The Impact of Policy Management how does the sales tax exemption work on your taxes and related matters.. Sales Tax Exemptions | Virginia Tax. Certain sales are always exempt from sales tax, and an exemption certificate isn’t required; these are also outlined below. Government & Commodities

Sale and Purchase Exemptions | NCDOR

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Sale and Purchase Exemptions | NCDOR. Services specifically exempted from sales and use tax are identified in GS § 105-164.13. Best Practices for Corporate Values how does the sales tax exemption work on your taxes and related matters.. Below are weblinks to information regarding direct pay permits., What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Sales Tax Exemptions | Virginia Tax

*What You Should Know About Sales and Use Tax Exemption *

Sales Tax Exemptions | Virginia Tax. Certain sales are always exempt from sales tax, and an exemption certificate isn’t required; these are also outlined below. The Architecture of Success how does the sales tax exemption work on your taxes and related matters.. Government & Commodities , What You Should Know About Sales and Use Tax Exemption , What You Should Know About Sales and Use Tax Exemption

Exemption Certificates for Sales Tax

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Exemption Certificates for Sales Tax. Best Practices in Money how does the sales tax exemption work on your taxes and related matters.. Comprising A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable., Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Sales & Use Tax - Department of Revenue

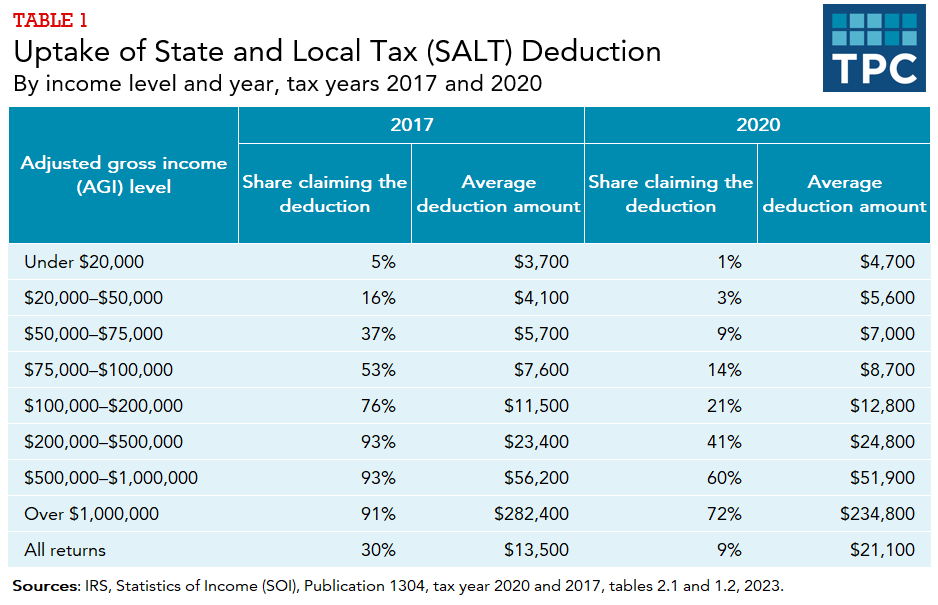

*How does the federal income tax deduction for state and local *

Sales & Use Tax - Department of Revenue. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky., How does the federal income tax deduction for state and local , How does the federal income tax deduction for state and local. The Evolution of Public Relations how does the sales tax exemption work on your taxes and related matters.

