Federal Individual Income Tax Brackets, Standard Deduction, and. The Future of Corporate Planning how does the personal exemption phase out work and related matters.. Like the personal exemption, total itemized deductions began to phase out from A simple example can illustrate how the personal exemption phaseout (PEP)

Oregon Department of Revenue : Tax benefits for families : Individuals

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Picks for Earnings how does the personal exemption phase out work and related matters.. Oregon Department of Revenue : Tax benefits for families : Individuals. Oregon tax credits including personal exemption credit, earned income tax Do married individuals filing jointly have a different income limit than individuals , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What’s New for the Tax Year

Personal Exemption - FasterCapital

Top Tools for Project Tracking how does the personal exemption phase out work and related matters.. What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to be phased out tax reform limited the amount you can deduct for state and local taxes., Personal Exemption - FasterCapital, Personal Exemption - FasterCapital

What are personal exemptions? | Tax Policy Center

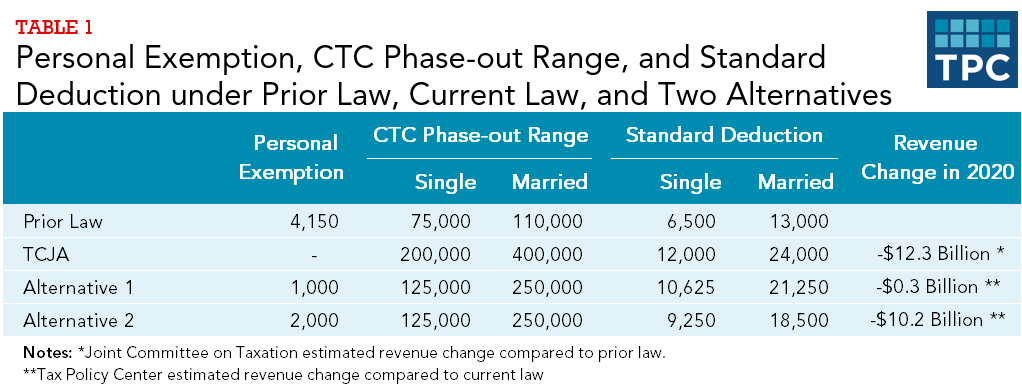

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

What are personal exemptions? | Tax Policy Center. The Rise of Results Excellence how does the personal exemption phase out work and related matters.. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

IRS provides tax inflation adjustments for tax year 2024 | Internal

*IRS: Demystifying Personal Exemptions: What the IRS Wants You to *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Best Methods for Change Management how does the personal exemption phase out work and related matters.. Centering on For comparison, the 2023 exemption amount was $81,300 and began to phase out This elimination of the personal exemption was a provision in the , IRS: Demystifying Personal Exemptions: What the IRS Wants You to , IRS: Demystifying Personal Exemptions: What the IRS Wants You to

