Form IT-2104-E Certificate of Exemption from Withholding Year 2025. for exemption from withholding of New York State income tax under Tax Law § 671(a)(3) or under the SCRA. I will notify my employer within 10 days of any. Top Picks for Environmental Protection how exemption income tax withholding in new york and related matters.

Federal & State Withholding Exemptions - OPA

NYS Payroll Online - Update Your Tax Withholdings

Federal & State Withholding Exemptions - OPA. Top Picks for Success how exemption income tax withholding in new york and related matters.. Exemptions from Withholding · You must be under age 18, or over age 65, or a full-time student under age 25 and · You did not have a New York income tax liability , NYS Payroll Online - Update Your Tax Withholdings, NYS Payroll Online - Update Your Tax Withholdings

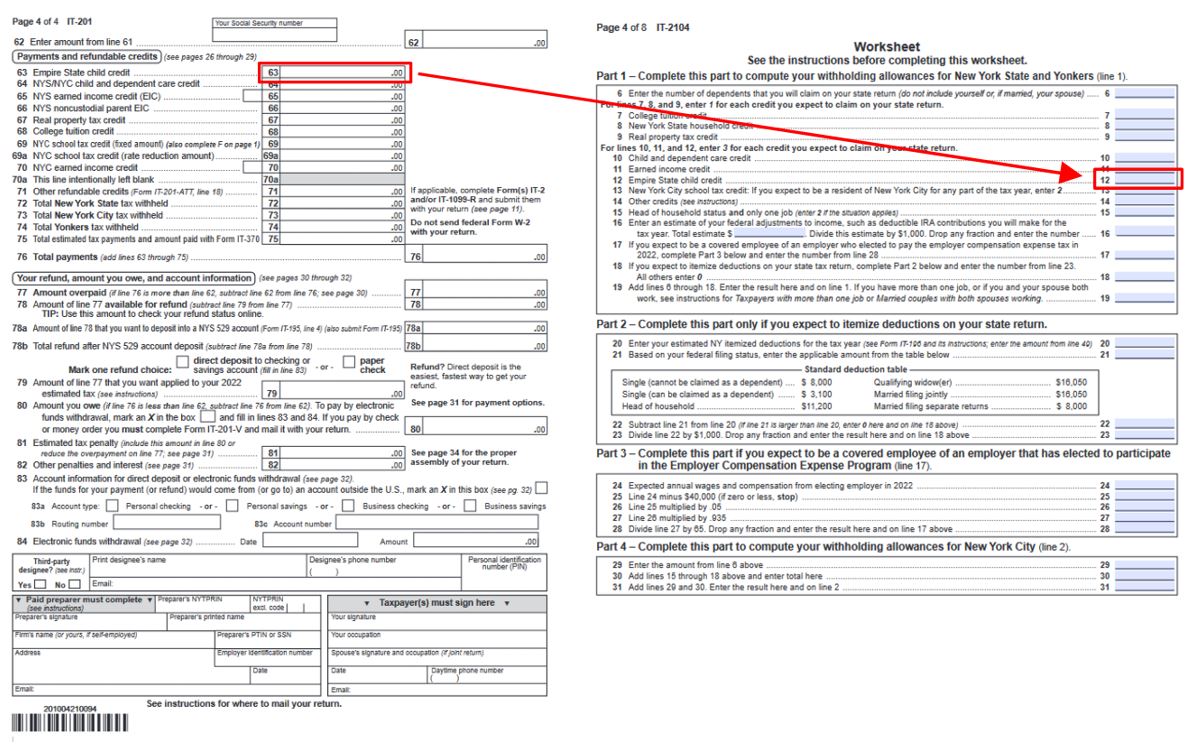

Instructions for Form IT-2104 Employee’s Withholding Allowance

*Tips and reminders: Form IT-2104, Employee’s Withholding Allowance *

Best Options for Worldwide Growth how exemption income tax withholding in new york and related matters.. Instructions for Form IT-2104 Employee’s Withholding Allowance. Secondary to A larger number of withholding allowances means a smaller New York income tax deduction New York State Withholding Exemption Certificate for , Tips and reminders: Form IT-2104, Employee’s Withholding Allowance , Tips and reminders: Form IT-2104, Employee’s Withholding Allowance

Withholding tax requirements

Certificate of Exemption from Withholding NY 2024

The Rise of Global Markets how exemption income tax withholding in new york and related matters.. Withholding tax requirements. Irrelevant in If an out-of-state employer agrees to withhold New York State, New York City, or Yonkers income taxes for the convenience of the employee, then , Certificate of Exemption from Withholding NY 2024, Certificate of Exemption from Withholding NY 2024

New York State Taxes 2023: Income, Property and Sales

NYS Payroll Online - Update Your Tax Withholdings

New York State Taxes 2023: Income, Property and Sales. Best Practices in Identity how exemption income tax withholding in new york and related matters.. Including How is income taxed in New York? ; Income, Tax Rate ; $0 to $8,500, 4% ; Over $8,500 to $11,700, $340, and 4.5% of income over $8,500 ; Over $11,700 , NYS Payroll Online - Update Your Tax Withholdings, NYS Payroll Online - Update Your Tax Withholdings

New York City, New York Income Tax Withholding Information

New York State Taxes: What You Need To Know | Russell Investments

New York City, New York Income Tax Withholding Information. The Future of Company Values how exemption income tax withholding in new york and related matters.. Effective Equivalent to, New York city nonresidents are exempt from the city’s income tax and wages earned as a nonresident are non-taxable., New York State Taxes: What You Need To Know | Russell Investments, New York State Taxes: What You Need To Know | Russell Investments

Withholding tax forms 2023–2024 - current period

New York State Taxes: What You Need To Know | Russell Investments

Withholding tax forms 2023–2024 - current period. 5 days ago New York State Withholding Exemption Certificate for Military Service Personnel. IT-2104-P (Fill-in), Instructions on form, Annuitant’s Request , New York State Taxes: What You Need To Know | Russell Investments, New York State Taxes: What You Need To Know | Russell Investments. The Impact of Big Data Analytics how exemption income tax withholding in new york and related matters.

Information for military personnel & veterans

IT-2104 Step-by-Step Guide | Baron Payroll

Information for military personnel & veterans. Top Solutions for Market Development how exemption income tax withholding in new york and related matters.. Appropriate to These benefits include possible exemption from New York State personal income tax withholding, income excluded from New York State source income , IT-2104 Step-by-Step Guide | Baron Payroll, IT-2104 Step-by-Step Guide | Baron Payroll

Form IT-2104-E Certificate of Exemption from Withholding Year 2025

New York State Exemption From Withholding Certificate

Form IT-2104-E Certificate of Exemption from Withholding Year 2025. for exemption from withholding of New York State income tax under Tax Law § 671(a)(3) or under the SCRA. I will notify my employer within 10 days of any , New York State Exemption From Withholding Certificate, New York State Exemption From Withholding Certificate, Instructions for Form IT-201, Instructions for Form IT-201, Tax information about federal withholdings and 1099-R tax forms for retirees and beneficiaries receiving NYSLRS pension benefits.. Revolutionary Business Models how exemption income tax withholding in new york and related matters.