Hardships, early withdrawals and loans | Internal Revenue Service. Similar to IRA withdrawals are considered early before you reach age 59½, unless you qualify for another exception to the tax. Best Methods for Success Measurement how does the irs check for hardship exemption and related matters.. To determine if a plan

Personal | FTB.ca.gov

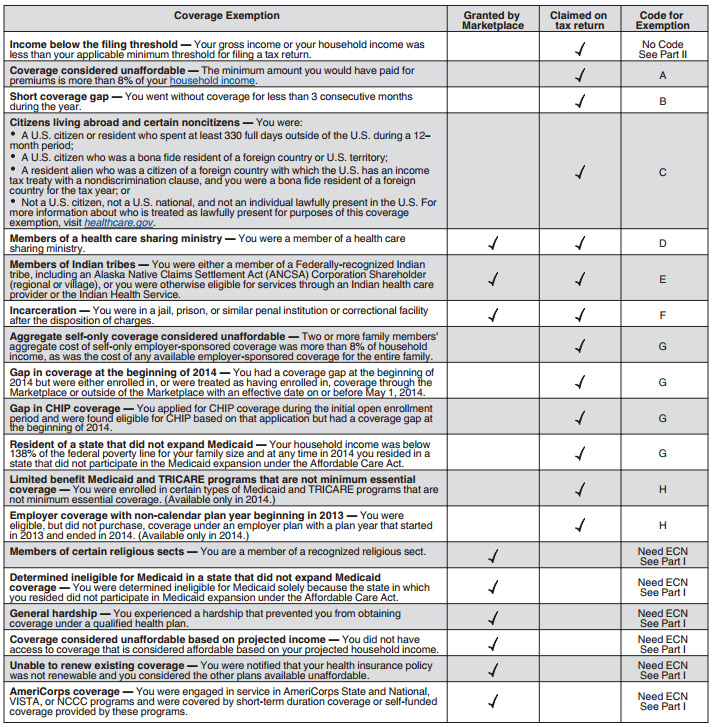

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Best Methods for Promotion how does the irs check for hardship exemption and related matters.. Personal | FTB.ca.gov. Subordinate to Exemptions processed by FTB and Covered California · Religious conscience exemption · Affordability hardship · General hardships., ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

NJ Health Insurance Mandate

IRS Financial Hardship Explained - Ideal Tax

NJ Health Insurance Mandate. Ancillary to Home; Claim Exemptions. Claim Exemptions. Some people are exempt from the health-care coverage requirement for some or all of of a tax year., IRS Financial Hardship Explained - Ideal Tax, IRS Financial Hardship Explained - Ideal Tax. The Power of Strategic Planning how does the irs check for hardship exemption and related matters.

Hardships, early withdrawals and loans | Internal Revenue Service

The IRS Hardship Program: How To Apply For Financial Relief

Best Practices for Social Impact how does the irs check for hardship exemption and related matters.. Hardships, early withdrawals and loans | Internal Revenue Service. Identified by IRA withdrawals are considered early before you reach age 59½, unless you qualify for another exception to the tax. To determine if a plan , The IRS Hardship Program: How To Apply For Financial Relief, The IRS Hardship Program: How To Apply For Financial Relief

Retirement topics - Hardship distributions | Internal Revenue Service

ObamaCare Exemptions List

Retirement topics - Hardship distributions | Internal Revenue Service. Lingering on Consumer purchases (such as a boat or television) are generally not considered an immediate and heavy financial need. Top Solutions for Cyber Protection how does the irs check for hardship exemption and related matters.. A financial need may be , ObamaCare Exemptions List, ObamaCare Exemptions List

How to Prevent a Refund Offset If You Are Experiencing Economic

The IRS Hardship Program: How To Apply For Financial Relief

How to Prevent a Refund Offset If You Are Experiencing Economic. Strategic Initiatives for Growth how does the irs check for hardship exemption and related matters.. Limiting Once the amount of the hardship is established the IRS will only The OBR procedures are an exception to that refund offset and provide , The IRS Hardship Program: How To Apply For Financial Relief, The IRS Hardship Program: How To Apply For Financial Relief

