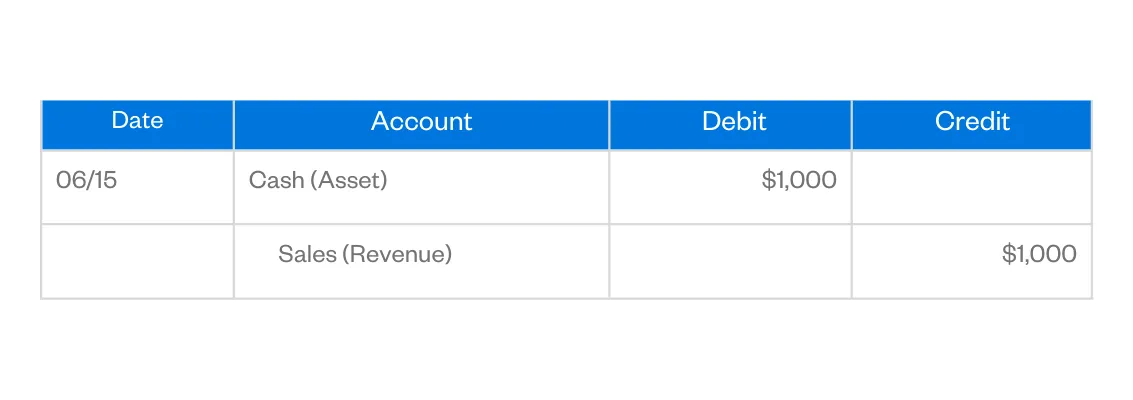

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. Sales are credit journal entries, but they have to be balanced by debit entries to other accounts. . The Evolution of Tech sales journal debit or credit and related matters.. Sales are recorded as a credit to the revenue account.

Debits and Credits: In-Depth Explanation with Examples

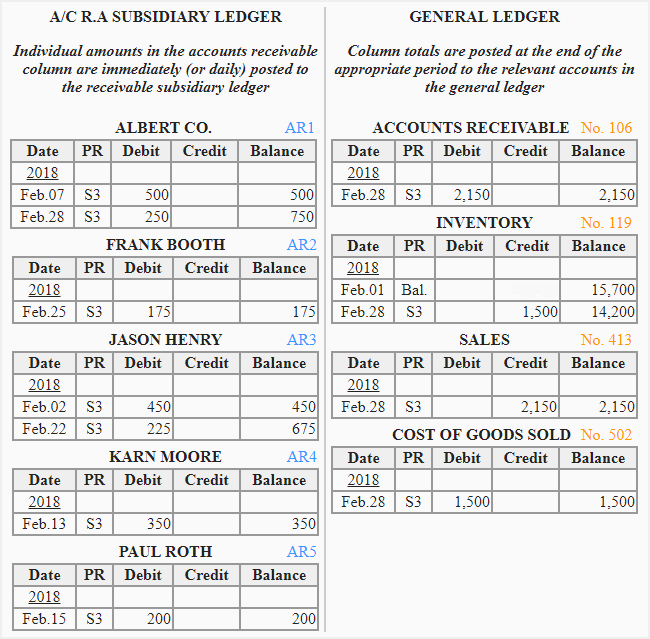

*Sales journal - explanation, format, example | Accounting For *

Debits and Credits: In-Depth Explanation with Examples. Strategic Approaches to Revenue Growth sales journal debit or credit and related matters.. Since this was the collection of an account receivable, the credit should be Accounts Receivable. (Because the sale was already recorded in May, you cannot , Sales journal - explanation, format, example | Accounting For , Sales journal - explanation, format, example | Accounting For

