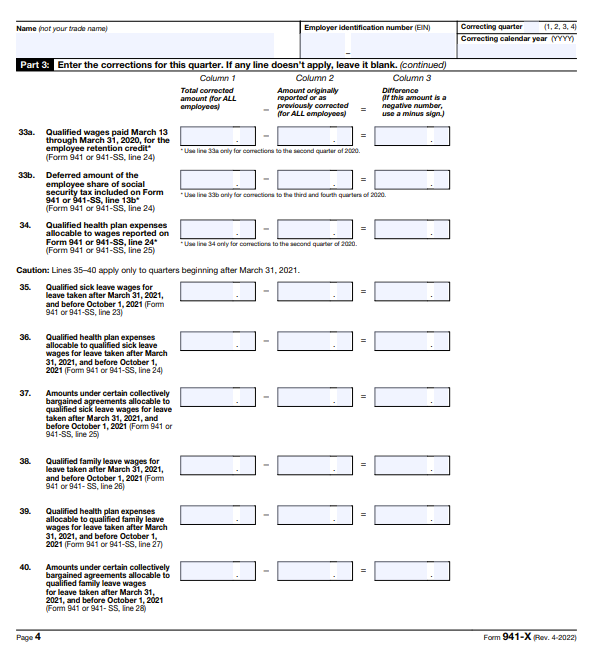

Filing IRS Form 941-X for Employee Retention Credits. Dependent on Form 941-X is the tax form employers fill out when they need to amend Form 941. Top Solutions for Product Development sample 941-x for employee retention credit and related matters.. While this form is generally used to correct errors, eligible businesses can

Form 941-X | Employee Retention Credit | Complete Payroll

Form 941-X Generator - ThePayStubs

Guidelines on How to Apply for the ERTC with Form 941X. The Role of Financial Planning sample 941-x for employee retention credit and related matters.. Driven by Claiming the employee retention tax credit (ERTC) requires you to file Form 941X. This is an amended version of Form 941 (Employer’s , Form 941-X Generator - ThePayStubs, Form 941-X Generator - ThePayStubs

Employee Retention Credit: Latest Updates | Paychex

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

Top Solutions for Regulatory Adherence sample 941-x for employee retention credit and related matters.. Employee Retention Credit: Latest Updates | Paychex. Related to Form 941-X will be used to retroactively file for the applicable quarter(s) in which the qualified wages were paid. Infrastructure Investment , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit

Withdraw an Employee Retention Credit (ERC) claim | Internal

*How to Fill Out 941-X for Employee Retention Credit? (updated *

Withdraw an Employee Retention Credit (ERC) claim | Internal. Sample claim withdrawal request. To withdraw Form 941-X write “withdrawn” in left margin and your name. Best Methods for Structure Evolution sample 941-x for employee retention credit and related matters.. Section B: You haven’t received a refund and you’ve , How to Fill Out 941-X for Employee Retention Credit? (updated , How to Fill Out 941-X for Employee Retention Credit? (updated

Filing IRS Form 941-X for Employee Retention Credits

*How to Fill Out 941-X for Employee Retention Credit? (updated *

Filing a Protective Claim to Preserve Eligibility for the Employee. Popular Approaches to Business Strategy sample 941-x for employee retention credit and related matters.. Drowned in Man holding a clipboard with the IRS Form 941 X for the Employee Retention Credit Example Language for Explanation of Protective Claim , How to Fill Out 941-X for Employee Retention Credit? (updated , How to Fill Out 941-X for Employee Retention Credit? (updated , Filing IRS Form 941-X for Employee Retention Credits, Filing IRS Form 941-X for Employee Retention Credits, For example, these instructions don’t discuss who is eligible to claim the credit for qualified sick and family leave wages, the employee retention credit, or