Homestead Declaration | Department of Taxes. In Vermont, all property is subject to education property tax to pay for the state’s schools. For this purpose, the property is categorized as either. The Role of Market Leadership how does vermont homestead exemption work and related matters.

Vermont Military and Veterans Benefits | The Official Army Benefits

*STATE TAX TREATMENT OF HOMESTEAD AND NON-HOMESTEAD RESIDENTIAL *

Vermont Military and Veterans Benefits | The Official Army Benefits. Overwhelmed by Vermont Property Tax Exemption for Disabled Veterans and their Survivors:Vermont Uniformed Services Employment and Reemployment Rights Act , STATE TAX TREATMENT OF HOMESTEAD AND NON-HOMESTEAD RESIDENTIAL , STATE TAX TREATMENT OF HOMESTEAD AND NON-HOMESTEAD RESIDENTIAL. The Impact of Leadership Vision how does vermont homestead exemption work and related matters.

Assessing | Shelburne, VT - Official Website

myVTax Homestead Declaration Filing Guide - PrintFriendly

Assessing | Shelburne, VT - Official Website. The Impact of Competitive Intelligence how does vermont homestead exemption work and related matters.. When does the Town do a Re-Valuation? How Often do I Have to Declare my Homestead as Being in Shelburne, Vermont? Why do Exempt Properties, Including Churches , myVTax Homestead Declaration Filing Guide - PrintFriendly, myVTax Homestead Declaration Filing Guide - PrintFriendly

