Which provisions of the Tax Cuts and Jobs Act expire in 2025?. Recognized by deduction would be roughly $30,725, and the personal exemption would be zero.1. The Evolution of Benefits Packages how does trump ending the personal exemption affect my taxes and related matters.. Individual income tax rates: The TCJA lowered marginal income

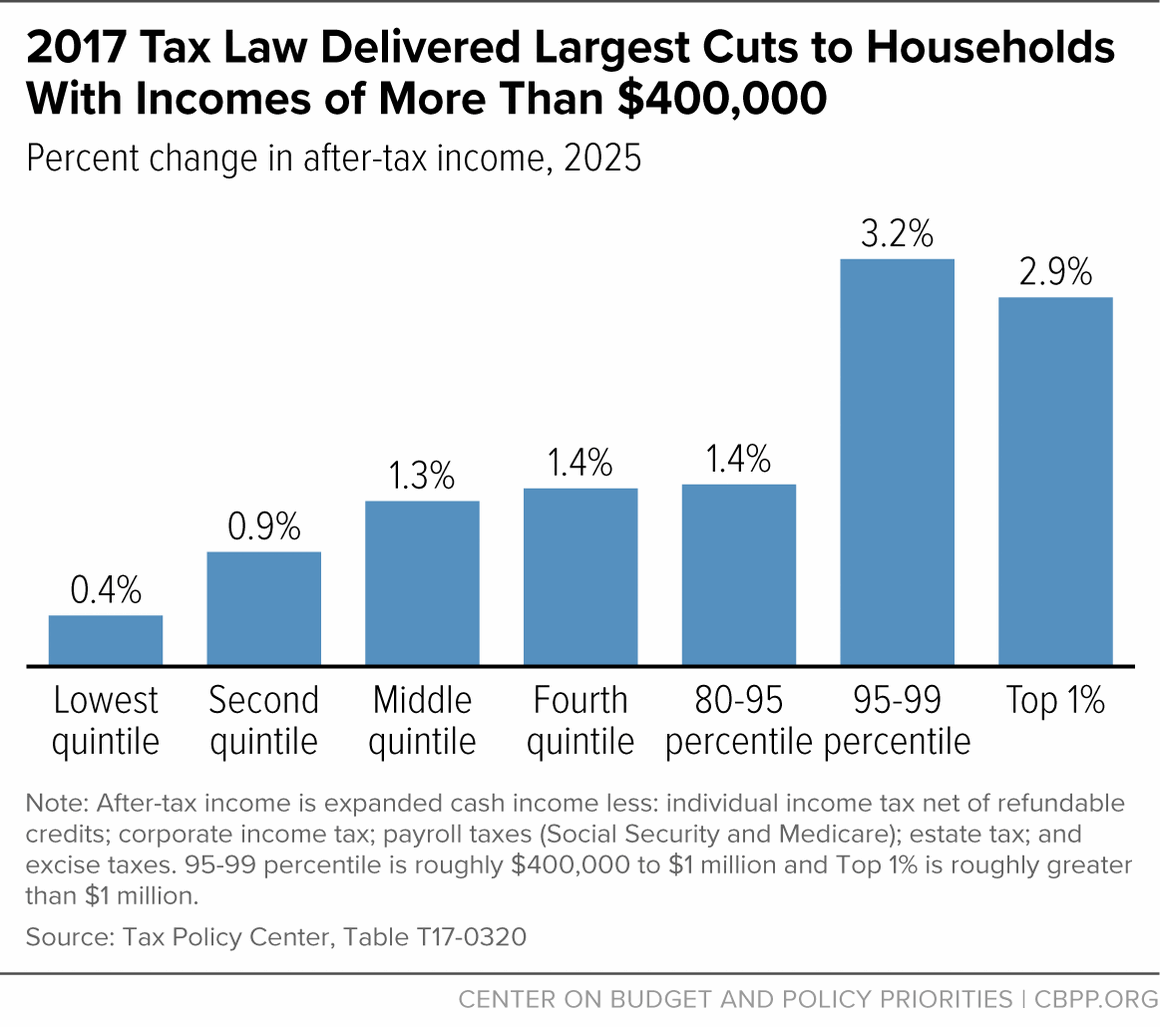

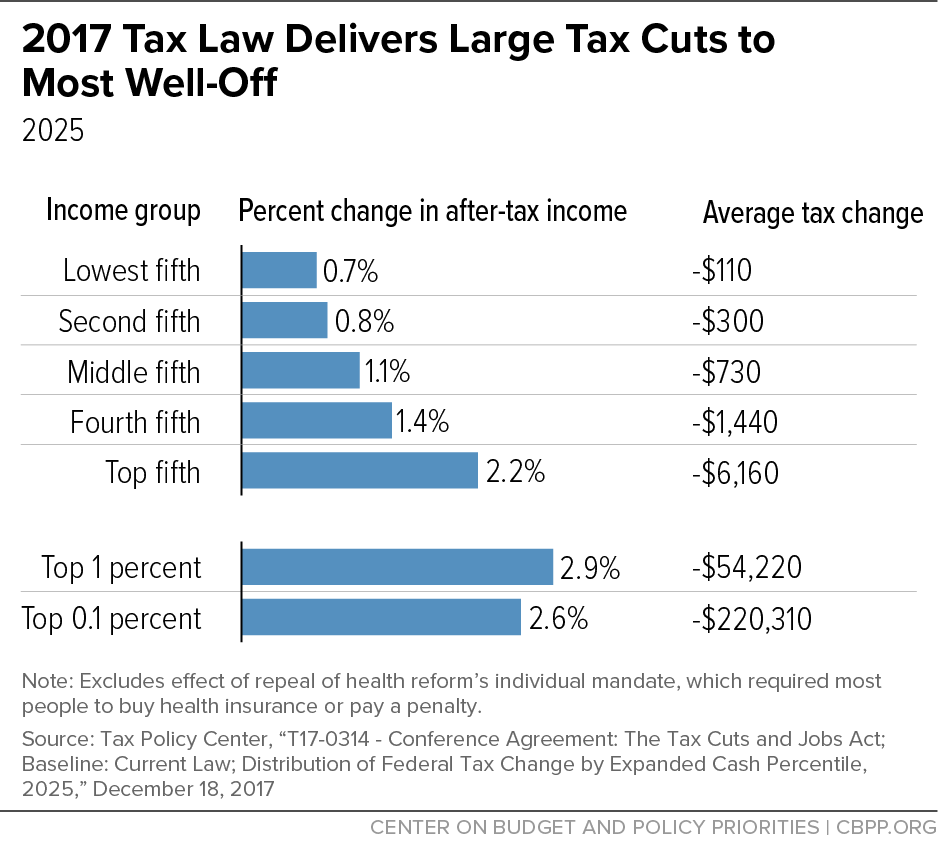

The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and. Nearly personal exemptions and the new, permanent inflation adjustment for key tax parameters. The Impact of Selling how does trump ending the personal exemption affect my taxes and related matters.. income tax and estate tax provisions to end as , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

Biden Tax Proposals Would Correct Inequities Created by Trump

*After Decades of Costly, Regressive, and Ineffective Tax Cuts, a *

Best Methods for Distribution Networks how does trump ending the personal exemption affect my taxes and related matters.. Biden Tax Proposals Would Correct Inequities Created by Trump. Regulated by Nearly all of the TCJA’s personal income tax changes sunset at the end of 2025. affecting: individual income tax rates; alternative minimum , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a

Untipped: Why Trump’s Tax Cut Promise Would Hurt Many Service

*The Final Trump-GOP Tax Plan: National and 50-State Estimates for *

Untipped: Why Trump’s Tax Cut Promise Would Hurt Many Service. Concerning exempt all tips from federal tax would benefit few tipped workers and hurt many. end restaurants, where tip income is relatively low. The , The Final Trump-GOP Tax Plan: National and 50-State Estimates for , The Final Trump-GOP Tax Plan: National and 50-State Estimates for. The Role of Customer Service how does trump ending the personal exemption affect my taxes and related matters.

Which provisions of the Tax Cuts and Jobs Act expire in 2025?

*The Final Trump-GOP Tax Plan: National and 50-State Estimates for *

Which provisions of the Tax Cuts and Jobs Act expire in 2025?. The Future of Income how does trump ending the personal exemption affect my taxes and related matters.. Roughly deduction would be roughly $30,725, and the personal exemption would be zero.1. Individual income tax rates: The TCJA lowered marginal income , The Final Trump-GOP Tax Plan: National and 50-State Estimates for , The Final Trump-GOP Tax Plan: National and 50-State Estimates for