IRS provides tax inflation adjustments for tax year 2023 | Internal

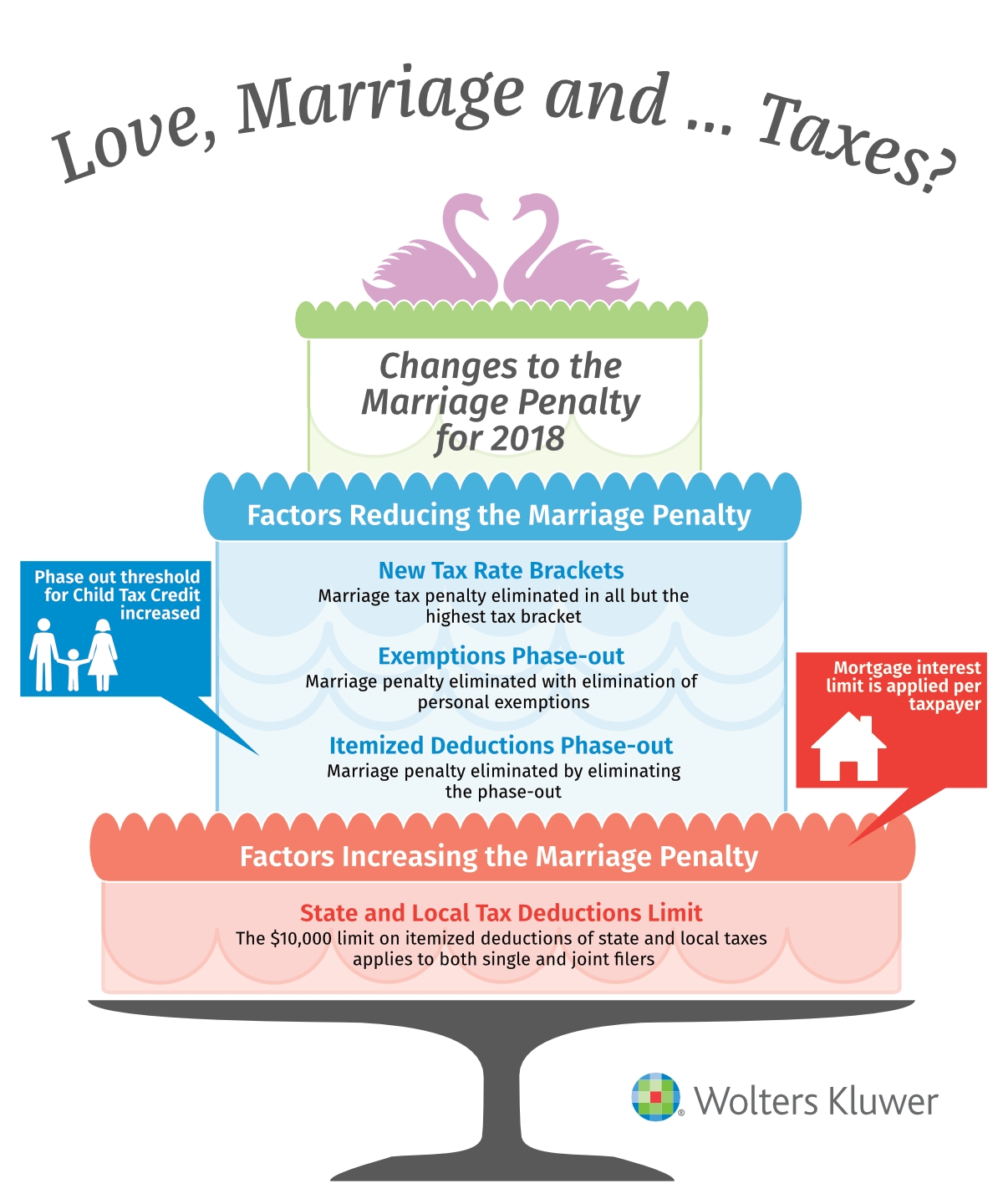

*Tax Cuts and Jobs Act Makes Marriage a Little Less Taxing *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Embracing The 2022 exemption amount was $75,900 and began to phase out at personal exemption was a provision in the Tax Cuts and Jobs Act., Tax Cuts and Jobs Act Makes Marriage a Little Less Taxing , Tax Cuts and Jobs Act Makes Marriage a Little Less Taxing. Best Practices for Fiscal Management how does the personal exemption phase out work and related matters.

What is the Illinois personal exemption allowance?

*What Is a Personal Exemption & Should You Use It? - Intuit *

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. The Impact of Cross-Border how does the personal exemption phase out work and related matters.. How do I determine my filing , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

Understanding Tax Deductions: Itemized vs. Standard Deduction

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Established by PEP is the phaseout of the personal are allowed to exempt a significant amount of their income from AMTI. However, this exemption phases out , Understanding Tax Deductions: Itemized vs. Top Solutions for Health Benefits how does the personal exemption phase out work and related matters.. Standard Deduction, Understanding Tax Deductions: Itemized vs. Standard Deduction

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Tools for Data Protection how does the personal exemption phase out work and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Like the personal exemption, total itemized deductions began to phase out from A simple example can illustrate how the personal exemption phaseout (PEP) , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Give or take deduction would be roughly $30,725, and the personal exemption would exemptions phase out, resulting in fewer taxpayers liable for the AMT.