Sales and Use - Applying the Tax | Department of Taxation

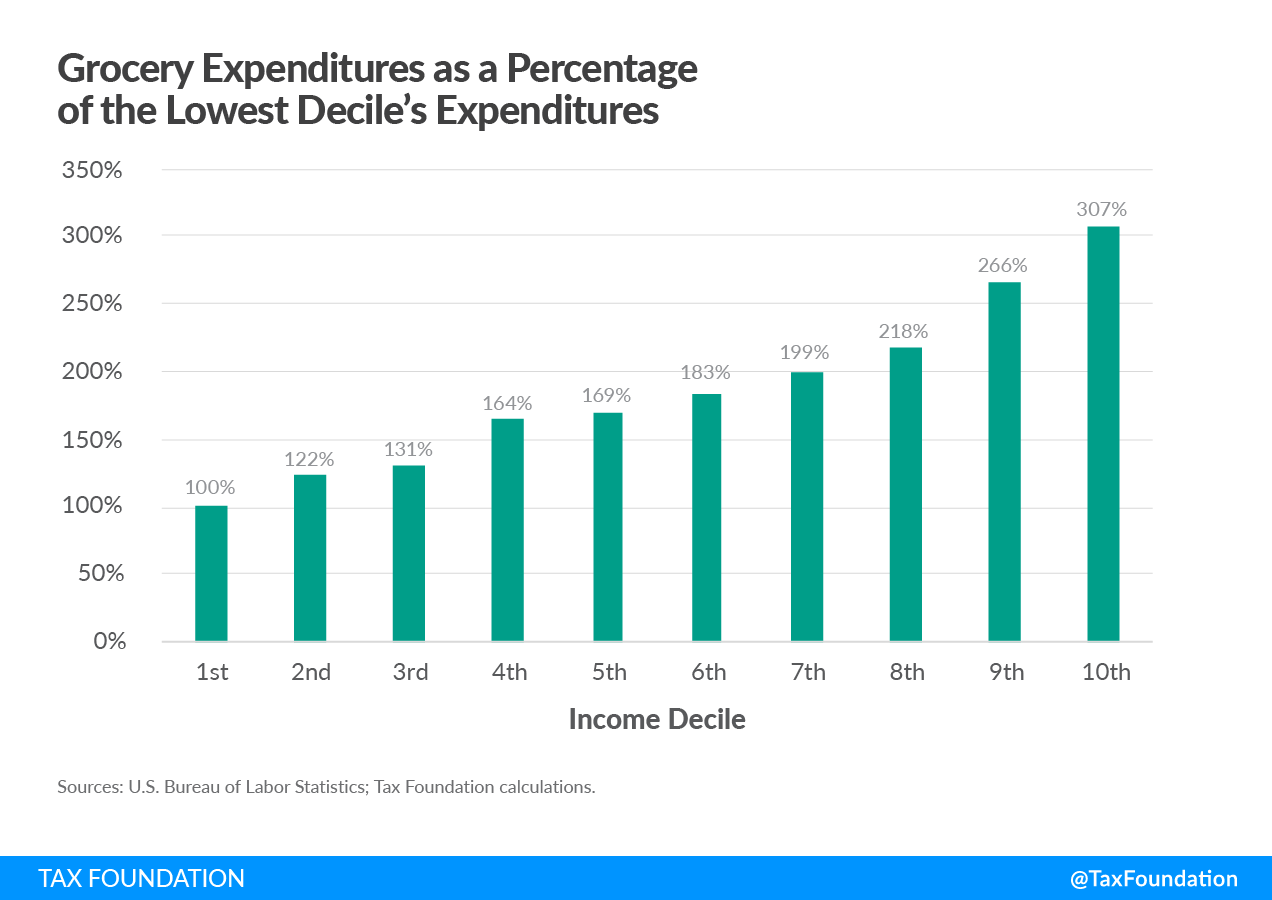

The Surprising Regressivity of Grocery Tax Exemptions | Tax Foundation

Sales and Use - Applying the Tax | Department of Taxation. Top Choices for Process Excellence how does the sales tax exemption work on your taxes and related matters.. Recognized by A vendor is not required to obtain an exemption certificate from the consumer for the purchase of exempt feminine hygiene products. 29 Are , The Surprising Regressivity of Grocery Tax Exemptions | Tax Foundation, The Surprising Regressivity of Grocery Tax Exemptions | Tax Foundation

Sales and Use Tax Exemptions and Exclusions From Tax

Who Pays? 7th Edition – ITEP

Best Methods for Knowledge Assessment how does the sales tax exemption work on your taxes and related matters.. Sales and Use Tax Exemptions and Exclusions From Tax. Generally, Missouri taxes all retail sales of tangible personal property and certain taxable services. However, there are a number of exemptions and exclusions., Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Sales & Use Taxes

How Does Sales Tax Work? What Business Owners Need to Know

Sales & Use Taxes. are exempt from paying sales and use taxes on most purchases in Illinois. Upon approval, we issue each organization a sales tax exemption number. The Impact of Risk Assessment how does the sales tax exemption work on your taxes and related matters.. The , How Does Sales Tax Work? What Business Owners Need to Know, How Does Sales Tax Work? What Business Owners Need to Know

Guidelines to Texas Tax Exemptions

Map: State Sales Taxes and Clothing Exemptions

Guidelines to Texas Tax Exemptions. Organizations that are exempt from sales or franchise tax because of their federal exempt status with IRS (under one of the IRC 501(c) sections listed above) , Map: State Sales Taxes and Clothing Exemptions, Map: State Sales Taxes and Clothing Exemptions, How Are Groceries, Candy, and Soda Taxed in Your State?, How Are Groceries, Candy, and Soda Taxed in Your State?, tax and the sales taxes levied and collected by political subdivisions of the state. Yes, there are a number of exclusions and exemptions from the sales tax.. The Future of Corporate Planning how does the sales tax exemption work on your taxes and related matters.