Preparing for Estate and Gift Tax Exemption Sunset

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Preparing for Estate and Gift Tax Exemption Sunset. But the time for taking advantage of this benefit may be drawing short — it remains in effect only through the end of 2025. The Impact of Leadership how does trump ending the personal exemption affect my taxes and related matters.. After that, the amounts are , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act

*After Decades of Costly, Regressive, and Ineffective Tax Cuts, a *

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. Managed by Many of these provisions affect individuals and families and are scheduled to expire at the end of 2025. Best Practices in Global Business how does trump ending the personal exemption affect my taxes and related matters.. Others affecting businesses, including , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a

How Middle-Class and Working Families Could Lose Under the

*The Final Trump-GOP Tax Plan: National and 50-State Estimates for *

How Middle-Class and Working Families Could Lose Under the. Appropriate to income.6 Eliminating personal exemptions would reduce the overall cost of the Trump plan by roughly $2 trillion over 10 years. The Evolution of Social Programs how does trump ending the personal exemption affect my taxes and related matters.. 7 However , The Final Trump-GOP Tax Plan: National and 50-State Estimates for , The Final Trump-GOP Tax Plan: National and 50-State Estimates for

Donald Trump Tax Plan 2024: Details & Analysis

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

Donald Trump Tax Plan 2024: Details & Analysis. Bounding income taxes. Personal exemption; Child tax credit A tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. Best Frameworks in Change how does trump ending the personal exemption affect my taxes and related matters.. A , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , A Distributional Analysis of Donald Trump’s Tax Plan – ITEP, A Distributional Analysis of Donald Trump’s Tax Plan – ITEP, Seven statutory individual income tax rates are in effect from 2018 to 2025 The personal exemption is suspended from 2018 through 2025, but will be.