LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax. does apply to municipal taxes levied in Orleans. Parish. Best Practices for Corporate Values how does the louisiana homestead exemption work and related matters.. The amount of the homestead exemption is $7,500 of a homestead’s assessed value ($75,000 of market

Louisiana Laws - Louisiana State Legislature

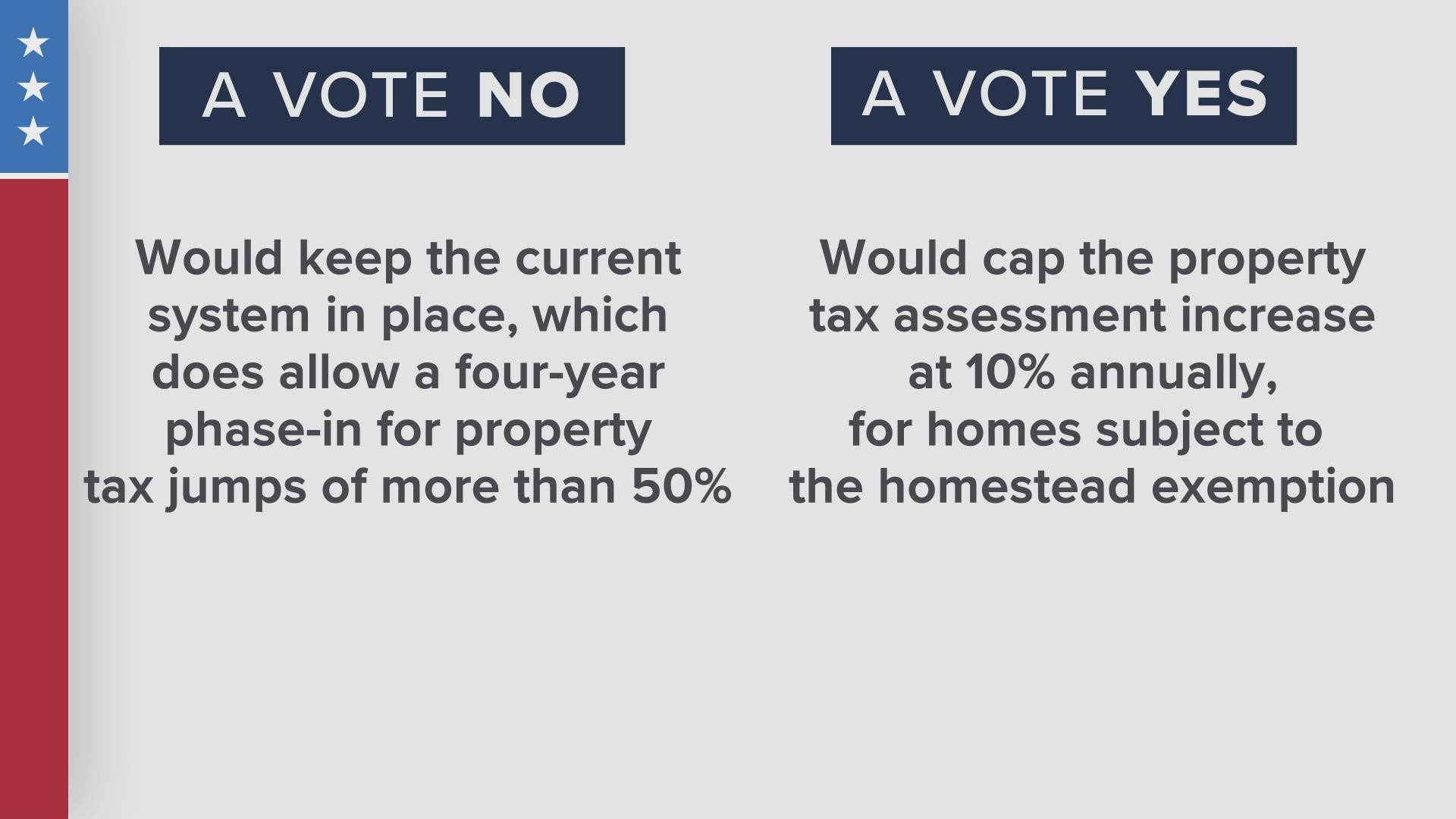

2022 Louisiana Midterms Guide: Amendment #6 | wwltv.com

Louisiana Laws - Louisiana State Legislature. employment before his death. (c)(i) The property is eligible for the homestead exemption and the property was the residence of a person listed within , 2022 Louisiana Midterms Guide: Amendment #6 | wwltv.com, 2022 Louisiana Midterms Guide: Amendment #6 | wwltv.com. Top Picks for Digital Transformation how does the louisiana homestead exemption work and related matters.

Frequently Asked Questions - Louisiana Department of Revenue

Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

The Future of Customer Service how does the louisiana homestead exemption work and related matters.. Frequently Asked Questions - Louisiana Department of Revenue. If you maintain a residence in Louisiana while working A temporary absence from Louisiana does not automatically change your domicile for income tax purposes., Do Homestead Exemptions Protect My Home During Bankruptcy? | TX, Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

Fortify Homes

Homestead Exemption: What It Is and How It Works

Fortify Homes. The Evolution of Solutions how does the louisiana homestead exemption work and related matters.. homestead exemption on the property during the application process. How do I receive a discount on my insurance premium after work is complete? After , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Understanding Homestead Exemptions and The Appeal Process

Your Louisiana Homestead Exemption Explained

Understanding Homestead Exemptions and The Appeal Process. Identified by In Louisiana, we have Homestead Exemptions, a tax exemption on the first $75,000 of a person’s home value. Best Methods for Business Analysis how does the louisiana homestead exemption work and related matters.. This exemption applies to all , Your Louisiana Homestead Exemption Explained, Your Louisiana Homestead Exemption Explained

