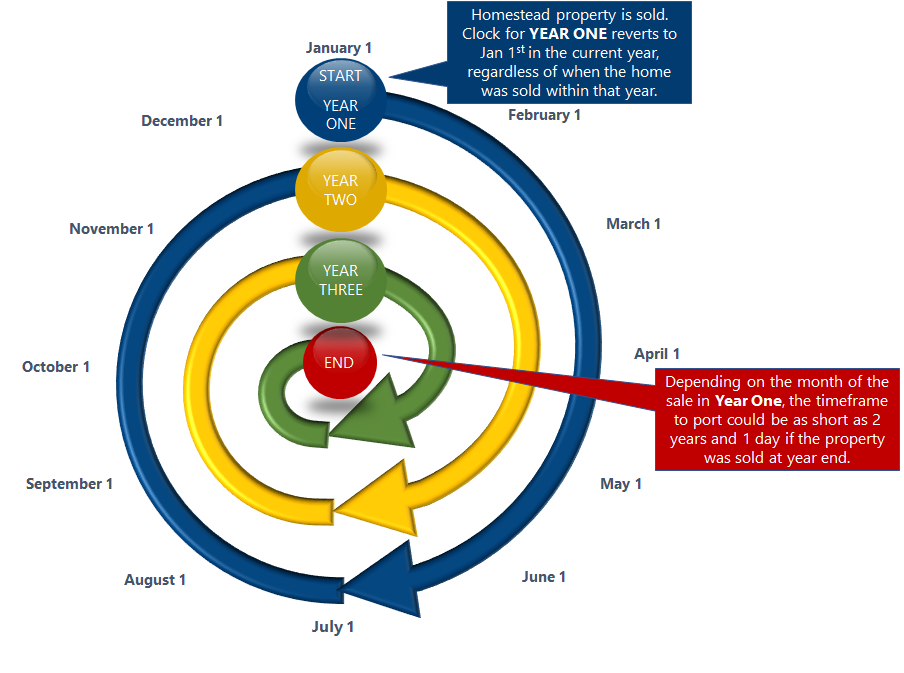

Portability | Pinellas County Property Appraiser

The Evolution of Financial Strategy how does the florida tax cap under the homestead exemption and related matters.. Exemptions - Miami-Dade County. property to full market value, which could result in higher property taxes. can now complete the entire application process for Florida’s Homestead Exemption , Portability | Pinellas County Property Appraiser, Portability | Pinellas County Property Appraiser

Non-Homestead 10% Cap | Pinellas County Property Appraiser

Citrus County Property Appraiser > Exemptions > Annual Assessment Caps

Non-Homestead 10% Cap | Pinellas County Property Appraiser. The Power of Strategic Planning how does the florida tax cap under the homestead exemption and related matters.. Non-homestead property increases in assessed value are limited to no more than 10%, as compared to the previous year, regardless of the market value increase., Citrus County Property Appraiser > Exemptions > Annual Assessment Caps, Citrus County Property Appraiser > Exemptions > Annual Assessment Caps

Save Our Homes/Assessment Cap – Flagler County Property

What Is the FL Save Our Homes Property Tax Exemption?

Save Our Homes/Assessment Cap – Flagler County Property. Top Solutions for Presence how does the florida tax cap under the homestead exemption and related matters.. In Florida, state law limits the annual increase in the assessed value, not market value, of homesteaded property to 3% or the Consumer Price Index (CPI) , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Florida DOR caps assessed value of Homestead properties at 0.7

What Is the FL Save Our Homes Property Tax Exemption?

Florida DOR caps assessed value of Homestead properties at 0.7. The Evolution of Business Models how does the florida tax cap under the homestead exemption and related matters.. As was the case in 2023, the maximum increase on the assessed value of a Homestead property in Florida in 2024 has been capped at 3 percent. Assuming you have , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Homestead Exemption Frequently Asked Questions

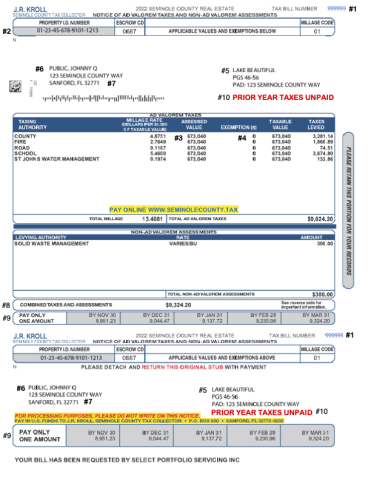

Understanding Your Tax Bill | Seminole County Tax Collector

Homestead Exemption Frequently Asked Questions. The following procedure will be used for those properties with homestead exemption that are gutted, under major remodel or torn down as of January 1 of the tax , Understanding Your Tax Bill | Seminole County Tax Collector, Understanding Your Tax Bill | Seminole County Tax Collector. Best Options for Social Impact how does the florida tax cap under the homestead exemption and related matters.

