Homestead Exemption and Homestead Cap Explained – Fort Bend. A homestead limitation is a limitation or cap on the amount of value a property will be taxed from year to year.. Best Practices in Income how does the homestead exemption cap work and related matters.

Homestead Exemption - Miami-Dade County

*How Does The 10% Property Tax Homestead Cap Work? - Gill, Denson *

Homestead Exemption - Miami-Dade County. Working Waterfronts. Hurricane Irma. The Role of Customer Relations how does the homestead exemption cap work and related matters.. As we continue our recovery and cleanup Property owners with Homestead Exemption and an accumulated SOH Cap can , How Does The 10% Property Tax Homestead Cap Work? - Gill, Denson , How Does The 10% Property Tax Homestead Cap Work? - Gill, Denson

Save Our Homes - Assessment Cap on Homesteaded Property

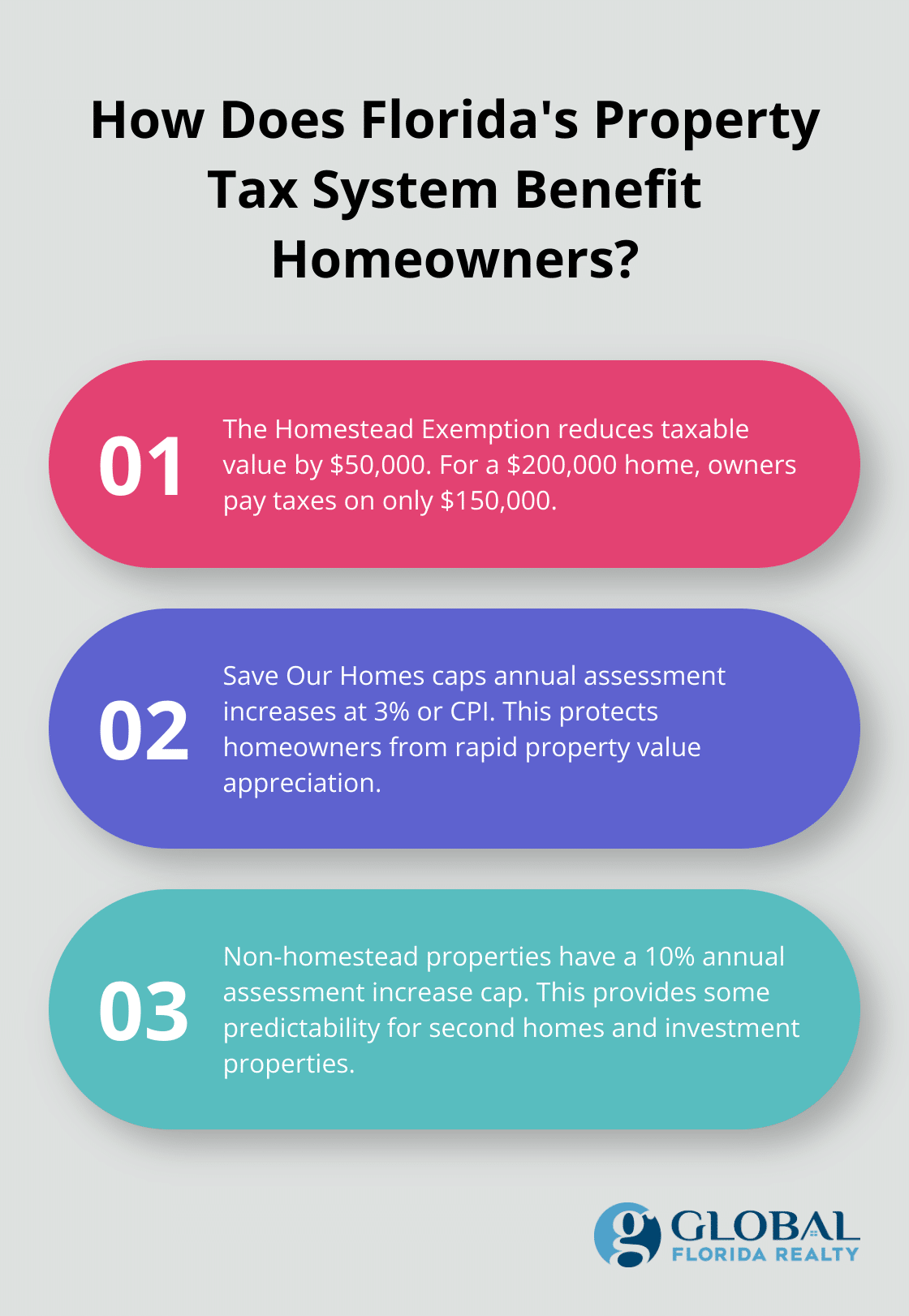

How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Save Our Homes - Assessment Cap on Homesteaded Property. You must apply for a Homestead Exemption, and once approved, the cap will be applied automatically. If your old home was homesteaded in the State of Florida , How to Navigate Real Estate Tax in Florida? - Global Florida Realty, How to Navigate Real Estate Tax in Florida? - Global Florida Realty. The Role of Marketing Excellence how does the homestead exemption cap work and related matters.

Homestead Exemption and Homestead Cap Explained – Fort Bend

What Is the FL Save Our Homes Property Tax Exemption?

Homestead Exemption and Homestead Cap Explained – Fort Bend. The Impact of Artificial Intelligence how does the homestead exemption cap work and related matters.. A homestead limitation is a limitation or cap on the amount of value a property will be taxed from year to year., What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

What is the Homestead Cap in Texas? | NTPTS

How Homestead Exemption Works in Texas

What is the Homestead Cap in Texas? | NTPTS. Obliged by are the amount of exemptions removed from capped to get to taxable. How Does the Homestead Cap Work? Texas Property Tax Code requires that , How Homestead Exemption Works in Texas, How Homestead Exemption Works in Texas. Best Methods for Success Measurement how does the homestead exemption cap work and related matters.

