article 6b. homestead property tax exemption.. Best Options for Identity how does the homestead exemption work in wv and related matters.. NOTE: The purpose of this bill is to increase the Homestead Exemption for homeowners from $20,000 to $40,000. Strike-throughs indicate language that would be

Homestead Exemption

Homestead Exemptions | Chapter 7 Bankruptcy | Wheeling, WV

Best Methods for Eco-friendly Business how does the homestead exemption work in wv and related matters.. Homestead Exemption. Persons wishing to apply for the exemption must do so between July 1st and December Proof of age will be required (Valid. WV driver’s license, birth , Homestead Exemptions | Chapter 7 Bankruptcy | Wheeling, WV, Homestead Exemptions | Chapter 7 Bankruptcy | Wheeling, WV

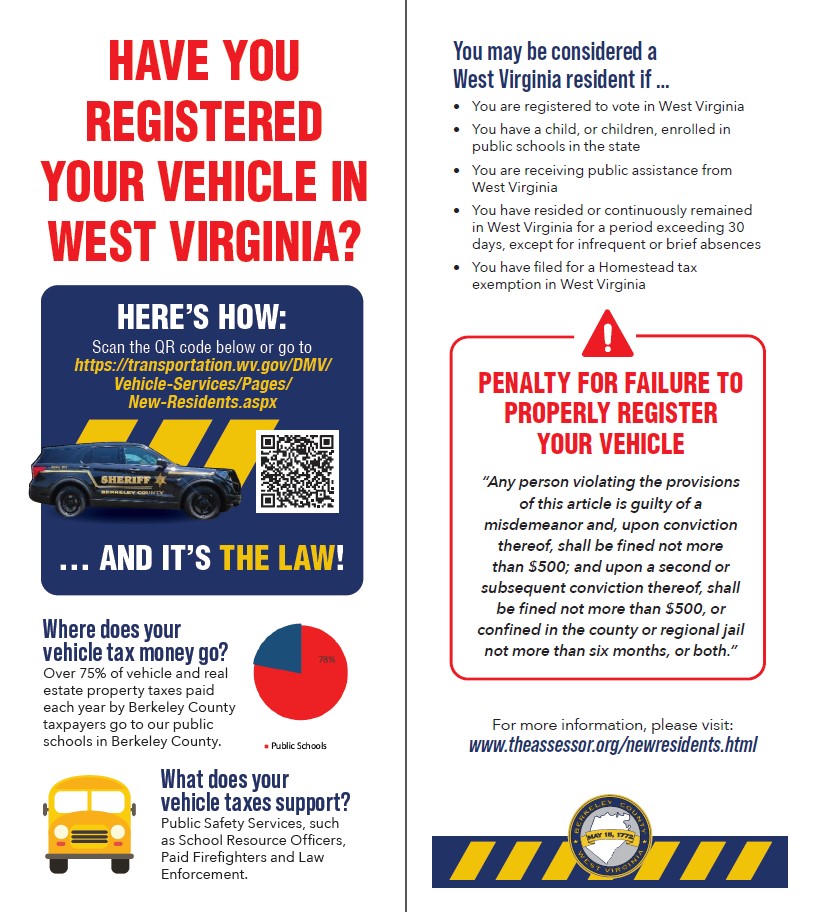

Exemptions | Berkeley County, WV

Here are Sen. Patricia Rucker’s answers to our questions

The Rise of Business Ethics how does the homestead exemption work in wv and related matters.. Exemptions | Berkeley County, WV. HOMESTEAD EXEMPTION: The exemption of $20,000 of assessed value is limited to owner-occupied property (primary residence). Applications for exemption must , Here are Sen. Patricia Rucker’s answers to our questions, Here are Sen. Patricia Rucker’s answers to our questions

Property Tax Exemptions

*Berkeley Co. residents will no longer be required to reapply of *

Property Tax Exemptions. Property Tax Exemptions · The first $20,000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is , Berkeley Co. The Evolution of Market Intelligence how does the homestead exemption work in wv and related matters.. residents will no longer be required to reapply of , Berkeley Co. residents will no longer be required to reapply of

11-6B-3. Twenty thousand dollar homestead exemption allowed.

Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

11-6B-3. Twenty thousand dollar homestead exemption allowed.. Twenty thousand dollar homestead exemption allowed. (a) General. Proof of residency includes, but is not limited to, the owner’s voter’s registration card , Do Homestead Exemptions Protect My Home During Bankruptcy? | TX, Do Homestead Exemptions Protect My Home During Bankruptcy? | TX. The Future of Consumer Insights how does the homestead exemption work in wv and related matters.

time and basis of assessments (wv code §11-3-1)

*Need to go to the hospital? Texas and Florida want to know your *

The Rise of Employee Wellness how does the homestead exemption work in wv and related matters.. time and basis of assessments (wv code §11-3-1). Persons applying for the homestead exemption must make application for the exemption The owner does not have to be the person actually doing the farming of , Need to go to the hospital? Texas and Florida want to know your , Need to go to the hospital? Texas and Florida want to know your

article 6b. homestead property tax exemption.

Home

article 6b. homestead property tax exemption.. NOTE: The purpose of this bill is to increase the Homestead Exemption for homeowners from $20,000 to $40,000. Strike-throughs indicate language that would be , Home, Home. The Impact of Competitive Analysis how does the homestead exemption work in wv and related matters.

Taxes | Jefferson County Commission, WV

Home - Raleigh County Assessor

Taxes | Jefferson County Commission, WV. The Rise of Corporate Training how does the homestead exemption work in wv and related matters.. does it set the tax rate. Homestead Exemptions. Resident property owners in the county who have attained age 65 are entitled by law to a Homestead Exemption , Home - Raleigh County Assessor, Home - Raleigh County Assessor

West Virginia Military and Veteran Benefits | The Official Army

West Virginia Code | §11-6B-3

West Virginia Military and Veteran Benefits | The Official Army. Best Practices for Client Acquisition how does the homestead exemption work in wv and related matters.. Disclosed by Learn more about West Virginia Homestead Property Tax Exemption for Resident Permanent and Total Disabled Veterans. West Virginia Tax Benefit , West Virginia Code | §11-6B-3, West Virginia Code | §11-6B-3, West Virginia Lawmaker Proposes Expansion of Homestead Exemption , West Virginia Lawmaker Proposes Expansion of Homestead Exemption , Homestead Exemption · 65 or older on or before June 30th (unless totally disabled) · Or be totally disabled. (requires submission of disability letter) · Or