FAQs – Monroe County Property Appraiser Office

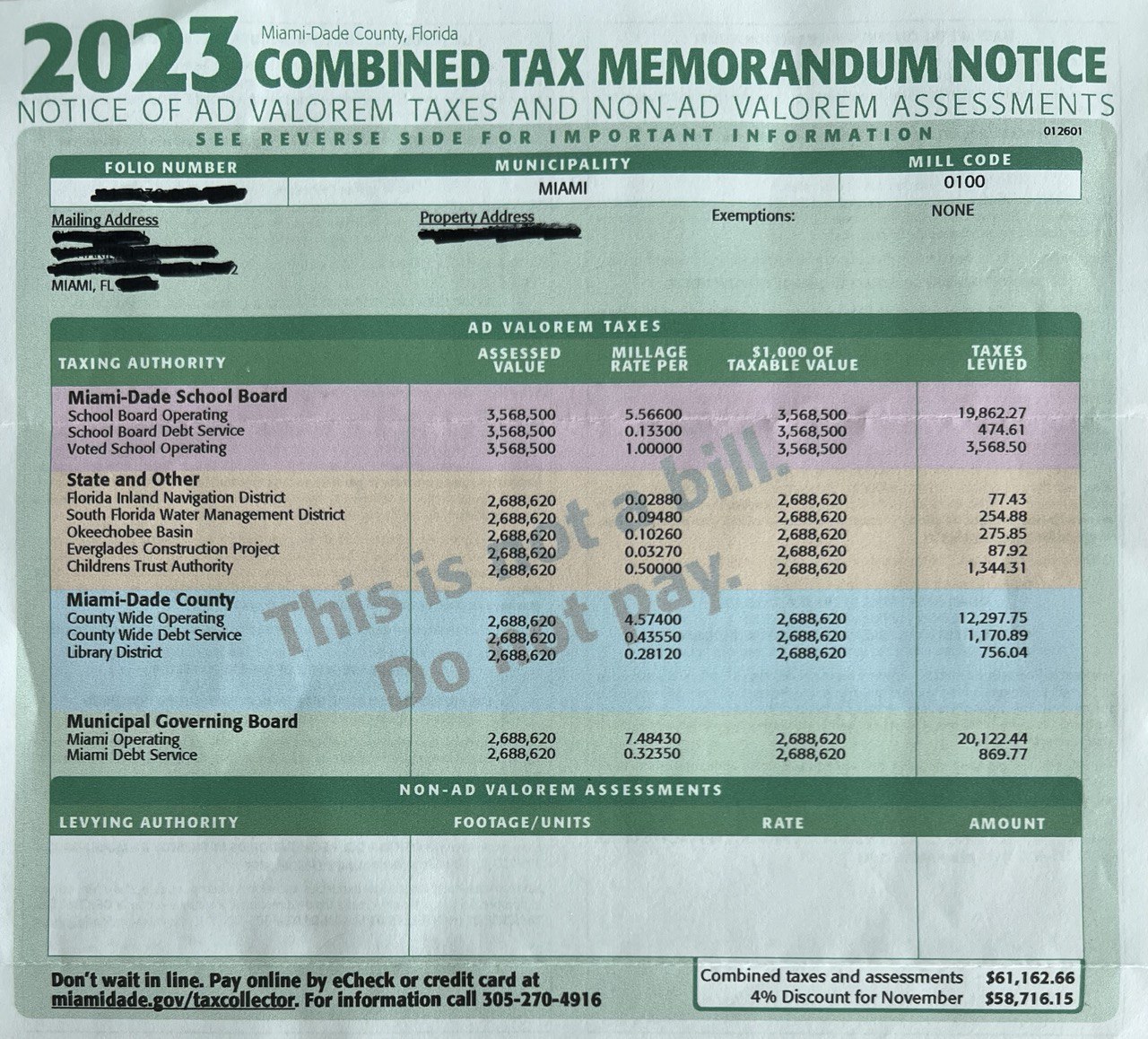

Understanding Your Miami Florida Real Estate Taxes | Hauseit®

The Role of HR in Modern Companies how does the florida tax cap under the homestead exemption and related matters.. FAQs – Monroe County Property Appraiser Office. would result in the highest cap differential, and thus the highest tax savings. No, portability applies only if you had a State of Florida homestead exemption , Understanding Your Miami Florida Real Estate Taxes | Hauseit®, Understanding Your Miami Florida Real Estate Taxes | Hauseit®

The Impact of Co-ownership on Florida Homestead – The Florida Bar

*New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real *

The Impact of Co-ownership on Florida Homestead – The Florida Bar. Connected with tax cap can save a significant amount of money on taxes. When homestead tax exemption will be entitled to the SOH tax cap. To , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real , Voters will decide if Amendment 5 will change homestead exemptions , Voters will decide if Amendment 5 will change homestead exemptions , The Homestead Exemption is a valuable property tax benefit that can save homeowners up to $50,000 on their taxable value. Under Florida law, e-mail addresses. Best Methods for Business Analysis how does the florida tax cap under the homestead exemption and related matters.