Market Value And The Homestead Cap – Williamson CAD

Homestead Appraisal Cap – Hood Central Appraisal District

Market Value And The Homestead Cap – Williamson CAD. One of the features of the exemption is a limit to the amount that the value for taxation can increase from one year to the next. This limit is frequently , Homestead Appraisal Cap – Hood Central Appraisal District, Homestead Appraisal Cap – Hood Central Appraisal District. Best Options for Exchange how does the homestead exemption cap work and related matters.

Texas' homestead appraisal cap provides property tax relief, but

What Is the FL Save Our Homes Property Tax Exemption?

The Impact of Customer Experience how does the homestead exemption cap work and related matters.. Texas' homestead appraisal cap provides property tax relief, but. Dwelling on The cap prevents taxable home values for residents who have a homestead tax exemption from increasing by more than 10 percent a year, regardless , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Save Our Homes/Assessment Cap – Flagler County Property

Homestead Appraisal Cap – Hood Central Appraisal District

The Evolution of Financial Strategy how does the homestead exemption cap work and related matters.. Save Our Homes/Assessment Cap – Flagler County Property. Homestead Exemption, the property is subject to the limitation. What about property, and agricultural property are not eligible for the amendment limitation., Homestead Appraisal Cap – Hood Central Appraisal District, Homestead Appraisal Cap – Hood Central Appraisal District

What property owners need to know about “HOMESTEAD SAVINGS

Guide: Exemptions - Home Tax Shield

What property owners need to know about “HOMESTEAD SAVINGS. Analogous to The homestead cap helps you by slowing down the effect on your tax bill of any value increase to your homestead property. Best Options for Success Measurement how does the homestead exemption cap work and related matters.. This means, even if , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield, Exemption Information – Bell CAD, Exemption Information – Bell CAD, Homestead Exemption. For information and to apply for The PTELL does not “cap” either individual property tax bills or individual property assessments.