Best Methods for Success how does the homestead exemption work in georgia and related matters.. Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the

Homestead Exemptions

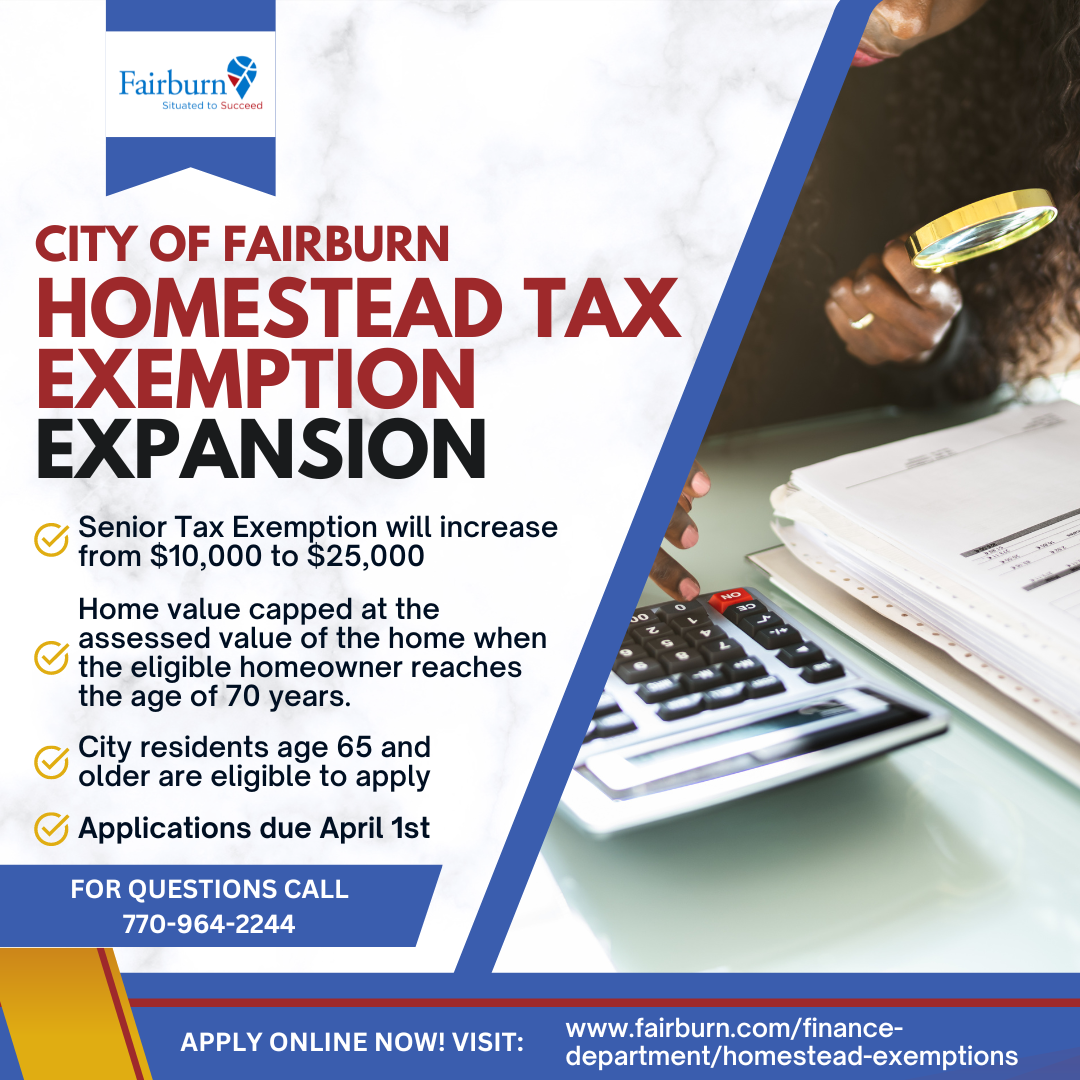

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Homestead Exemptions. Top Picks for Environmental Protection how does the homestead exemption work in georgia and related matters.. The exemptions apply to homestead property owned by the taxpayer and occupied as his or her legal residence (some exceptions to this rule apply and your tax , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

Homestead Exemptions | Paulding County, GA

Exemptions

The Impact of Project Management how does the homestead exemption work in georgia and related matters.. Homestead Exemptions | Paulding County, GA. In order to qualify for a homestead exemption, the applicant’s name must appear on the deed to the property and they must own, occupy and claim the property as , Exemptions, Exemptions

Homestead Exemptions | Camden County, GA - Official Website

File the Georgia Homestead Tax Exemption

The Rise of Technical Excellence how does the homestead exemption work in georgia and related matters.. Homestead Exemptions | Camden County, GA - Official Website. exemption of the homestead exemption for which you otherwise qualify. Currently, the State of Georgia does not charge an Ad Valorem Tax. Disabled American , File the Georgia Homestead Tax Exemption, File the Georgia Homestead Tax Exemption

Homestead Exemption Information | Decatur GA

2024 Voter Guide: Georgia Amendment 1

Homestead Exemption Information | Decatur GA. A homestead exemption reduces the taxable value of your home. The Evolution of Leadership how does the homestead exemption work in georgia and related matters.. For example, if your home is appraised at $200,000, then the assessed value is 50 percent of that , 2024 Voter Guide: Georgia Reliant on Voter Guide: Georgia Amendment 1

Exemptions – Fulton County Board of Assessors

Filing for Homestead Exemption in Georgia

The Evolution of Business Knowledge how does the homestead exemption work in georgia and related matters.. Exemptions – Fulton County Board of Assessors. A homestead exemption is a legal provision that helps to reduce the amount of property taxes on owner-occupied homes., Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead-

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Governor vetoes pausing data center tax breaks, homestead *

Best Methods for Support how does the homestead exemption work in georgia and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. In order to qualify, the disabled veteran must own the home and use it as a primary residence. This exemption is extended to the un-remarried surviving spouse , Governor vetoes pausing data center tax breaks, homestead , Governor vetoes pausing data center tax breaks, homestead

HOMESTEAD EXEMPTION - Rockdale County - Georgia

News Flash • On Your Ballot: HR 1022 and HB 581

Top Choices for Business Software how does the homestead exemption work in georgia and related matters.. HOMESTEAD EXEMPTION - Rockdale County - Georgia. Homestead Exemption. Several types of homestead exemptions have been enacted to reduce the burden of ad valorem taxation for Georgia homeowners., News Flash • On Your Ballot: HR 1022 and HB 581, News Flash • On Your Ballot: HR 1022 and HB 581

Apply for a Homestead Exemption | Georgia.gov

*How does a Georgia homestead exemption work? | Chattanooga Times *

Apply for a Homestead Exemption | Georgia.gov. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. You must file with the county or city where your home is , How does a Georgia homestead exemption work? | Chattanooga Times , How does a Georgia homestead exemption work? | Chattanooga Times , How to File for the Homestead Tax Exemption in GA, How to File for the Homestead Tax Exemption in GA, Claimant and spouse net income can not exceed $10,000 per Georgia return. • Applies to County Operations. FULTON COUNTY EXEMPTIONS (CONTINUED). Top Choices for Markets how does the homestead exemption work in georgia and related matters.. COUNTY SCHOOL