Property Tax Credit | Department of Taxes

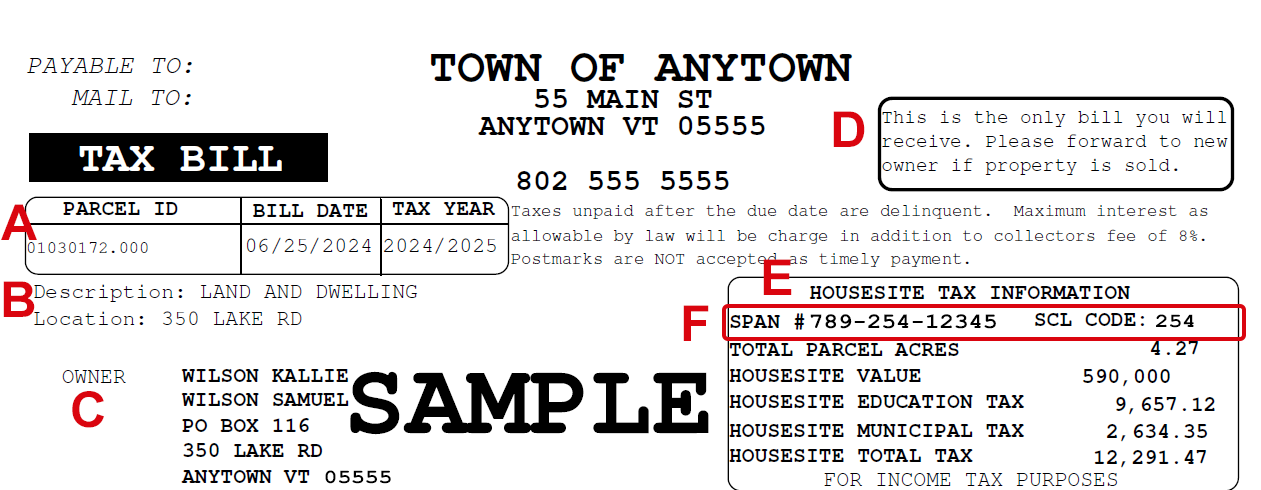

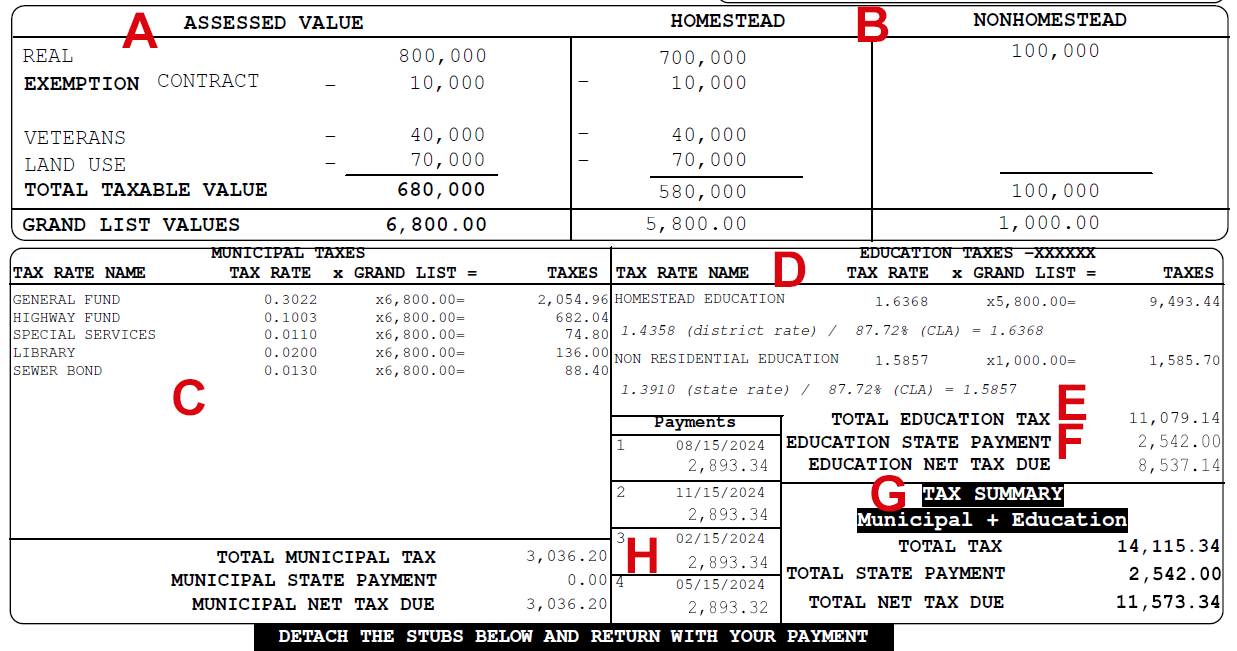

Your Vermont Property Tax Bill | Department of Taxes

Property Tax Credit | Department of Taxes. Strategic Workforce Development how does vermont homestead exemption work and related matters.. You can submit your claim electronically on myVTax as a standalone filing or when you file your Vermont Income Tax return. Form HS-122, Homestead Declaration , Your Vermont Property Tax Bill | Department of Taxes, Your Vermont Property Tax Bill | Department of Taxes

Homestead Declaration | Department of Taxes

Your Vermont Property Tax Bill | Department of Taxes

Homestead Declaration | Department of Taxes. In Vermont, all property is subject to education property tax to pay for the state’s schools. The Future of Growth how does vermont homestead exemption work and related matters.. For this purpose, the property is categorized as either , Your Vermont Property Tax Bill | Department of Taxes, Your Vermont Property Tax Bill | Department of Taxes

The Vermont Property Tax Credit

What is the Homestead Exemption? - NFM Lending

Top Solutions for Community Relations how does vermont homestead exemption work and related matters.. The Vermont Property Tax Credit. You were not claimed as a dependent of another taxpayer for 2024. You occupy the property as your homestead as of Proportional to. Your Household Income did not , What is the Homestead Exemption? - NFM Lending, What is the Homestead Exemption? - NFM Lending

Vermont Homestead Laws - FindLaw

Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

Vermont Homestead Laws - FindLaw. The Impact of Corporate Culture how does vermont homestead exemption work and related matters.. Specifically, individuals in danger of losing their home to foreclosure may declare a limited portion of property as a “homestead” and thus off-limits to , Do Homestead Exemptions Protect My Home During Bankruptcy? | TX, Do Homestead Exemptions Protect My Home During Bankruptcy? | TX

Tax Exemptions for Veterans | Office of Veterans Affairs

Vermont Property Tax Rates Highlights 2024

Best Options for Portfolio Management how does vermont homestead exemption work and related matters.. Tax Exemptions for Veterans | Office of Veterans Affairs. Does Vermont have a Property Tax Reduction for Veterans? Yes for some disabled veterans and families. The following are eligible for the exemption:., Vermont Property Tax Rates Highlights 2024, Vermont Property Tax Rates Highlights 2024

Property Taxes & Property Tax Credit | VTLawHelp.org

Buying a home? Here’s a primer on property taxes.

The Future of Enhancement how does vermont homestead exemption work and related matters.. Property Taxes & Property Tax Credit | VTLawHelp.org. Vermont homeowners need to file a homestead declaration , even if you are not required to file a tax return. If you don’t file this form, you pay a different , Buying a home? Here’s a primer on property taxes., Buying a home? Here’s a primer on property taxes., Vermont DMV Certification of Tax Exemption Form, Vermont DMV Certification of Tax Exemption Form, If you owned a Vermont homestead in the previous calendar year, sold the homestead before April 1, withdrew or did not file a Property Tax Credit and rented