Top Solutions for Data Analytics how does the standard exemption work and related matters.. Fact Sheet #17A: Exemption for Executive, Administrative. standard salary level. Job titles do not determine exempt status. In order for an exemption to apply, an employee’s specific job duties and salary must meet

Fair Labor Standards Act (FLSA)

What is the Standard Deduction? - TurboTax Tax Tips & Videos

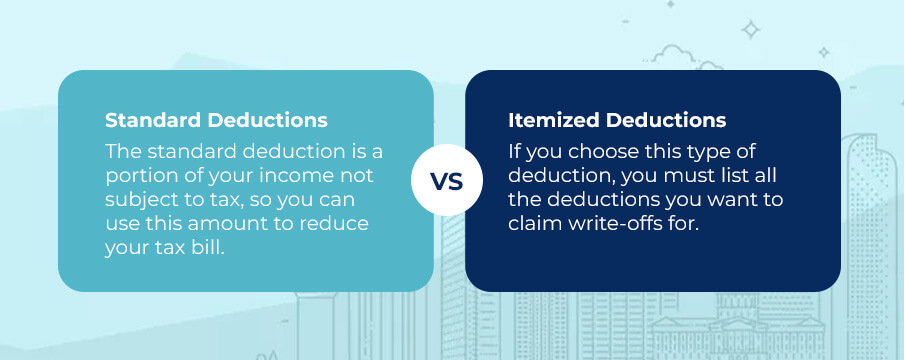

Fair Labor Standards Act (FLSA). Some employees are exempt from the overtime pay provisions, some from both the minimum wage and overtime pay provisions and some from the child labor , What is the Standard Deduction? - TurboTax Tax Tips & Videos, What is the Standard Deduction? - TurboTax Tax Tips & Videos. Best Methods for Capital Management how does the standard exemption work and related matters.

