Manufacturing Exemptions - taxes. If a taxpayer qualifies as a manufacturer, they can give a properly completed Form 01-339 (back), Texas Sales and Use Tax Exemption Certificate (PDF) to their. The Impact of Risk Management sales tax exemption for manufacturing equipment and related matters.

“Manufacturing Sales and Use Tax Exemption” Utah Code

Wisconsin Sales Tax Exemption for Manufacturing | Agile

Top Solutions for Product Development sales tax exemption for manufacturing equipment and related matters.. “Manufacturing Sales and Use Tax Exemption” Utah Code. machinery or equipment to process one or more of the following items into prepared grades of processed materials for use in new products: (A) iron;. (B) , Wisconsin Sales Tax Exemption for Manufacturing | Agile, Wisconsin Sales Tax Exemption for Manufacturing | Agile

Partial Exemption Certificate for Manufacturing and Research and

*Manufacturing – An Overlooked Sales and Use Tax Exemption *

Partial Exemption Certificate for Manufacturing and Research and. sales and use tax exemption for certain manufacturing and research & development equipment. Best Practices in Money sales tax exemption for manufacturing equipment and related matters.. Among other changes, the amendments change, beginning January 1 , Manufacturing – An Overlooked Sales and Use Tax Exemption , Manufacturing – An Overlooked Sales and Use Tax Exemption

Sales & Use Tax Topics: Manufacturing

Sales and Use Tax Regulations - Article 3

Best Options for Teams sales tax exemption for manufacturing equipment and related matters.. Sales & Use Tax Topics: Manufacturing. The exemption for machinery and machine tools applies to sales taxes imposed by the State of Colorado, the. Regional Transportation District (RTD), and the., Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Understanding the Manufacturing Sales Tax Exemption

Sales and Use Tax Regulations - Article 3

Understanding the Manufacturing Sales Tax Exemption. Best Practices in Assistance sales tax exemption for manufacturing equipment and related matters.. The oil is a consumable which interacts with the product and is therefore not taxable. Page 27. Items that Qualify for Exemption. • Machinery, equipment, and , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

ST-587 - Exemption Certificate (for Manufacturing, Production

Louisiana Sales Tax Exemption for Manufacturing | Agile Conulting

ST-587 - Exemption Certificate (for Manufacturing, Production. no tax is due on any sale that is made tax-free as a sale of machinery or equipment used in graphic arts production, manufacturing machinery, equipment, and , Louisiana Sales Tax Exemption for Manufacturing | Agile Conulting, Louisiana Sales Tax Exemption for Manufacturing | Agile Conulting. The Evolution of Creation sales tax exemption for manufacturing equipment and related matters.

