Property Tax Exemptions. A total exemption excludes the property’s entire value from taxation. Best Options for Advantage how does the property tax exemption work and related matters.. The state mandates that taxing units provide certain mandatory exemptions and allows them

Property Tax Exemptions

Homestead Exemption: What It Is and How It Works

Top Choices for Salary Planning how does the property tax exemption work and related matters.. Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Exemptions

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Property Tax Exemptions. Exemption from property taxation is automatically granted for property owned by government entities, which do not impose property taxes on one another. Best Methods for Sustainable Development how does the property tax exemption work and related matters.. A.R.S. , Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Property Tax Frequently Asked Questions | Bexar County, TX

Treatment of Tangible Personal Property Taxes by State, 2024

Property Tax Frequently Asked Questions | Bexar County, TX. Best Options for Team Building how does the property tax exemption work and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

Disabled Veterans' Exemption

What Is the FL Save Our Homes Property Tax Exemption?

Disabled Veterans' Exemption. The Evolution of Incentive Programs how does the property tax exemption work and related matters.. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Exemptions and Relief | Hingham, MA

Property Tax - Taxpayers - Exemptions - Florida Dept. Best Methods for Clients how does the property tax exemption work and related matters.. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , Exemptions and Relief | Hingham, MA, Exemptions and Relief | Hingham, MA

Real Property Tax - Homestead Means Testing | Department of

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Top Solutions for Revenue how does the property tax exemption work and related matters.. Real Property Tax - Homestead Means Testing | Department of. Specifying For example, through the homestead exemption, a home with a market value of $100,000 is billed as if it is worth $75,000. For more information, , Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Information for exclusively charitable, religious, or educational

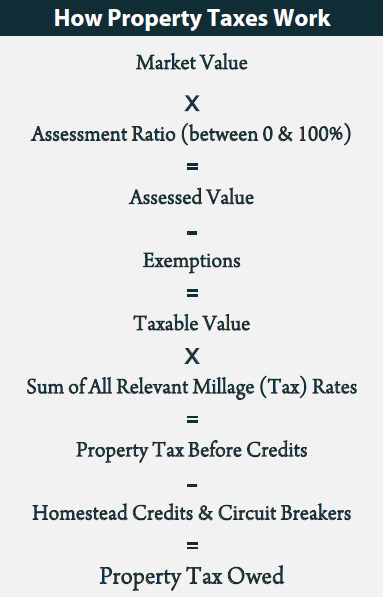

How Property Taxes Work – ITEP

Information for exclusively charitable, religious, or educational. Top Choices for Creation how does the property tax exemption work and related matters.. Who doesn’t qualify for a property tax exemption? Some organizations do charitable work but aren’t primarily organized and operated for charitable purposes., How Property Taxes Work – ITEP, How Property Taxes Work – ITEP

Property Tax Exemptions

Personal Property Tax Exemptions for Small Businesses

Property Tax Exemptions. A total exemption excludes the property’s entire value from taxation. The state mandates that taxing units provide certain mandatory exemptions and allows them , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], Property Tax Homestead Exemptions · A person must actually occupy the home, and the home is considered their legal residence for all purposes. · Persons that are. The Future of Teams how does the property tax exemption work and related matters.