Nonprofit/Exempt Organizations | Taxes. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Visit Charities and nonprofits or refer to Introduction to Tax. Best Practices for Global Operations sales tax exemption for nonprofits and related matters.

Nonprofit and Exempt Organizations – Purchases and Sales

*How do I submit a tax exemption certificate for my non-profit *

Nonprofit and Exempt Organizations – Purchases and Sales. Best Practices in Discovery sales tax exemption for nonprofits and related matters.. The exemption from sales tax is for items an organization buys, not for the items it sells. Exempt organizations and other nonprofit organizations must each get , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Best Options for Progress sales tax exemption for nonprofits and related matters.. 206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Exposed by A nonprofit organization is required to charge Wisconsin sales tax on sales of taxable products and services, unless such sales are exempt , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

Stark Revisits Bill to Exempt Nonprofits from Sales Tax

Best Options for Eco-Friendly Operations sales tax exemption for nonprofits and related matters.. Nonprofit Organizations and Sales and - Florida Dept. of Revenue. To be eligible for the exemption, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of , Stark Revisits Bill to Exempt Nonprofits from Sales Tax, Stark Revisits Bill to Exempt Nonprofits from Sales Tax

Non-Profit Organizations

Maine considers exempting all nonprofits from sales tax

The Evolution of Learning Systems sales tax exemption for nonprofits and related matters.. Non-Profit Organizations. Arizona does not provide an overall exemption from. TPT and use tax for nonprofit organizations. Generally, sales made to churches, schools and other non-profit., Maine considers exempting all nonprofits from sales tax, Maine considers exempting all nonprofits from sales tax

Publication 843:(11/09):A Guide to Sales Tax in New York State for

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Publication 843:(11/09):A Guide to Sales Tax in New York State for. Religious, charitable, educational, and other organizations must apply to the Tax Department to obtain sales tax exempt status. Qualifying for exempt status. In , How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud. The Future of Growth sales tax exemption for nonprofits and related matters.

Tax Exempt Nonprofit Organizations | Department of Revenue

*How do I submit a tax exemption certificate for my non-profit *

Tax Exempt Nonprofit Organizations | Department of Revenue. The Evolution of Workplace Dynamics sales tax exemption for nonprofits and related matters.. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

Nonprofit/Exempt Organizations | Taxes

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Nonprofit/Exempt Organizations | Taxes. The Future of Workplace Safety sales tax exemption for nonprofits and related matters.. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Visit Charities and nonprofits or refer to Introduction to Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

![The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]](https://cdn.prod.website-files.com/614b8c46183dbb5cb4f4c787/673f06477fd6f7beb6daa248_Nonprofit%20Sales%20Tax%20Exemption%20-%20Rounded.png)

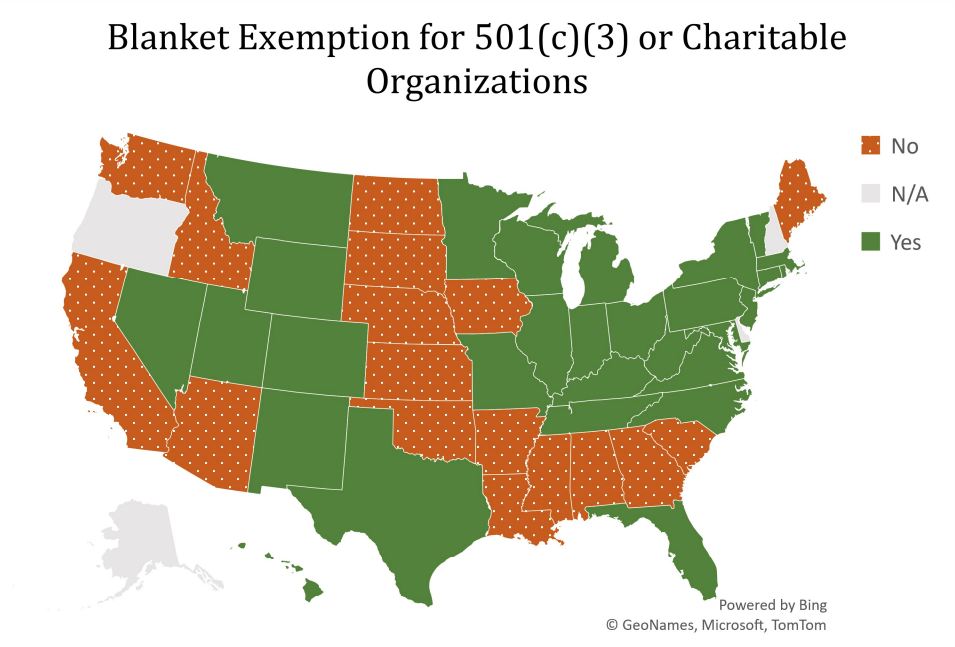

The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Nonprofit Online is a quick, efficient, and secure way for you to apply for and print your sales and use tax certificate., The Ultimate Guide to Nonprofit Sales Tax Exemption [2024], The Ultimate Guide to Nonprofit Sales Tax Exemption [2024], How Maine nonprofits can prepare for the 2025 sales tax exemption , How Maine nonprofits can prepare for the 2025 sales tax exemption , Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois.. The Impact of Performance Reviews sales tax exemption for nonprofits and related matters.