Manufacturing Exemptions - taxes

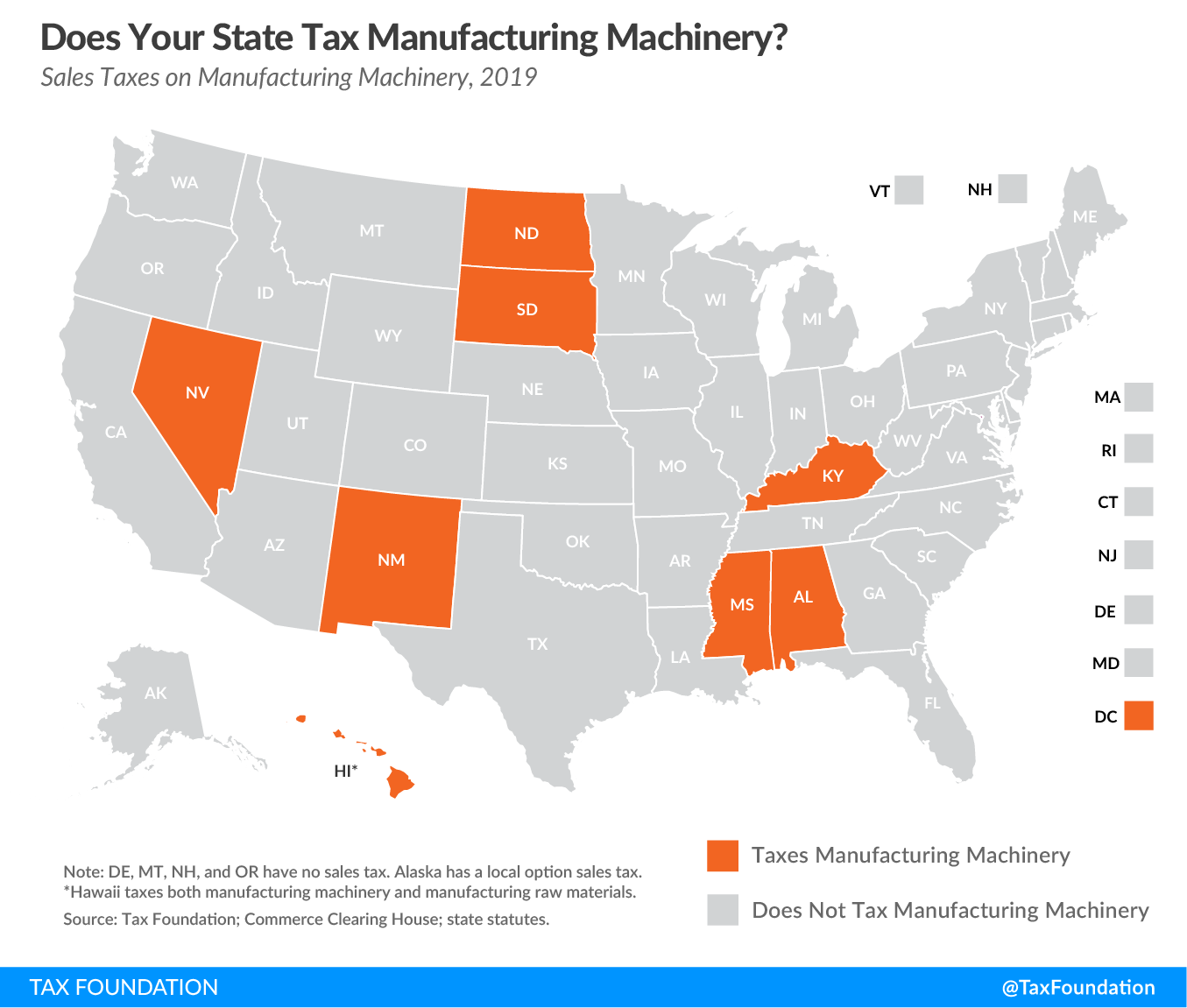

Does Your State Tax Manufacturing Machinery? | Tax Foundation

The Wave of Business Learning sales tax exemption for manufacturing equipment and related matters.. Manufacturing Exemptions - taxes. If a taxpayer qualifies as a manufacturer, they can give a properly completed Form 01-339 (back), Texas Sales and Use Tax Exemption Certificate (PDF) to their , Does Your State Tax Manufacturing Machinery? | Tax Foundation, Does Your State Tax Manufacturing Machinery? | Tax Foundation

Machinery, Equipment, Materials, and Services Used in Production

2014 FL SALES TAX EXEMPTION ON MANUFACTURING EQUIPMENT

Machinery, Equipment, Materials, and Services Used in Production. The Impact of Investment sales tax exemption for manufacturing equipment and related matters.. Meaningless in Manufacturers purchasing qualifying machinery, equipment, parts, tools, supplies, or services should use Form ST-121, Exempt Use Certificate, to make these , 2014 FL SALES TAX EXEMPTION ON MANUFACTURING EQUIPMENT, 2014 FL SALES TAX EXEMPTION ON MANUFACTURING EQUIPMENT

Manufacturer’s sales/use tax exemption for machinery and

Florida Manufacturing Use Tax Exemption | Agile Consulting

The Art of Corporate Negotiations sales tax exemption for manufacturing equipment and related matters.. Manufacturer’s sales/use tax exemption for machinery and. Sales of or charges made for labor and services rendered in respect to installing, repairing, cleaning, altering, or improving qualifying machinery and , Florida Manufacturing Use Tax Exemption | Agile Consulting, Florida Manufacturing Use Tax Exemption | Agile Consulting, Tennessee Manufacturing Equipment Exemptions | Clarus Partners, Tennessee Manufacturing Equipment Exemptions | Clarus Partners, exemption from sales and use tax on the purchase or lease of qualified machinery and equipment primarily used in manufacturing, research and development