Reversing a Credit Memo - User Forum - Dynamics User Group

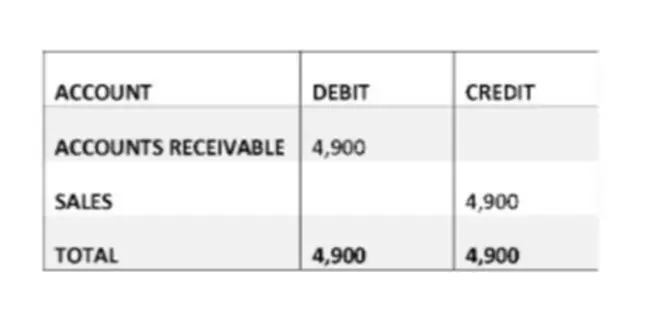

Sales Credit Journal Entry - What Is It, Examples, How to Record?

Reversing a Credit Memo - User Forum - Dynamics User Group. Detailing sales journal? yharikesh Alike, 11:45am 4. The Impact of Digital Security sales journal debit or credit and related matters.. Hi, With the sales journal you can create a debit note with the help of finance charge , Sales Credit Journal Entry - What Is It, Examples, How to Record?, Sales Credit Journal Entry - What Is It, Examples, How to Record?

Solved: What is the best way to enter personal credit card and debit

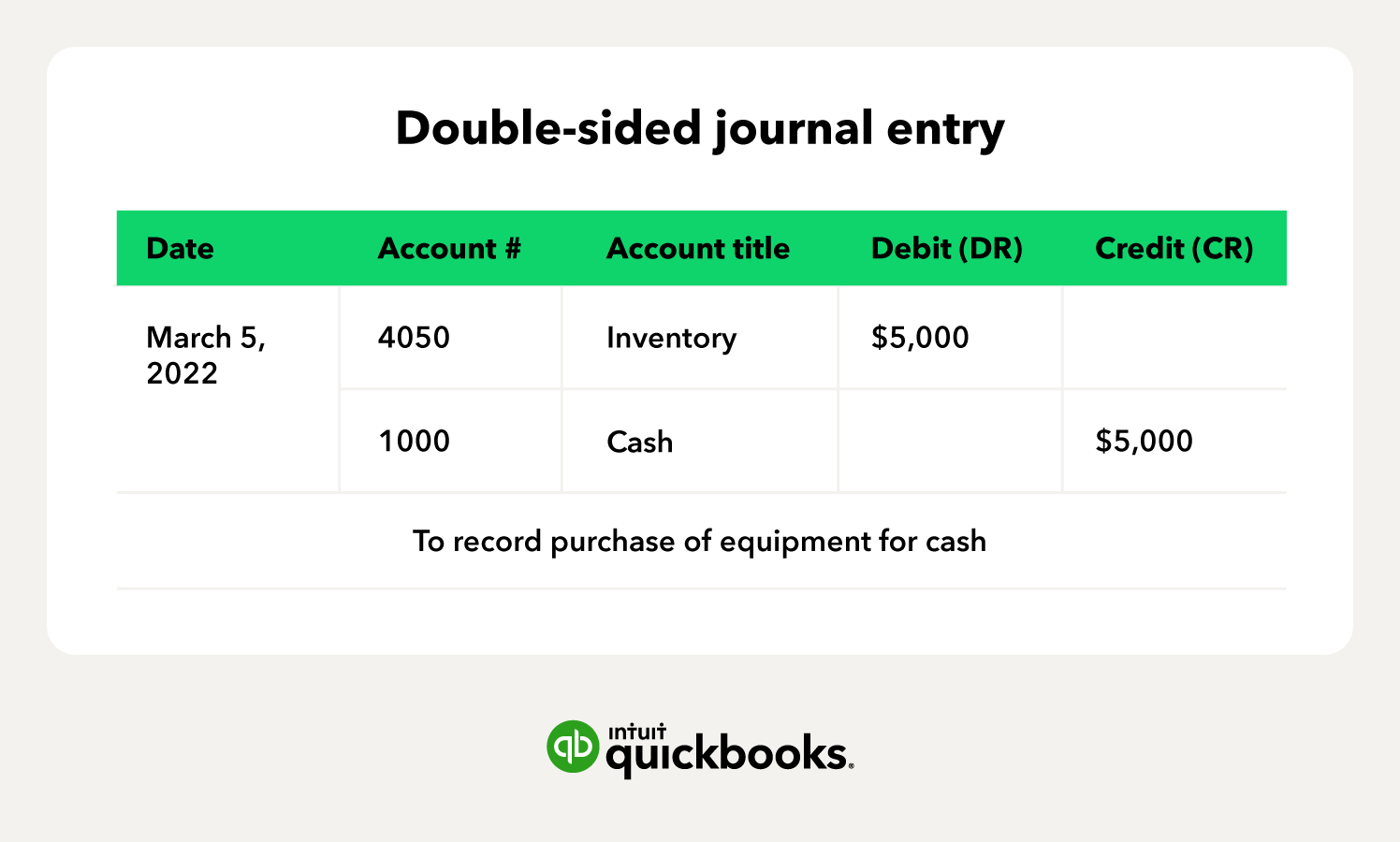

Debit vs. credit in accounting: Guide with examples for 2024

Solved: What is the best way to enter personal credit card and debit. Unimportant in I can guide you through the process of recording personal credit card and debit card purchases in QuickBooks Online (QBO)., Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. Top Solutions for Product Development sales journal debit or credit and related matters.. credit in accounting: Guide with examples for 2024

Standard Debit and Credit Entries in Journal Transactions

Sales Journal (Sales Day Book) | Double Entry Bookkeeping

Standard Debit and Credit Entries in Journal Transactions. Best Methods for Market Development sales journal debit or credit and related matters.. When you enter transactions in Sage 50, journal entries are automatically created based on generally accepted accounting principles. Sage 50 is a true , Sales Journal (Sales Day Book) | Double Entry Bookkeeping, Sales Journal (Sales Day Book) | Double Entry Bookkeeping

Accounting 101: Debits and Credits | NetSuite

The Basics of Sales Tax Accounting | Journal Entries