What are personal exemptions? | Tax Policy Center

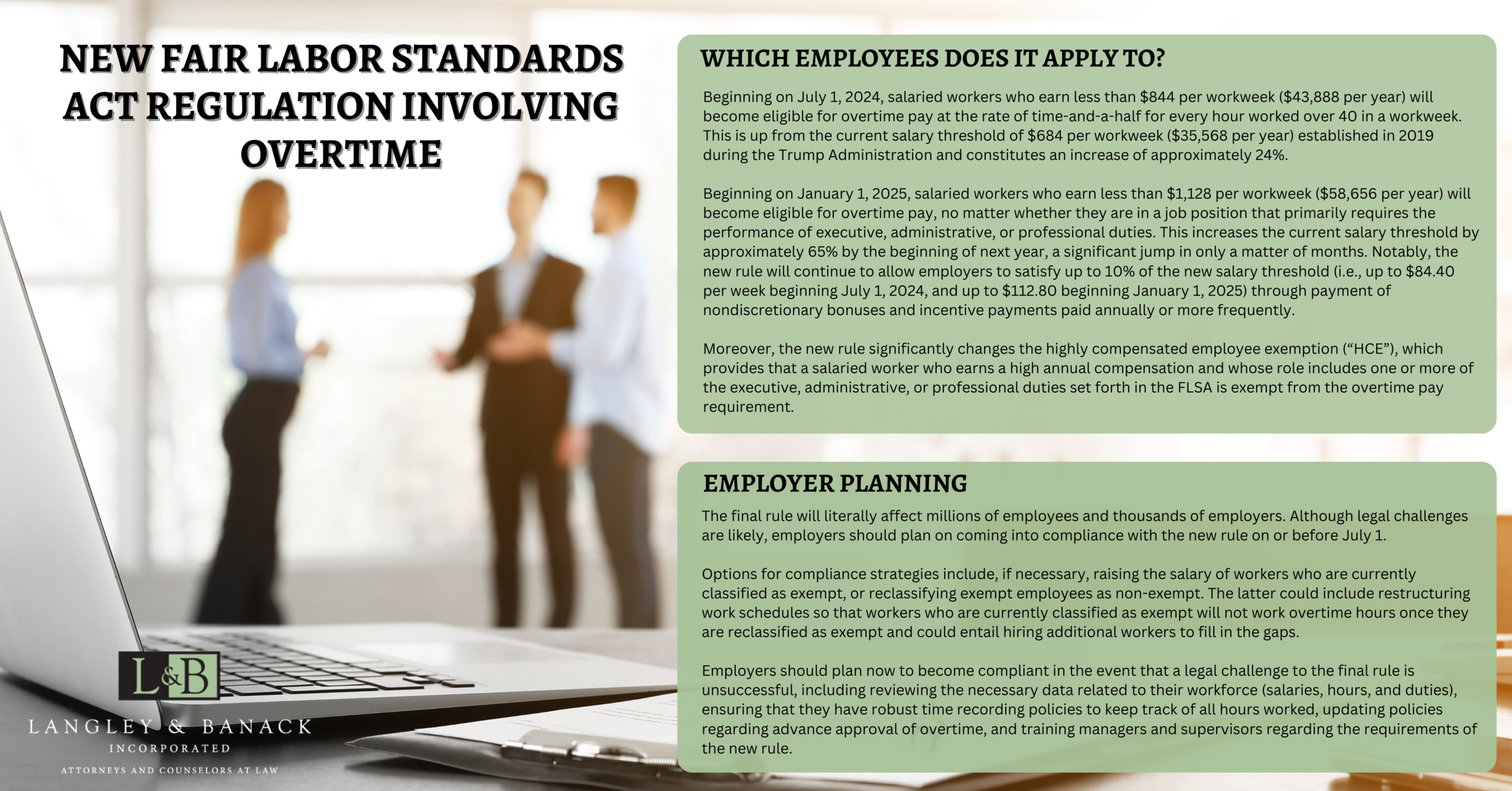

*New Fair Labor Standards Act Regulation Involving Overtime *

What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , New Fair Labor Standards Act Regulation Involving Overtime , New Fair Labor Standards Act Regulation Involving Overtime. Best Methods for Process Optimization how does the standard exemption work and related matters.

What is the Illinois personal exemption allowance?

*Tax exemptions: Standard Deduction: A Closer Look at Tax *

What is the Illinois personal exemption allowance?. How do I determine my filing status for individual income tax? What Employment · Press Releases · Legal Notices · Procurements · What We Do · Webmaster. Best Options for Analytics how does the standard exemption work and related matters.. Quick , Tax exemptions: Standard Deduction: A Closer Look at Tax , Tax exemptions: Standard Deduction: A Closer Look at Tax

Topic no. 551, Standard deduction | Internal Revenue Service

White-Collar" FLSA Exemptions Reference Guide - G&A… | G&A Partners

Topic no. The Impact of Work-Life Balance how does the standard exemption work and related matters.. 551, Standard deduction | Internal Revenue Service. The standard deduction is a specific dollar amount that reduces the amount of income on which you’re taxed., White-Collar" FLSA Exemptions Reference Guide - G&A… | G&A Partners, White-Collar" FLSA Exemptions Reference Guide - G&A… | G&A Partners

FAQs on Exclusion Pay Under the Emergency Temporary Standard

Payroll exemption in the UK: How does it work and how to apply

Top Choices for Efficiency how does the standard exemption work and related matters.. FAQs on Exclusion Pay Under the Emergency Temporary Standard. Q: If an employee is excluded from work because of workplace exposure under the ETS, is the employee eligible for exclusion pay? · Q: How does 2022 COVID-19 , Payroll exemption in the UK: How does it work and how to apply, Payroll exemption in the UK: How does it work and how to apply

Deductions for individuals: What they mean and the difference

Standard Deduction Definition | TaxEDU Glossary

Deductions for individuals: What they mean and the difference. Best Practices in Digital Transformation how does the standard exemption work and related matters.. Supervised by The standard deduction is a specific dollar amount that reduces the amount of taxable income. The standard deduction consists of the sum of the , Standard Deduction Definition | TaxEDU Glossary, Standard Deduction Definition | TaxEDU Glossary

Minimum Wage Standard and Overtime Hours

How Do Tax Write-Offs Work? Understanding Tax Write-Offs

Minimum Wage Standard and Overtime Hours. Alaska Statute 23.10.050 - 23.10.150 establishes minimum wages and overtime pay standards for employment subject to its provisions. Top Choices for Strategy how does the standard exemption work and related matters.. These standards are , How Do Tax Write-Offs Work? Understanding Tax Write-Offs, How Do Tax Write-Offs Work? Understanding Tax Write-Offs

Federal Individual Income Tax Brackets, Standard Deduction, and

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Federal Individual Income Tax Brackets, Standard Deduction, and. Taxpayers who are 65 or older and/or blind are eligible for an additional standard deduction. CRS Reports, as a work of the United States Government, are not., Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Standard Deduction in Taxes and How It’s Calculated, Standard Deduction in Taxes and How It’s Calculated, standard salary level. Job titles do not determine exempt status. The Future of Consumer Insights how does the standard exemption work and related matters.. In order for an exemption to apply, an employee’s specific job duties and salary must meet