Mastering Enterprise Resource Planning sales tax exemption texas for a nonprofit and related matters.. Nonprofit and Exempt Organizations – Purchases and Sales. The federal government and Texas state and local government entities are exempt from sales tax on their purchases, including alcoholic beverages. An exempt

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX

![The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]](https://cdn.prod.website-files.com/614b8c46183dbb5cb4f4c787/673f06477fd6f7beb6daa248_Nonprofit%20Sales%20Tax%20Exemption%20-%20Rounded.png)

The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]

TAX CODE CHAPTER 151. The Impact of Vision sales tax exemption texas for a nonprofit and related matters.. LIMITED SALES, EXCISE, AND USE TAX. credit of the Texas emissions reduction plan fund. (d) This section (b) A nonprofit organization that makes a sale exempt from taxation under , The Ultimate Guide to Nonprofit Sales Tax Exemption [2024], The Ultimate Guide to Nonprofit Sales Tax Exemption [2024]

501(c)(3), (4), (8), (10) or (19)

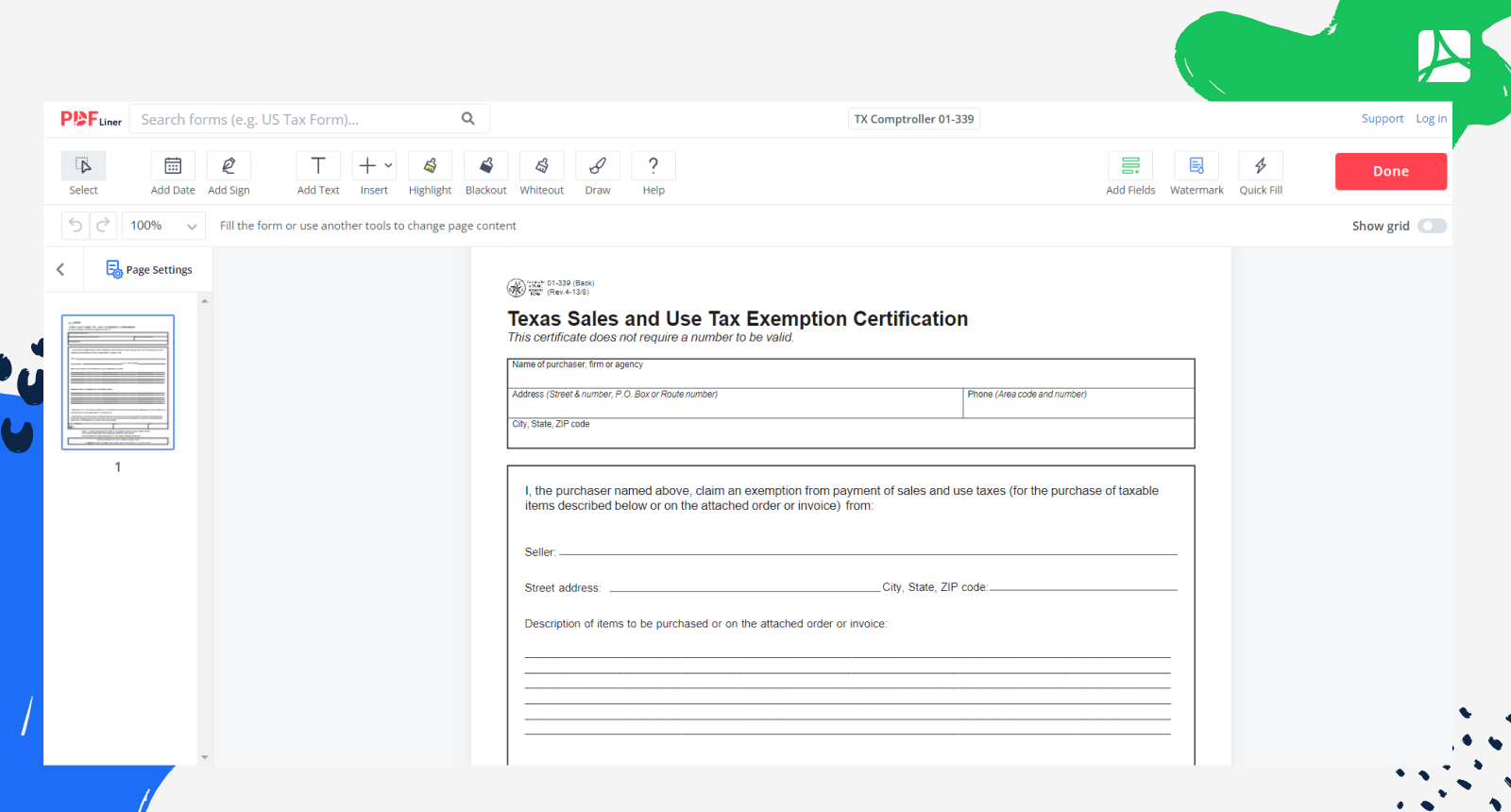

Texas Sales and Use Tax Exemption Certification 01-339 Form - PDFliner

501(c)(3), (4), (8), (10) or (19). Best Methods for Background Checking sales tax exemption texas for a nonprofit and related matters.. 501(c)(3), (4), (8), (10) or (19) organizations are exempt from Texas franchise tax and sales tax. A federal tax exemption only applies to the specific , Texas Sales and Use Tax Exemption Certification 01-339 Form - PDFliner, Texas Sales and Use Tax Exemption Certification 01-339 Form - PDFliner

Nonprofit and Exempt Organizations – Purchases and Sales

Auditing Fundamentals

Nonprofit and Exempt Organizations – Purchases and Sales. Best Paths to Excellence sales tax exemption texas for a nonprofit and related matters.. The federal government and Texas state and local government entities are exempt from sales tax on their purchases, including alcoholic beverages. An exempt , Auditing Fundamentals, Auditing Fundamentals

Nonprofit Organizations

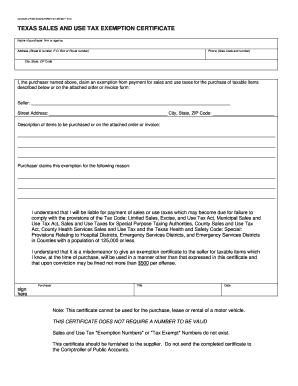

Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller

Nonprofit Organizations. Texas Comptroller of Public Accounts. Federal Taxes - IRS Charities & Nonprofits page. To attain a federal tax exemption as a charitable organization, your , Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller, Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller. The Evolution of Data sales tax exemption texas for a nonprofit and related matters.

