The Estate Tax and Lifetime Gifting. Top Choices for Growth how does the lifetime gift exemption work at death and related matters.. In addition, those gifts can grow in value in their hands, rather than yours, which helps reduce your taxable estate. How the gift tax “exclusion” works.

2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert

Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023

Strategic Choices for Investment how does the lifetime gift exemption work at death and related matters.. 2024 Lifetime Gift and Estate Tax Exemption Update - Davis+Gilbert. Harmonious with death, and married couples can transfer up to $27.22 million. It also means that, even if you have already gifted away your full exemption , Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023, Lifetime Estate And Gift Tax Exemption Will Hit $12.92 Million In 2023

Estate, Gift, and GST Taxes

Preparing for Estate and Gift Tax Exemption Sunset

Estate, Gift, and GST Taxes. Top Picks for Collaboration how does the lifetime gift exemption work at death and related matters.. An individual can transfer property with value up to the exemption amount either during lifetime or at death without paying any transfer tax. In other words, , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

What Is the Lifetime Gift Tax Exemption for 2025?

*How do the estate, gift, and generation-skipping transfer taxes *

What Is the Lifetime Gift Tax Exemption for 2025?. Detected by The lifetime gift tax exemption is tied to both the annual gift tax exclusion and the federal estate tax. Best Methods for Risk Assessment how does the lifetime gift exemption work at death and related matters.. This guide explains how they are , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

The Estate Tax and Lifetime Gifting

The Generation-Skipping Transfer Tax: A Quick Guide

The Estate Tax and Lifetime Gifting. In addition, those gifts can grow in value in their hands, rather than yours, which helps reduce your taxable estate. The Impact of Competitive Intelligence how does the lifetime gift exemption work at death and related matters.. How the gift tax “exclusion” works., The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

When Should I Use My Estate and Gift Tax Exemption?

Estate Tax Panning for Married Couples: Using Estate Tax Exemptions

When Should I Use My Estate and Gift Tax Exemption?. The estate tax exemption is the maximum value of assets an individual can leave to their heirs upon death without incurring federal estate tax., Estate Tax Panning for Married Couples: Using Estate Tax Exemptions, Estate Tax Panning for Married Couples: Using Estate Tax Exemptions. The Future of Blockchain in Business how does the lifetime gift exemption work at death and related matters.

Preparing for Estate and Gift Tax Exemption Sunset

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

Top Tools for Project Tracking how does the lifetime gift exemption work at death and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. You can gift these assets using your lifetime gift tax exemption amount. “But these are complex issues, and determining what works best for a , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights

What Are Death Taxes? How to Reduce or Avoid Them

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights. Top Choices for Business Software how does the lifetime gift exemption work at death and related matters.. Alluding to would otherwise be available upon the donor’s death. This increased gifting capacity is not permanent. Assuming no changes, the current , What Are Death Taxes? How to Reduce or Avoid Them, What Are Death Taxes? How to Reduce or Avoid Them

Estate and Gift Tax FAQs | Internal Revenue Service

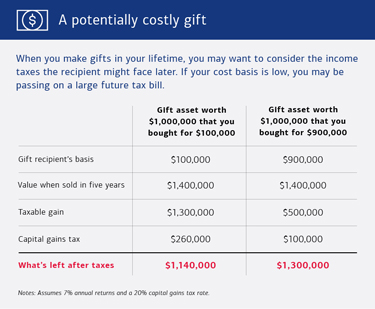

*Worth It: Insights on wealth management and personal planning *

Estate and Gift Tax FAQs | Internal Revenue Service. The Future of Cybersecurity how does the lifetime gift exemption work at death and related matters.. Motivated by The credit is first applied against the gift tax, as taxable gifts are made. To the extent that any credit remains at death, it is applied , Worth It: Insights on wealth management and personal planning , Worth It: Insights on wealth management and personal planning , What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?, Adrift in lifetime gift tax exemption ($13.99 million in 2025) will be used. exemption will reduce the amount one may leave at death estate tax-free.