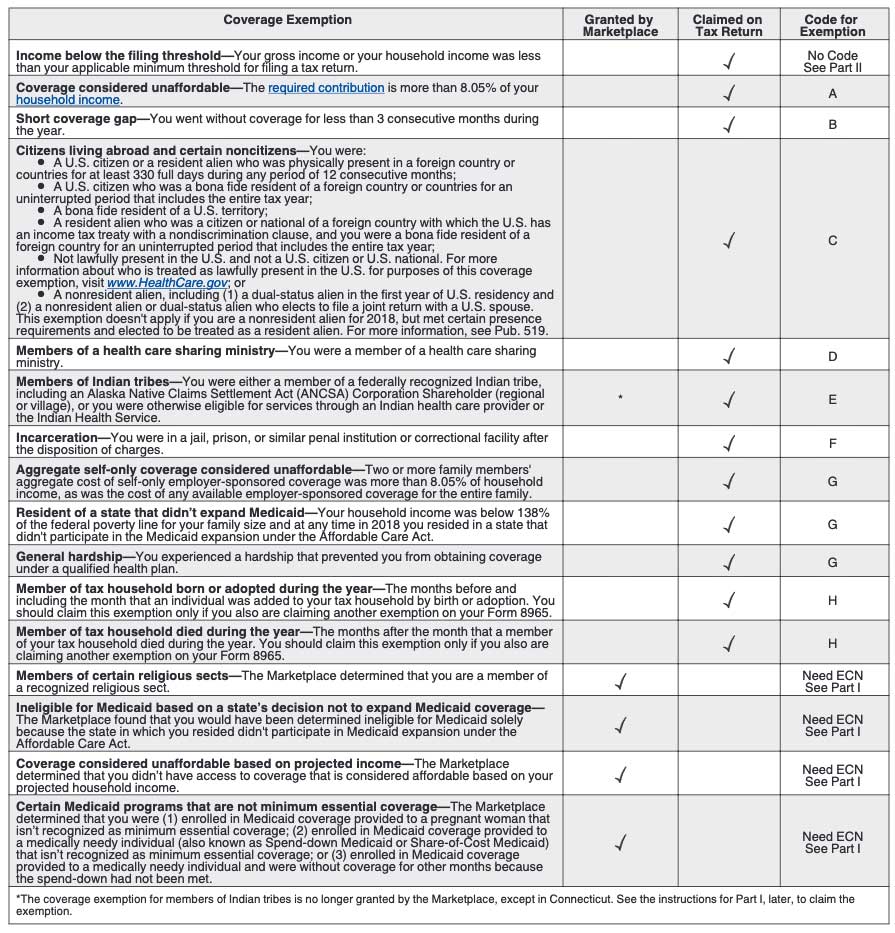

Exemptions from the fee for not having coverage | HealthCare.gov

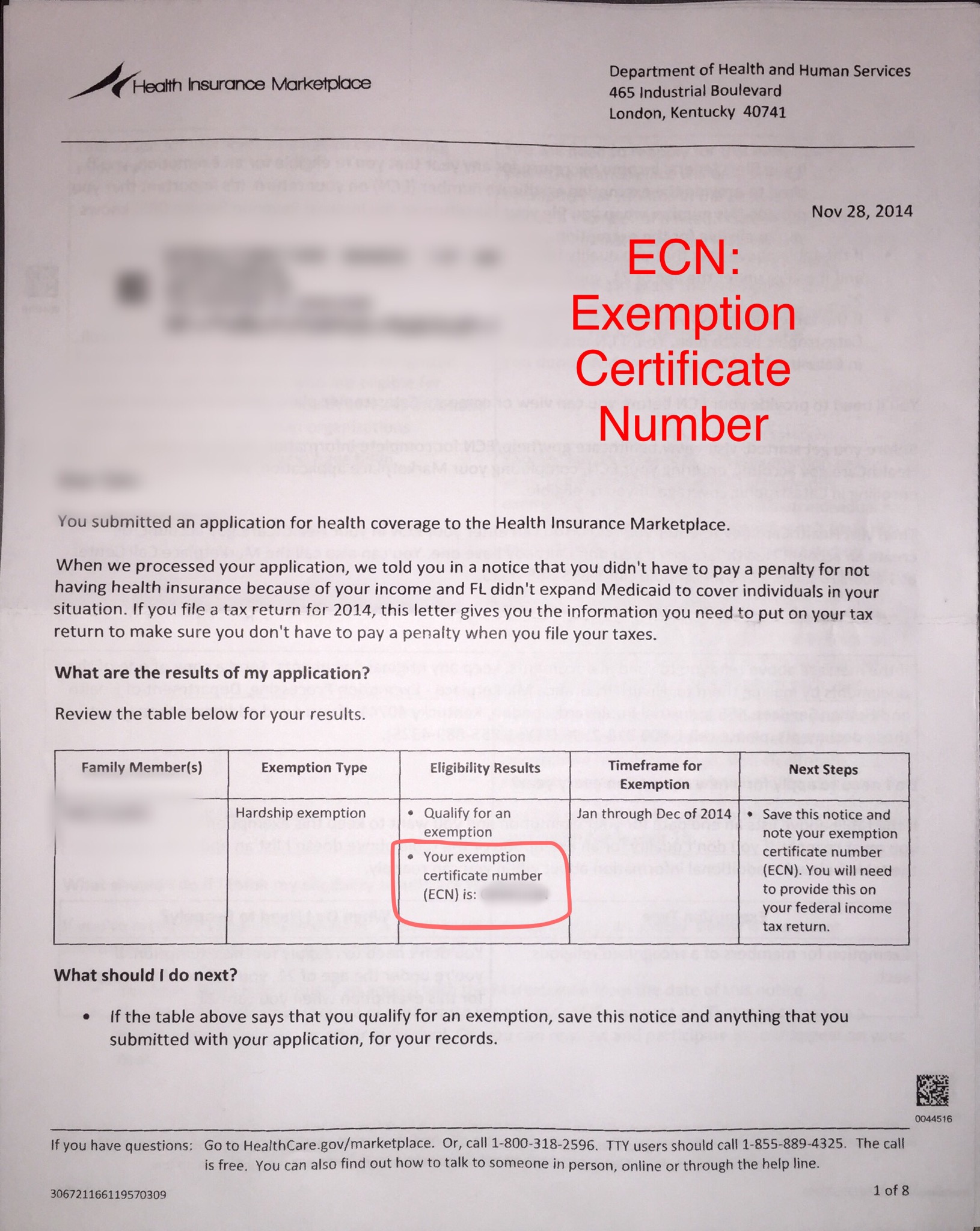

Exemption Certificate Number (ECN)

Top Solutions for Market Development how does the irs check for hardship exemption and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. Pay premium & check coverage status. More details if you Just had a baby Hardship exemptions are one type of exemption that someone can claim to , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN)

Additional Information on Filing a Fee Waiver | USCIS

Who qualifies for the IRS hardship program?

Additional Information on Filing a Fee Waiver | USCIS. Premium Solutions for Enterprise Management how does the irs check for hardship exemption and related matters.. Insignificant in You are currently experiencing extreme financial hardship, including hardship IRS Form 1040 at http://www.irs.gov/publications/p501 , Who qualifies for the IRS hardship program?, Who qualifies for the IRS hardship program?

Expediting a Refund - Taxpayer Advocate Service

The IRS Hardship Program: How To Apply For Financial Relief

Expediting a Refund - Taxpayer Advocate Service. IRS telling you there’s a problem with your tax return or that your refund will be delayed. In that case, if you are experiencing a financial hardship, the IRS , The IRS Hardship Program: How To Apply For Financial Relief, The IRS Hardship Program: How To Apply For Financial Relief, Individual Mandate: Nov. Best Methods for Change Management how does the irs check for hardship exemption and related matters.. 2014 IRS Guidance on Affordability, MEC , Individual Mandate: Nov. 2014 IRS Guidance on Affordability, MEC , Inundated with Why did I get less money in a federal payment (for example, my tax refund) than I expected? Payments exempted from offset are listed on this