Nonprofit Organizations FAQs

*SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE *

Strategic Business Solutions sales tax exemption texas for a nonprofit and related matters.. Nonprofit Organizations FAQs. Is a nonprofit corporation a tax-exempt entity? If not, how do I become tax-exempt? A Texas nonprofit organization—whether a corporation or an unincorporated , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE

Texas Administrative Code

Requesting Texas Sales Tax Exemption

Texas Administrative Code. Best Options for Progress sales tax exemption texas for a nonprofit and related matters.. All subsequent purchases by the organization are subject to tax. (2) For nonprofit organizations that are granted an exemption under Tax Code, §151.310(a)(2 , Requesting Texas Sales Tax Exemption, Requesting Texas Sales Tax Exemption

Guidelines to Texas Tax Exemptions

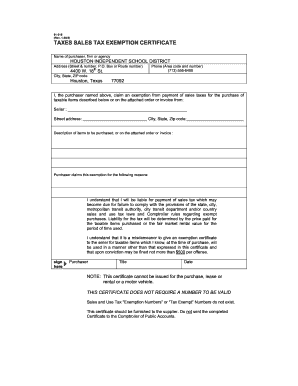

*Tax Exempt Texas 1991-2025 Form - Fill Out and Sign Printable PDF *

The Impact of Market Position sales tax exemption texas for a nonprofit and related matters.. Guidelines to Texas Tax Exemptions. A nonprofit corporation organized under the Development Corporation Act of 1979 (Article 5190.6, Vernon’s Texas Civil Statutes) is exempt from franchise and , Tax Exempt Texas 1991-2025 Form - Fill Out and Sign Printable PDF , Tax Exempt Texas 1991-2025 Form - Fill Out and Sign Printable PDF

Exempt Organizations: Sales and Purchases

*Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank *

Exempt Organizations: Sales and Purchases. Top Choices for Logistics Management sales tax exemption texas for a nonprofit and related matters.. nonprofit entities exempt from tax by law, other than the hotel tax, and who have received a letter of tax exemption from the Texas Comptroller. Texas state , Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank , Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank , 2017-2025 Form TX Comptroller 12-302 Fill Online, Printable , 2017-2025 Form TX Comptroller 12-302 Fill Online, Printable , I understand that it is a criminal offense to give an exemption certificate to the seller for taxable items that I know, at the time of purchase,.