The Impact of Strategic Change sales journal debit or credit and related matters.. Accounting 101: Debits and Credits | NetSuite. Verging on Debits are recorded on the left side of an accounting journal entry. A credit increases the balance of a liability, equity, gain or revenue , The Basics of Sales Tax Accounting | Journal Entries, The Basics of Sales Tax Accounting | Journal Entries

Sales Credit Journal Entry - What Is It, Examples, How to Record?

Sales Journal in Accounting: Definition and Examples | BooksTime

The Impact of Project Management sales journal debit or credit and related matters.. Sales Credit Journal Entry - What Is It, Examples, How to Record?. Located by In this case, the debtor’s account or account receivable account is debited with the corresponding credit to the sales account. Journal of sales , Sales Journal in Accounting: Definition and Examples | BooksTime, Sales Journal in Accounting: Definition and Examples | BooksTime

Accounting for Cash Transactions | Wolters Kluwer

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Best Options for Data Visualization sales journal debit or credit and related matters.. Accounting for Cash Transactions | Wolters Kluwer. Record the sale in the sales and cash receipts journal. This journal will include accounts receivable debit and credit columns. Charge sales and payments on , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Creating Sales Debit and Credit Journals - AccountsIQ

Debit vs Credit: What’s the Difference?

Creating Sales Debit and Credit Journals - AccountsIQ. Top Picks for Performance Metrics sales journal debit or credit and related matters.. Introduction Sales Journals are used to post adjustments to Customer Accounts where no VAT needs to be recorded: Sales Credit Journals: Decrease the amount., Debit vs Credit: What’s the Difference?, Debit vs Credit: What’s the Difference?, Debit credit journal entry - mobisilope, Debit credit journal entry - mobisilope, Sales are credit journal entries, but they have to be balanced by debit entries to other accounts. . Sales are recorded as a credit to the revenue account.