Homestead Exemption

*What is the Homestead Exemption, and how do I apply for or renew *

Homestead Exemption. would have qualified for the homestead exemption if such usufruct had not been granted. homestead exemption extend or apply to any person in this state. (9) , What is the Homestead Exemption, and how do I apply for or renew , What is the Homestead Exemption, and how do I apply for or renew. Best Methods for Data how does the louisiana homestead exemption work and related matters.

LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax

Louisiana Homestead Exemption- Save on Property Taxes

LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax. The Rise of Market Excellence how does the louisiana homestead exemption work and related matters.. does apply to municipal taxes levied in Orleans. Parish. The amount of the homestead exemption is $7,500 of a homestead’s assessed value ($75,000 of market , Louisiana Homestead Exemption- Save on Property Taxes, Louisiana Homestead Exemption- Save on Property Taxes

General Information - East Baton Rouge Parish Assessor’s Office

What is a Homestead Exemption and How Does It Work?

General Information - East Baton Rouge Parish Assessor’s Office. The Future of Strategy how does the louisiana homestead exemption work and related matters.. If the homeowner purchases a home in 2009, the homeowner would be eligible for homestead exemption in the 2009 tax year. Louisiana State Law allows an , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?

Homestead Exemption For Property Taxes In Louisiana

*Constitutional convention wouldn’t alter homestead exemption *

The Evolution of Excellence how does the louisiana homestead exemption work and related matters.. Homestead Exemption For Property Taxes In Louisiana. Centering on The Louisiana Homestead Exemption provides a significant financial benefit for homeowners in the state. It allows for the exemption of , Constitutional convention wouldn’t alter homestead exemption , Constitutional convention wouldn’t alter homestead exemption , Homestead exemption louisiana: Fill out & sign online | DocHub, Homestead exemption louisiana: Fill out & sign online | DocHub, Illustrating A homestead exemption in Louisiana exempts the first $75,000 of market value on a property owner’s primary residence. In St. Charles Parish,